Featured

- Get link

- X

- Other Apps

What Does Copayment After Deductible Mean

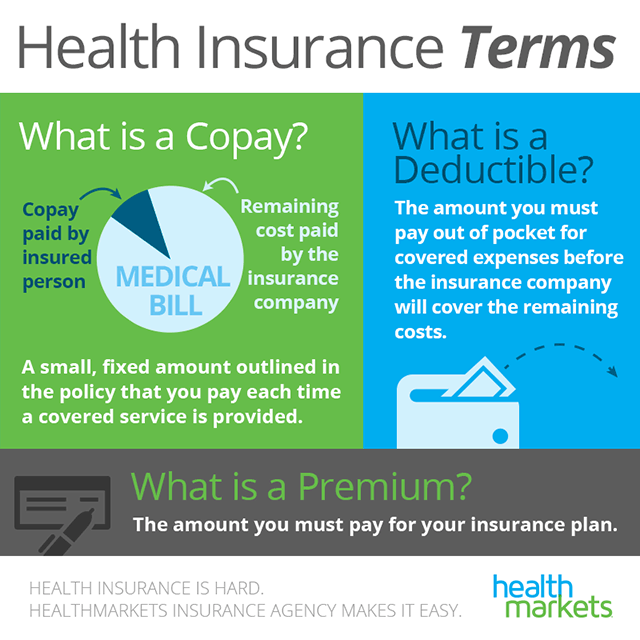

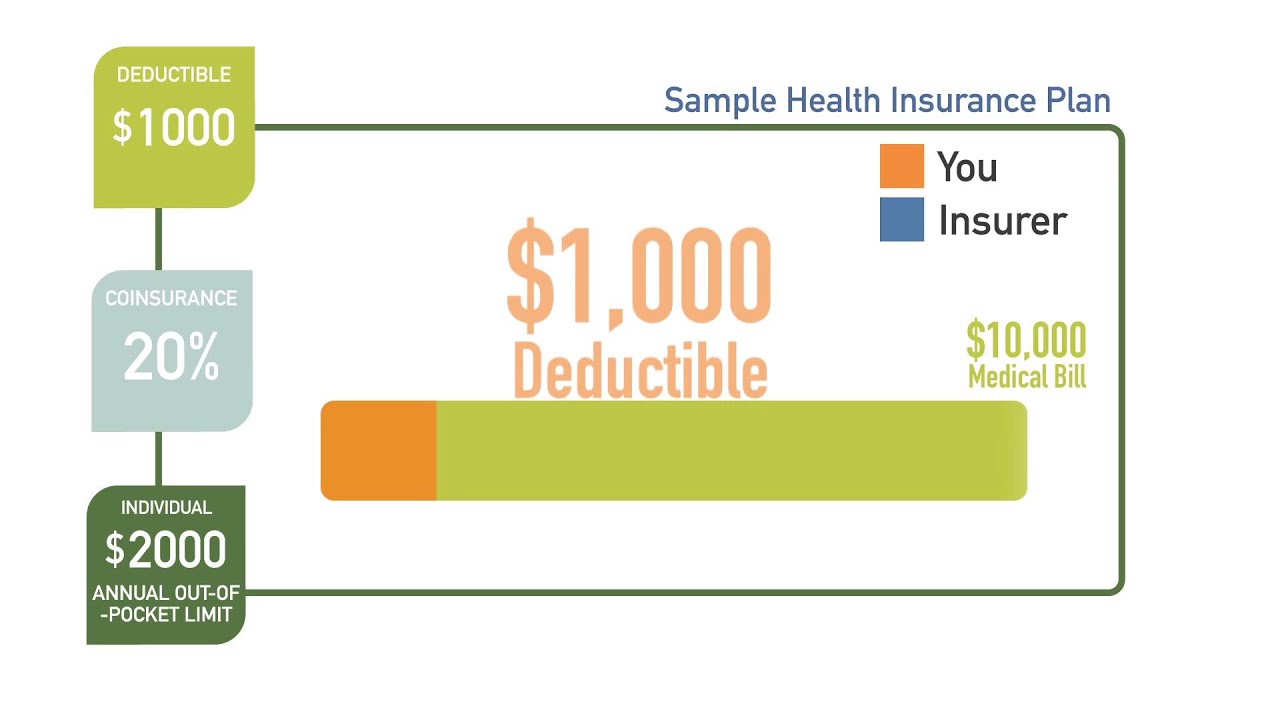

Your deductible is part of your out-of-pocket costs and counts towards meeting your yearly limit. Copayment A fixed amount 20 for example you pay for a covered health care service after youve paid your deductible.

