Featured

California Penalty For No Health Insurance 2020

Starting in 2020 California residents must either. To find out more about health insurance options and financial help visit Covered California.

California Reintroduced Health Insurance Mandate Enforced By New Tax Penalty Solid Health Insurance

California Reintroduced Health Insurance Mandate Enforced By New Tax Penalty Solid Health Insurance

Obtain an exemption from the requirement to have coverage.

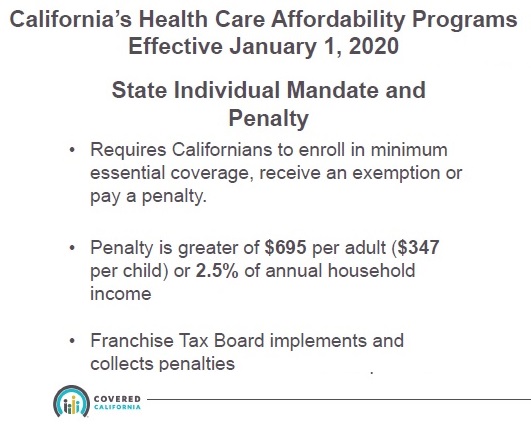

California penalty for no health insurance 2020. An adult who is uninsured in 2020 face could be hit. You were not eligible for an exemption from coverage for any month of the year. The penalty will amount to 695 for an.

You will begin reporting your health care coverage on your 2020 tax return which you will file in the spring of. If you arent covered and owe a penalty for 2020 it will be due when you file your tax return in 2021. The penalty for not having coverage the entire year will be at least 750 per adult and 375 per dependent child under 18 in the household when you file your 2020 state income tax return in 2021.

1 requires Californians to have health insurance in. You did not have health coverage. The penalty for no coverage is based on.

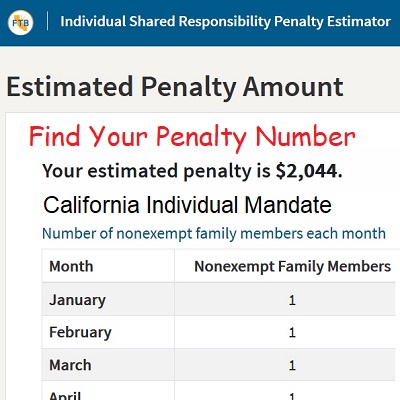

A penalty for an uninsured family of three earning 150000 could be about 2522 according to the California Franchise Tax Board website. A penalty for an uninsured family of three earning 150000 could be about 2522 according to the California Franchise Tax Board website. Get an exemption from the requirement to have coverage.

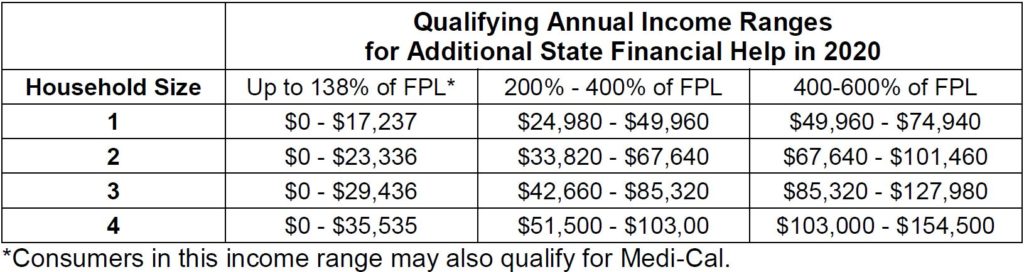

Uninsured Californians still have time to avoid a penalty for not having healthcare if they sign up through Covered California by March 31. Starting in 2020 California residents must have qualifying health insurance coverage or face a penalty when you file your state tax returns. The number of people in your household.

California loosens its individual mandate for health. You will have to pay a penalty the Individual Shared Responsibility Penalty when you file your state tax return if. Beginning January 1 2020 all California residents must either.

The money raised from the penalties which is expected to be about 1 billion. Subscribe to California Healthlines free Daily Edition. Have qualifying health insurance coverage orPay a penalty when filing a state tax return orGet an exemption from the requirement to have coverageAbout the Penalty Generally speaking the penalty will be 695 or more when you file your 2020 state income tax return in 2021.

The penalty will amount to 695 for an adult and half that much for dependent children. Though in 2019 the Trump administration rescinded the tax penalty established by the Affordable Care Act you may still need to pay a tax penalty in 2021 if you live in California and do not have health insurance. Have qualifying health insurance coverage.

A new California law that went into effect on Wednesday resuscitates the requirement that people obtain health coverage or face tax penalties. You can get qualifying health insurance coverage through an employer-sponsored plan Covered California Medicare most Medicaid plans and coverage bought directly from an insurer. If you are a Californian with no health insurance in 2020 you may face a tax penalty in 2021.

According to the California Franchise Tax Board FTB the penalty for not having health insurance is the greater of either 25 of the household annual income or a flat dollar amount of 750 per adult and 375 per child these number will rise every year with inflation in the household. October 14 2019 Transcript Subscribe to this podcast A new state law going into effect Jan. If you arent covered and owe a penalty for 2020 it will be due when you file your tax return in 2021.

An individual who earns 46000 could be charged 750. Pay a penalty when they file their state tax return. Beginning in 2020 California residents must either.

An individual who earns 46000 could be charged 750.

Covered California Announces New Law Requiring Health Insurance Susan Polk Insurance Agency Inc San Luis Obispo California

Covered California Announces New Law Requiring Health Insurance Susan Polk Insurance Agency Inc San Luis Obispo California

Californians Without Health Insurance Will Pay A Penalty Or Not California Healthline

Californians Without Health Insurance Will Pay A Penalty Or Not California Healthline

California Penalty For Not Having Health Insurance

California Penalty For Not Having Health Insurance

California Penalty For Not Having Health Insurance

California Penalty For Not Having Health Insurance

California Individual Mandate Penalty Cheap Compared To Cost Of Health Insurance

California Individual Mandate Penalty Cheap Compared To Cost Of Health Insurance

The 2020 Changes To California Health Insurance Ehealth

The 2020 Changes To California Health Insurance Ehealth

Penalty For No Health Insurance 2020 In California Choi Hong Lee Kang

Penalty For No Health Insurance 2020 In California Choi Hong Lee Kang

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

The Health Insurance Penalty Ends In 2019

The Health Insurance Penalty Ends In 2019

The Health Insurance Penalty Ends In 2019

The Health Insurance Penalty Ends In 2019

Health Insurance Penalty In The Year 2020 Do I Pay It

Health Insurance Penalty In The Year 2020 Do I Pay It

Penalty For No Health Insurance 2020 In California Cost U Less Insurance

Penalty For No Health Insurance 2020 In California Cost U Less Insurance

Penalty For No Health Insurance 2020 In California Freeway Insurance

Penalty For No Health Insurance 2020 In California Freeway Insurance

The 2017 Covered California Tax Penalty For Not Having Insurance

Comments

Post a Comment