Featured

- Get link

- X

- Other Apps

California 1099 Form Pdf

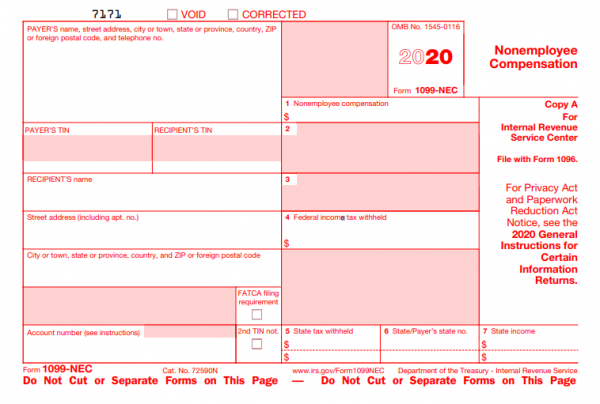

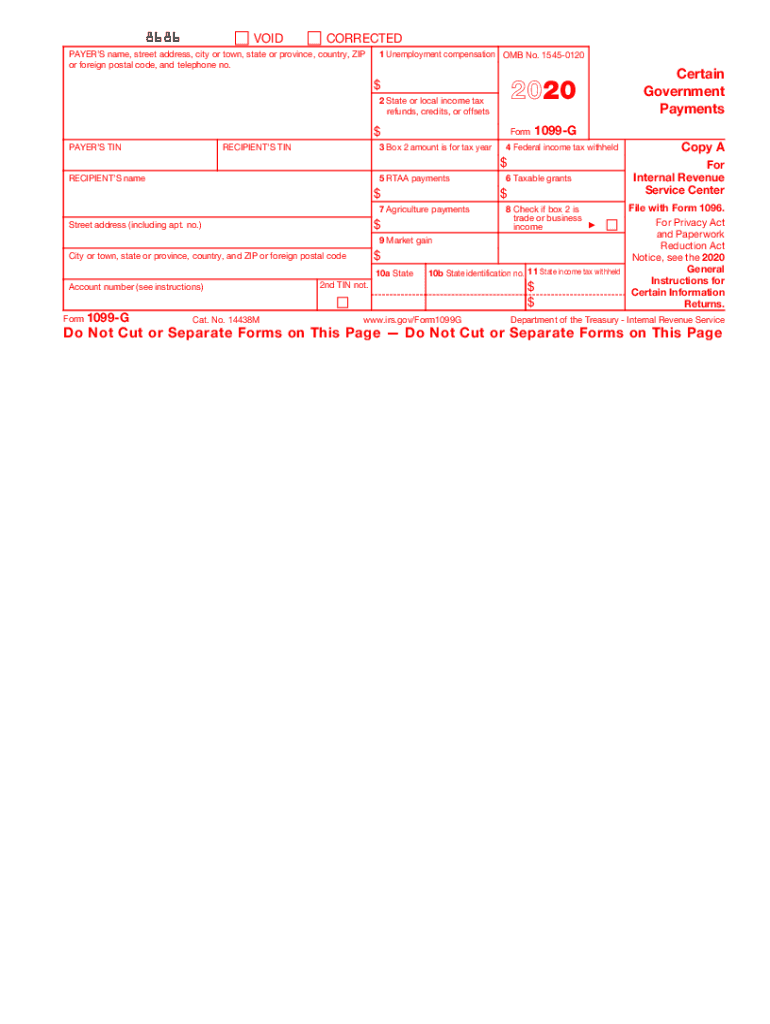

File with Form 1096. 2020 General Instructions for Certain Information Returns.

Tax Form 1099 K The Lowdown For Amazon Fba Sellers Taxjar Blog

Tax Form 1099 K The Lowdown For Amazon Fba Sellers Taxjar Blog

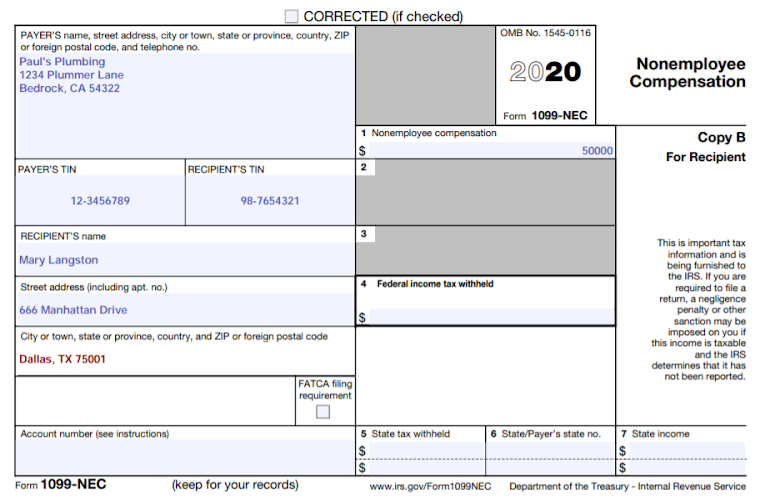

Use Form 1099-NEC beginning with tax year 2020.

California 1099 form pdf. 1099-R tax forms are mailed by the end of January each year. The 2021 General Instructions for Certain Information Returns and The 2021 Instructions for Form 1099-S. The recipient is a California resident or part-year resident.