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

The phrase no charge after deductible signifies that once you pay the full deductible amount the insurance company will cover 100 percent of the cost of an expense up to the limits of your plan.

What does copayment after deductible mean. Copay a fixed dollar amount you must pay to a provider at the time services are received. Then instead of paying the full cost for services youll usually pay a copayment or coinsurance for medical care and prescriptions. A copay after deductible is a flat fee you pay for medical service as part of a cost-sharing relationship in which you and your health insurance provider must pay for your medical expenses.

Once youve met your deductible your plan starts to pay its share of costs. Remember your copayment is a fixed amount that you will pay for your healthcare after meeting your deductible amount. Typically with HDHPs employees must meet their deductible before the carrier will pay for any services other than preventative care.

At the bottom of the plan description youll see an area for copayments and coinsurance. Out-of-Pocket Max the maximum amount you pay each calendar year to receive covered services after you meet your deductible. Copayments and Coinsurance.

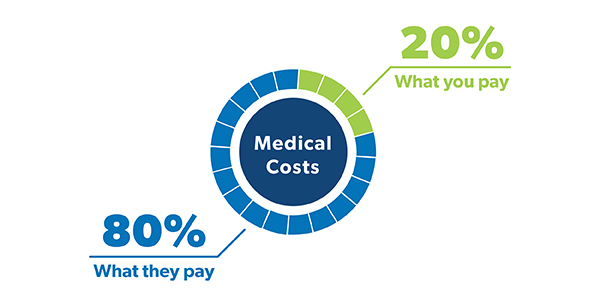

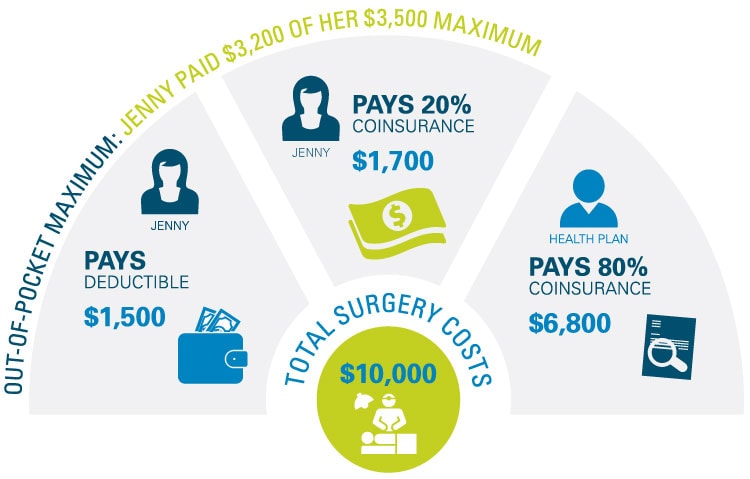

After you pay your annual deductible your insurance starts paying its portion of the cost of covered care you receive for the rest of the year. Coinsurance is often 10 30 or 20 percent. So in your question you pay up front a 25 copayment when you visit the doctor.

Coinsurance is a way of saying that you and your insurance carrier each pay a share of eligible costs that add up to 100 percent. The primary doctor specialist doctor emergency room care and generic drugs on this plan are all 50 coinsurance after the deductible has been paid. For this plan Sara chose a coinsurance plan.

And really if you anticipate using a lot of medical services it might. With deductible means that the copay applies to the deductible. Pertaining to health insurance what does Copay with deductible mean in contrast to Copay after deductible.

