Featured

Do Hsa Funds Expire

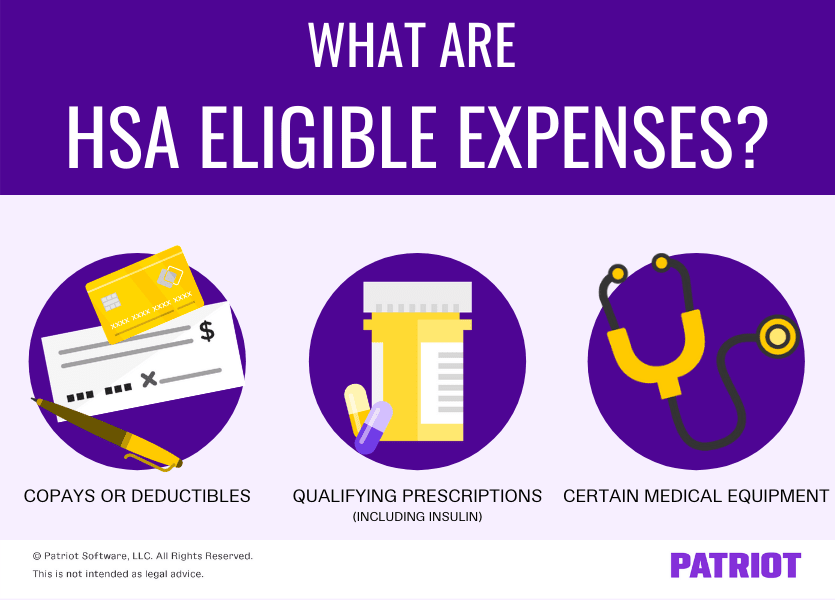

You have until the end of your benefit generally calendar year to use any funds in your FSA before they expire Additionally if you leave your job you forfeit any remaining dollars in your FSA. HSAs are intended to make medical expenses more affordable by allowing consumers with high-deductible health plans to set aside pretax money in an account that unlike a Flexible Spending Account.

A Massage Health Savings Accounts May Cover More Than You Think

A Massage Health Savings Accounts May Cover More Than You Think

They can be considered a use it or lose it type of plan.

Do hsa funds expire. When does my FSA expire. One of the lesser known benefits of an HSA is that you can invest those funds into good growth stock mutual funds. Unlike flexible spending accounts the funds in an HSA do not expire at the end of the year the entire amount rolls over each year.

Those who are young and single may prefer a HSA to an FSA as unused contributions do not expire at the end of the year or if the individual changes jobs allowing. Your contributions stay in your HSA until you use them. Without the investment piece choosing an FSA means losing out on tax-free interest and earnings.

Do HSA funds expire. FSAs do expire. HSA funds automatically carry over from year to year and the money can be used indefinitely as long as the purchase is a qualified medical expense.

There is a limit to the amount that a person or family can contribute to their HSA each year as well as other limits and policies that the IRS updates each year. Any funds you dont spend roll over year after year and can be saved for retirement. The money in an HSA never expires.

You own your HSA. Once youre ready to withdraw your funds to pay for qualifying healthcare expenses you still dont have to pay taxes on your money. 2 You can withdraw funds from an HSA to use for non-medical spending but you will pay income tax and a 20 penalty until age 65.

Unlike flexible spending accounts FSAs all remaining HSA funds roll over each year. If youre terminated from your job any eligible purchases made on the same day can be submitted for reimbursement. Unlike Health Savings Accounts HSAs which also offered by employers as a way to use pre-tax earnings towards health-related purchases FSAs typically do.

While Health Spending Account HSA funds usually roll over every year FSA funds are a use-it-or-lose-it kind of benefit and expire on December 31st of each year. For this reason HSAs can be used as part of an overall retirement plan. Although there is an annual limit for contributions there is no limit to the total amount saved in your account.

If youre able to wait until age 65 to use money saved up in. All of the money in an HSA including any contributions deposited by an employer is owned by the employee even if they leave their job lose their qualifying coverage or retire. Because FSA funds have a 12-month lifespan you lose the investment opportunityand the tax benefitswith an FSA.

Your HSA funds never expire. Some company plans do allow employees to roll over 500 to the following year or to defer the spending deadline to March 15 2021. HSAs are owned by individuals and never expire.

3 Any money deferred into an FSA during the calendar year is forfeited if it is not claimed by the expiration deadline. 3 What Is an FSA. HSA funds dont have to be spent every year.

What happens if I change jobs or health plans. After age 65 you only pay income tax on what you withdraw so an HSA could also be an additional source of retirement funds.

Can I Use My Hsa Or Fsa To Buy Contacts Eye Society

What Is An Hsa Rules And Benefits Of An Hsa

What Is An Hsa Rules And Benefits Of An Hsa

Will My Hsa Expire If I Stop Contributing To It Insurance Neighbor

Will My Hsa Expire If I Stop Contributing To It Insurance Neighbor

Health Savings Account Benefits

Health Savings Account Benefits

Fsa Vs Hsa Difference And Comparison Diffen

Fsa Vs Hsa Difference And Comparison Diffen

Employees Still Perplexed By Hsa Plans During Open Enrollment

Employees Still Perplexed By Hsa Plans During Open Enrollment

Do Hsa Funds Cover Byte Clear Aligners Smile Prep

Do Hsa Funds Cover Byte Clear Aligners Smile Prep

Preparing For Retirement An Hsa Can Help

Preparing For Retirement An Hsa Can Help

Three Things You Should Know About Hsas Part 3 Spending Your Hsa Funds

Three Things You Should Know About Hsas Part 3 Spending Your Hsa Funds

Hsa Vs Fsa What S The Difference Quick Reference Chart

Hsa Vs Fsa What S The Difference Quick Reference Chart

These Are The New Hsa Limits For 2020

These Are The New Hsa Limits For 2020

Comments

Post a Comment