Featured

- Get link

- X

- Other Apps

Medicare Part D Late Enrollment Penalty

If you decide to get this coverage. Part D premium for as long as he or she.

Medicare Late Enrollment Penalty Avoid Penalty Fees

Medicare Late Enrollment Penalty Avoid Penalty Fees

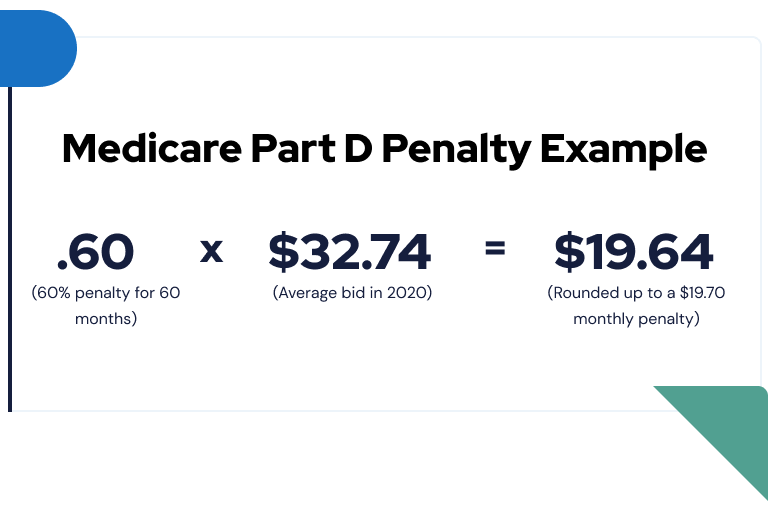

Medicare multiplies 1 of the national base premium which is 3274 in 2020 by the number of months you delayed your Medicare Part D enrollment or didnt have creditable coverage through another plan such as an employer-based plan this number is rounded to the nearest 10 and added to your Medicare Part.

Medicare part d late enrollment penalty. Generally the late enrollment penalty is added to the persons monthly. The Part D late enrollment penalty is a penalty thats addied in addition to the national base benefificary Part D premium. If you miss the initial enrollment period and go 63 or more consecutive days without creditable prescription drug coverage you will likely have to pay a late enrollment fee for the duration of your time on Part D.

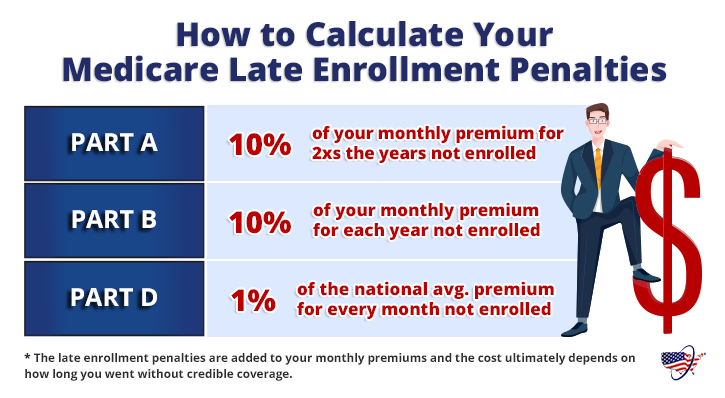

The late enrollment penalty for Medicare Part D is 1 of the average national base monthly premium rounded to the nearest 10 cents for each month you did not enroll. Medicare beneficiaries may incur a late enrollment penalty LEP if there is a continuous period of 63 days or more at any time after the end of the individuals Part D initial enrollment period during which the individual was eligible to enroll but was not enrolled in a Medicare Part D plan and was not covered under any creditable prescription drug coverage. Higher earners pay more for both.