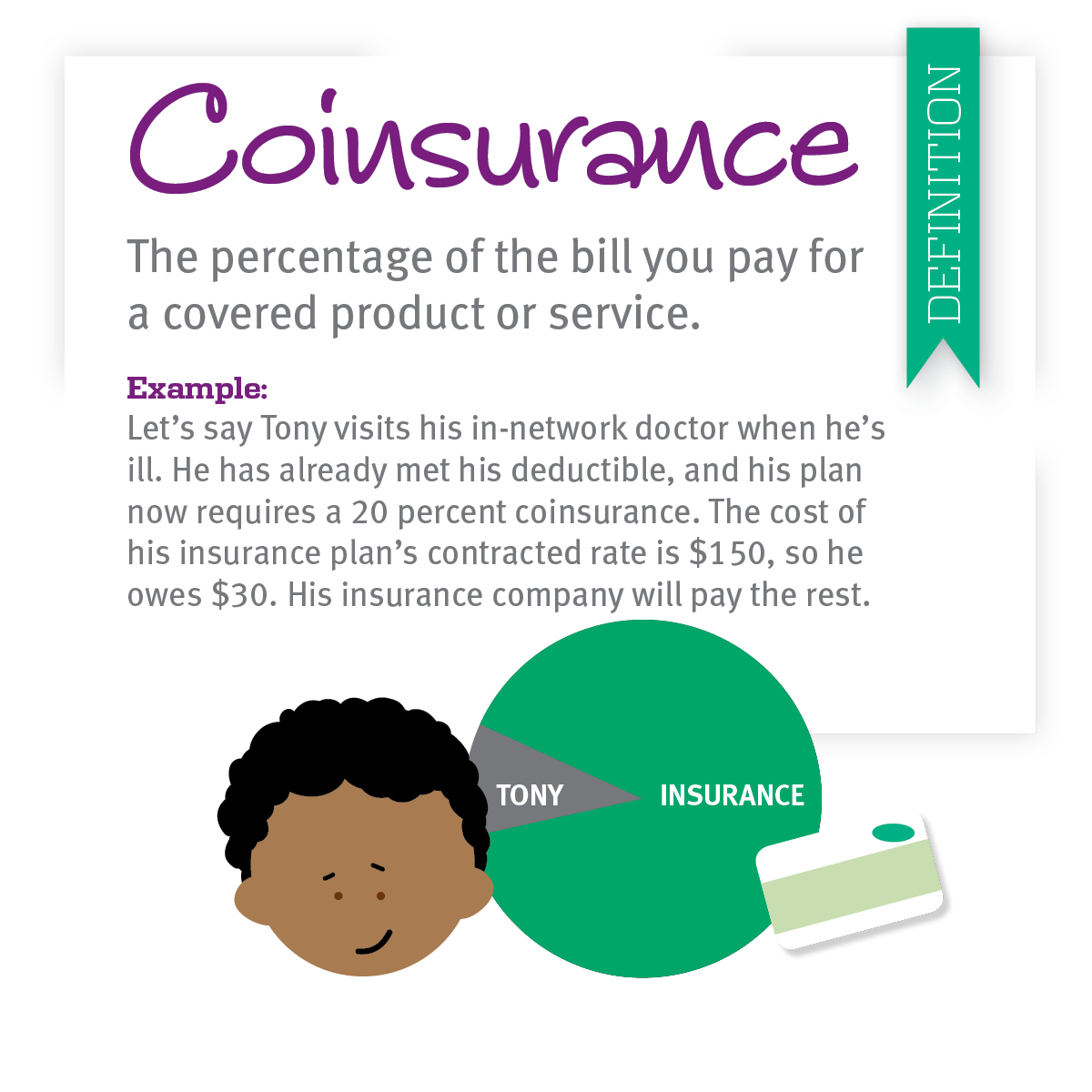

The deductible is how much you pay before your health insurance starts to cover your bills. Coinsurance the percentage of cost of a covered health care service you pay once you have met your deductible. Copays for High Deductible Health Plans HDHPs work a little different from other types of plans.

I get Copay after deductible -- you must pay for the service fully out of pocket until your deductible is met after which you must only pay the copay amount and the insurance pays for the rest. You start paying coinsurance after youve paid your plans deductible. Lets say your health insurance plans allowable cost for a doctors office visit is 100.