Form 1099G is a record of the total taxable income the California Employment Development Department EDD issued you in a calendar year and is reported to the IRS. Turn on the Wizard mode on the top toolbar to acquire more pieces of advice. To order these instructions and additional forms go to.

To complete Form 1099-S use. Inst 1099 General Instructions. Understanding Your 1099-R Tax Form This form reports the amount of income you received during the tax year.

Department of the Treasury - Internal Revenue Service. Hit the Get Form option to begin editing. If a vendor receives at least 10 in royalties.

Download a fill-in DE 542 PDF from the EDD website. Form 1099G reports the total taxable income we issue you in a calendar year and is reported to the IRS. The Form 1099G reports the total taxable income we issue you in a calendar year.

Indicate the date to the sample using the Date option. File with Form 1096. For Internal Revenue Service Center.

Call the Taxpayer Assistance Center at 1-888-745-3886 to obtain a form. We are unable to change your prior year Form 1099-R per IRS regulations. File with Form 1096.

The source of a 1099 transaction was in California. Acquisition or Abandonment of Secured Property Info Copy Only 2021. In essence the state of California is requiring companies that operate in the state to make their 1099 employees hourly staff.

Repayments received in 2020 for overpayments in years prior to 2020 are not reflected on your 2020 Form 1099-R. Order through the Online Forms and Publications page. For Privacy Act and Paperwork Reduction Act Notice see the.

They receive pay in accord with the terms of their contract and get a 1099 form to report income on their tax return. Form 1099-INT interest earned or paid Form 1099-DIV dividends including those from stocks or mutual funds Form 1099-MISC various types of income prizes awards or gross proceeds Form 1099-B stock or mutual fund sales and certain other transactions by brokers Form 1099-S proceeds from real estate transactions. Department of the Treasury - Internal Revenue Service.

The employer withholds income. For Internal Revenue Service Center. 2021 General Instructions for Certain Information Returns.

You need it to complete your federal and state tax returns. 2021 General Instructions for Certain Information Returns. For Privacy Act and Paperwork Reduction Act Notice see the.

Ensure the information you fill in California 1099 Form Pdf is updated and accurate. What is a 1099G form. You will receive a Form 1099G if you collected unemployment compensation UC from the EDD and must report it on your federal tax return as income.

Report any payment of 600 or more to any payee using Form 1099-NEC when certain conditions are satisfied. This income is reported to the IRS. Because paper forms are scanned during processing you cannot file Forms 1096 1097 1098.

You may receive a 1099-MISC if you received at least 600 for. CalSTRS sends an acknowledgment letter for the total repayment amount of 300000 or more received in 2020 for prior year overpayments. You can find three available choices.

Payment Card and Third Party Network Transactions. According to FUNDERA 1099 employees are self-employed independent contractors. This income will be included in your federal adjusted gross income which you report to California.

Select the Sign icon and create an electronic signature. Or 600 or more in gross proceeds paid to an attorney vendors must receive a Form 1099. Department of the Treasury - Internal Revenue Service.

Any fishing boat proceeds. 2019 California Form 3525 Substitute for Form W-2 Wage and Tax Statement or Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc. For Internal Revenue Service Center.

Report the amount indicated on the form as income when you file your federal return. 600 in rent services prizes awards medical payments crop insurance proceeds payments for aquatic life. Create your own form with all of the required information.

General Instructions for Certain Information Returns Forms 1097 1098 1099 3921 3922 5498 and W-2G 2020. Apply for Pandemic Unemployment Assistance if your work situation changed because of COVID-19 and you meet any of these requirements. If you are a business owner independent contractor or self-employed worker and only received a 1099 tax form last year you are most likely eligible for Pandemic Unemployment Assistance.

Print your data directly from your computer to the DE 542 by following the Print Specifications PDF. As taxable income these payments must be reported on your federal tax return but they are exempt from California state income tax. Complete each fillable area.

As taxable income these payments must be reported on your federal tax return but they are exempt from California state income tax. Payers of nonemployee compensation must now. For Privacy Act and Paperwork Reduction Act Notice see the.

California 1099 Form Pdf Fill And Sign Printable Template Online Us Legal Forms

California 1099 Form Pdf Fill And Sign Printable Template Online Us Legal Forms

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

California 1099 Form Pdf Fill Online Printable Fillable Blank Pdffiller

California 1099 Form Pdf Fill Online Printable Fillable Blank Pdffiller

Irs Form 1099 Reporting For Small Business Owners In 2020

Irs Form 1099 Reporting For Small Business Owners In 2020

1099 Nec And 1099 Misc Changes And Requirements For Property Management

1099 Nec And 1099 Misc Changes And Requirements For Property Management

Order 1099 Nec Misc Forms Envelopes To Print File

Order 1099 Nec Misc Forms Envelopes To Print File

1099 G Fill Online Printable Fillable Blank Pdffiller

1099 G Fill Online Printable Fillable Blank Pdffiller

Free California Independent Contractor Agreement Word Pdf Eforms

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

1099 Misc Form Fillable Printable Download Free 2020 Instructions

1099 Misc Form Fillable Printable Download Free 2020 Instructions

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

:max_bytes(150000):strip_icc()/Form1099-NEC-46cc30fa3f2646d8be4987b14d4aa5d4.png)

Comments

Post a Comment