Featured

How To Get 1095 A Form Online

If your form is accurate youll use it to reconcile your premium tax credit. Under Your Existing Applications select your 2019 application not your 2020 application.

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

This form will be mailed by Jan.

/1095b-741f9631132347ab8f1d83647278c783.jpg)

How to get 1095 a form online. The downloaded PDF will appear at the bottom of the screen. Log into your healthcare account and follow these steps. If you dont get Form 1095-B dont worry.

The federal IRS Form 1095-A Health Insurance Marketplace Statement. It also is available in your online account. If you didnt get the form online or by mail contact the Marketplace Call Center How to use Form 1095-A.

Under Your Existing Applications select your 2020 application not your 2021 application. About Form 1095-C Employer-Provided Health Insurance Offer and Coverage. Updated on January 7 2021.

Form 1095-B Proof of Health Coverage. Theres only one place where you can get a copy of your 1095 tax form. Click the green Start a new application or update an existing one button.

If you have Part A you may get IRS Form 1095-B from Medicare in the early part of the year. Get screen-by-screen directions with pictures PDF or follow the steps below. To find your 1095-A online follow these steps.

Click here if you purchased your plan via healthcaregov. If anyone in your household had Marketplace health coverage in 2020 you should have already received Form 1095-A Health Insurance Marketplace Statement. Click your name in the top right and select My applications coverage from the dropdown.

Under Your Forms 1095-A for Tax Filing click Down-load PDF and follow these steps based on your browser. The information on Form 1095-A is used to determine the amount of taxes you will owe or the refund you receive based on the tax credit you may have taken in advance to lower the cost of your health insurance plan. For those that previously received their Form 1095-B in the mail you can receive a copy of your Form 1095-B by going out to the Aetna Member Website in the Message Center under the Letters and Communications tab or by sending us a request at Aetna PO BOX 981206 El Paso TX 79998.

Calculate your tax refund or credit or the tax amount. ALE members must report that information for all twelve months of the calendar year for each employee. Select Tax Forms from the menu on the left.

Download all 1095-As shown on the screen. Download all 1095-As shown on the screen. Log into your HealthCaregov account.

Click Save at the bottom and then Open. How to find your 1095-A online Log in to your HealthCaregov account. To understand more about the Federal and State Individual Mandates please see the information and links below.

Under Your Existing Applications select your 2019 application not your 2020 application. Select Tax Forms from the menu on the left. These forms are used when you file your federal and state tax returns to.

Instructions for Forms 1094-B and 1095-B Print Version PDF. Not everyone will get this form from Medicare and you dont need to have it to file your taxes. Frequently asked questions.

When the pop-up appears select Open With and then OK. Log in to your HealthCaregov account. Your 1095-A should be available in your HealthCaregov account.

Contact them directly ONLY your insurer will have access to it and can provide you with a copy. Q What is the Form 1095-B. Use the California Franchise Tax Board forms finder to view this form.

How to find Form 1095-A online. As a result Aetna will not be mailing Form 1095-B for the reporting tax year. Form 1095-B is used to report certain information to the IRS and to taxpayers about individuals who are covered by minimum essential coverage and therefore are not liable for the individual shared responsibility payment.

A Form 1095-B is an IRS document that shows you had health insurance coverage considered Minimum Essential Coverage during the last tax yearUnder the Tax Cuts and Jobs Act the amount of the individual shared responsibility payment is reduced to zero for months. Form 1095-C is filed and furnished to any employee of an Applicable Large Employers ALE member who is a full-time employee for one or more months of the calendar. Your Form 1095-B is proof of healthcare insurance for the IRS and does not require completion or submission to DHCSPlease keep this form for your records.

The California Form FTB 3895 California Health Insurance Marketplace Statement. Select Tax Forms from the menu on the left. Under Helpful Links at the bottom left of the page click 1095-B Tax Form Reprint Click here if you have more questions or call 877-617-9906.

Internet Explorer users.

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Annual Health Care Coverage Statements

Annual Health Care Coverage Statements

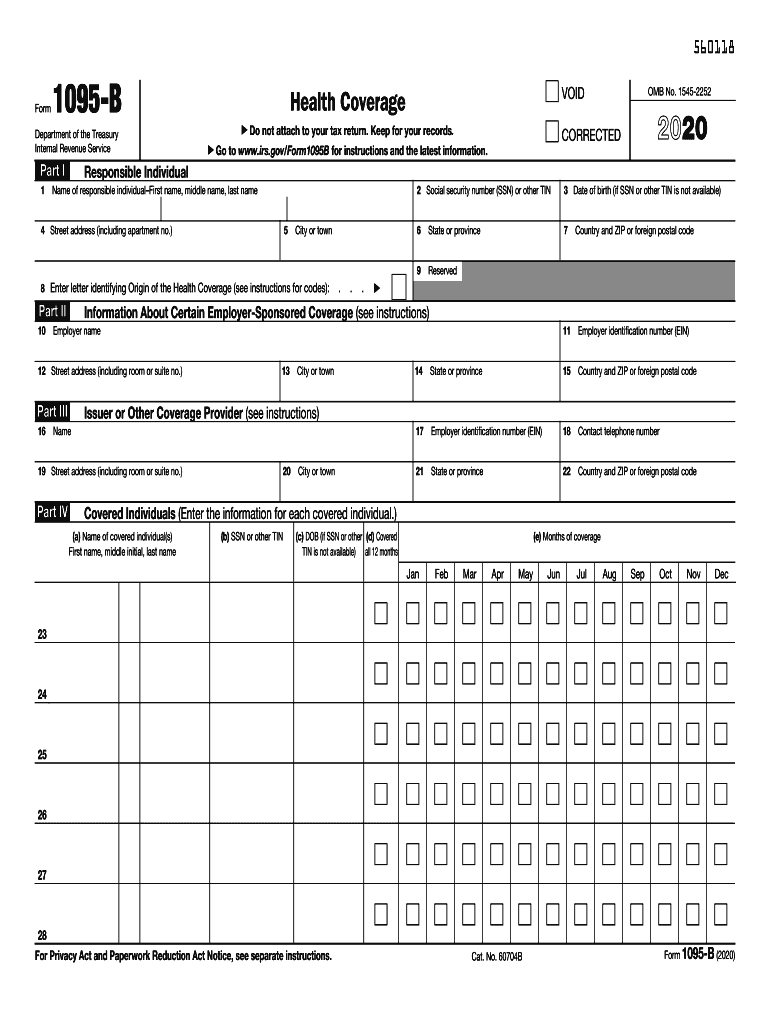

/1095b-741f9631132347ab8f1d83647278c783.jpg) Form 1095 B Health Coverage Definition

Form 1095 B Health Coverage Definition

Breakdown Form 1095 A Liberty Tax Service

Breakdown Form 1095 A Liberty Tax Service

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

New Irs Form 1095 A Among Tax Docs That Are On Their Way Don T Mess With Taxes

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png) About Form 1095 A Health Insurance Marketplace Statement Definition

About Form 1095 A Health Insurance Marketplace Statement Definition

Irs 1095 B 2020 2021 Fill Out Tax Template Online Us Legal Forms

Irs 1095 B 2020 2021 Fill Out Tax Template Online Us Legal Forms

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

2020 Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

2020 Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

Comments

Post a Comment