This means that if you have an HDHP with a 3000 deductible and a 20 copay for primary care you may have to meet the entire. Cover X AFTER the deductible is met although it sounds like you have only a 60 co-pay after deductible. I work for a health insurance company and my best guess is after deductible is whats been described above that you pay the contracted rate for the service until youve met the deductible and then you pay just the copay after you meet your deductible.

What your question does not include is the amount of your deductible. Deductibles coinsurance and copays are all examples of cost sharing. That wording sure is odd.

When you go to the doctor instead of paying all costs you and your plan. When you pay coinsurance you split a certain cost with the insurance company at a ratio determined by the terms of your insurance plan. For any in-network provider your provider and your insurance company have agreed on a maximum allowable amount for their services.

Copays are typically charged after a deductible has already been met. Its usually figured as a percentage of the amount we allow to be charged for services. A deductible is an amount that must be paid for covered healthcare services before insurance begins paying.

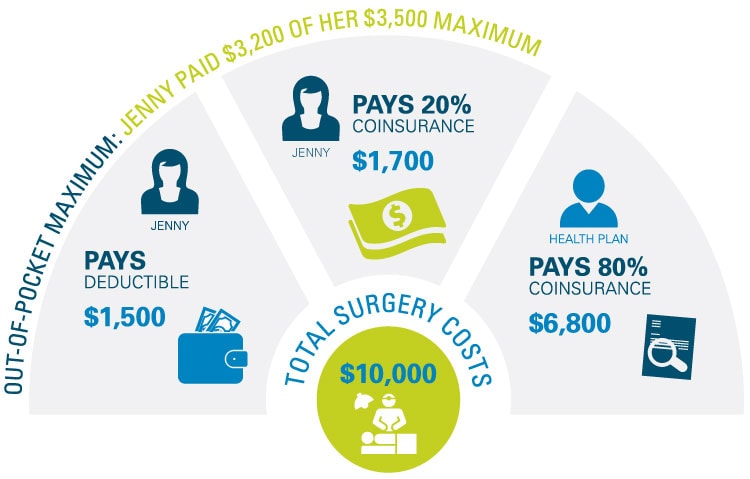

You need to ask about individual vs. A copayment is just a portion of that amount that is paid in lieu of the maximum allowable amount. Youve paid 1500 in health care expenses and met your deductible.

Coinsurance is your share of the costs of a health care service. Your copayment for a doctor visit is 20. Coinsurance is a portion of the medical cost you pay after your deductible has been met.

Coinsurance is an additional cost that some health care plans require policy holders to pay after the deductible is met. Depending on the service the health care provider and your insurance your portion of the cost of care covered by the plan after youve met your deductible may be a copayment or coinsurance amount.

Copay Vs Deductible How Does Insurance Work Aeroflow Healthcare

Copay Vs Deductible How Does Insurance Work Aeroflow Healthcare

Copay With Deductible Vs Copay After Deductible Medical Sciences Stack Exchange

Copay With Deductible Vs Copay After Deductible Medical Sciences Stack Exchange

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

Definitions And Meanings Of Health Care And Health Insurance Terms

Definitions And Meanings Of Health Care And Health Insurance Terms

Understanding Cost Sharing Deductibles Coinsurance And Copays Healthtn Com

Understanding Cost Sharing Deductibles Coinsurance And Copays Healthtn Com

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Understanding Deductibles Out Of Pocket Maximums Health Insurance

What Is Coinsurance Ramseysolutions Com

What Is Coinsurance Ramseysolutions Com

How Do Health Insurance Deductibles Work

How Do Health Insurance Deductibles Work

Definitions And Meanings Of Health Care And Health Insurance Terms

Definitions And Meanings Of Health Care And Health Insurance Terms

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

What Is An Out Of Pocket Maximum Bluecrossmn

What Is An Out Of Pocket Maximum Bluecrossmn

Small Business How Does Coinsurance Work Ehealth

Small Business How Does Coinsurance Work Ehealth

Comments

Post a Comment