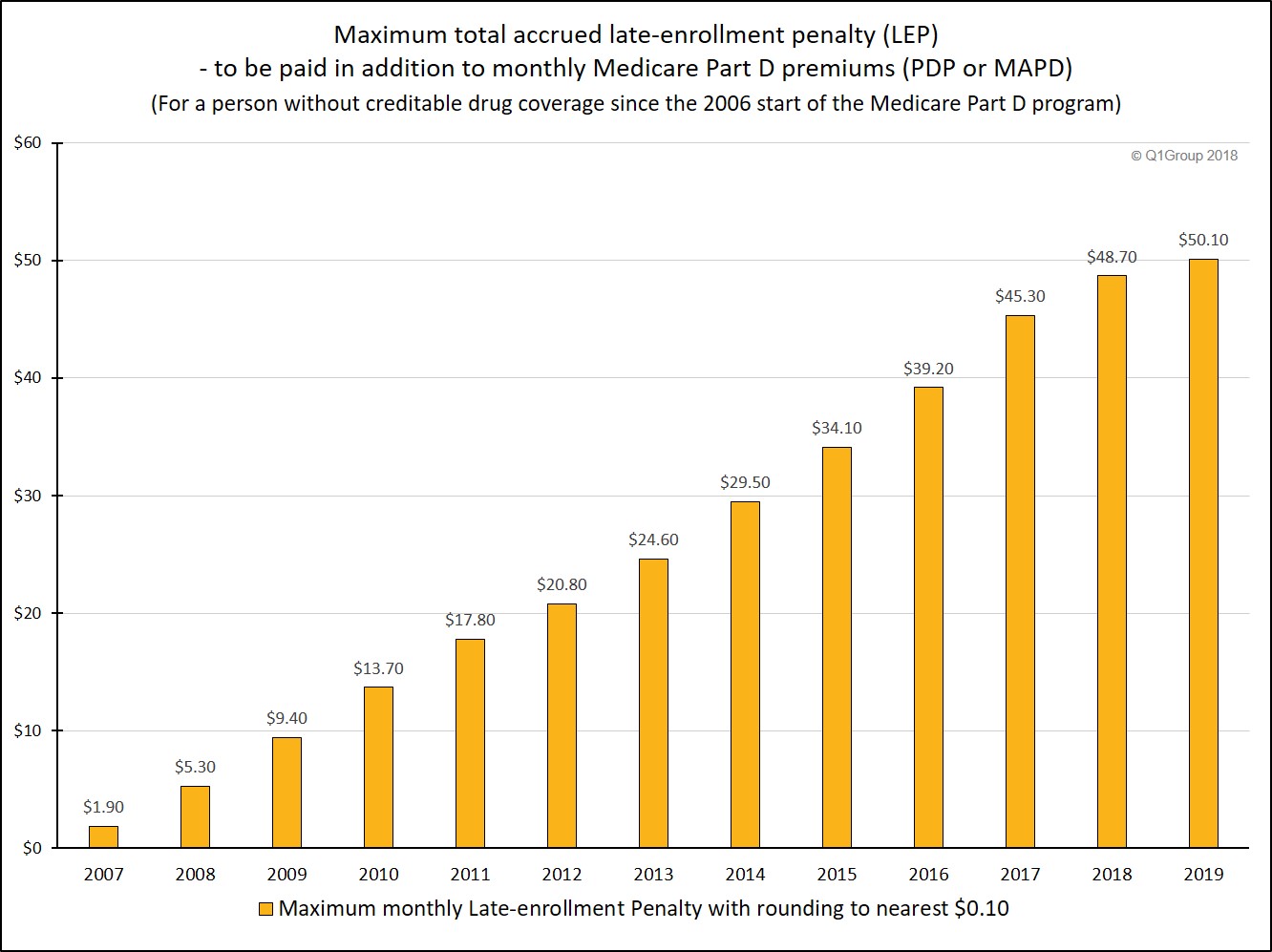

According to Medicare if you go without one of the following for 63 days or more after your initial enrollment period you may be on the hook for a late enrollment penalty. The penalty applies no matter how long you delay Part A enrollment. The national base premium 3306 in 2021 may change each year so your Medicare Part D late-enrollment penalty may vary from year to year.

This fee is 1 percent of the average monthly prescription premium cost. If you have to pay a premium the penalty for late enrollment is 10. Its calculated like this.

When you return to the country you will receive a special enrollment period to choose a Part D plan and wont have to pay a penalty for not being enrolled in that coverage. The Part A premium penalty is charged for twice the number of years you delay enrollment. Part A Late Enrollment Penalty Medicaregov Part B Late Enrollment Penalty Medicaregov Part D Late Enrollment Penalty Medicaregov.

What is the Medicare Part D Late Enrollment Penalty. The amount is 1 for every month you went without coverage when first eligible. Heres an example of how the penalty is calculated in 2020 for a Medicare beneficiary enrolling in a Part D plan 10 months late.

More information on Medicare late enrollment penalties. If you wait past this window to enroll a late enrollment penalty for Medicare Part D will be added to your monthly premium. For 2020 Part B comes with a standard monthly premium of 14460 and Part Ds base premium is 3274.

Even if you sign up for Medicare at age 65 you can drop it. The figure is rounded to the nearest 010. If you do not enroll in Part D coverage during your initial enrollment period and do not have other creditable drug coverage you will have to pay a late enrollment penalty when you sign up for Part D later.

This penalty is added to your premium each month you are enrolled and generally lasts for as long as you have Medicare drug coverage. Medicare calculates the late-enrollment penalty by multiplying the 1 penalty rate of the national base beneficiary. Have creditable drug coverage Qualify for the Extra Help program Prove that you received inadequate information about.

Part D prescription drug coverage A Medicare Advantage plan Part C Another Medicare plan that offers prescription drug. In a Medicare drug plan may owe a late enrollment penalty if he or she goes without Part D or other creditable prescription drug coverage for any continuous period of 63 days or more in a row after the end of his or her Initial Enrollment Period for Part D coverage. Part D late enrollment penalty NBBP x Months without drug coverage x 1 So if you went six months.

If you enroll in a Medicare Prescription Drug Plan when youre first eligible for Medicare you wont be subject to a late-enrollment penalty. Youll probably owe a late-enrollment penalty for Part B due to the years you were eligible for Medicare but not enrolled in it. The Medicare Part D penalty is calculated by multiplying 1 of the national base beneficiary premium 3306 in 2021 by the number of full months that you were eligible for but didnt enroll in a Medicare Prescription Drug Plan and went without other creditable prescription drug coverage.

You may have to pay a higher monthly premium for your Medicare Part D Prescription Drug Plan if you go 63 or more. 2020 Part D National Base Premium 3274mo 1 of 3274 03274 Multiply 03274 by the number of months you are late enrolling 03274 X 10. For each month you delay enrollment in Medicare Part D you will have to pay a 1 Part D late enrollment penalty LEP unless you.

In most cases if you dont sign up for Medicare when youre first eligible you may have to pay a higher monthly premium. If you wait 2 years for example you would pay the additional 10 for 4 years 2 x 2 years. Part D late enrollment penalty formula Now that you know both variables you can calculate your total late enrollment penalty.

How Do I Calculate My Medicare Part D Late Enrollment Penalty

How Do I Calculate My Medicare Part D Late Enrollment Penalty

Https Www Cms Gov Medicare Appeals And Grievances Medprescriptdrugapplgriev Downloads Part D Late Enrollment Penalty Reconsideration Request Form Pdf

Penalties For Not Signing Up For Medicare Boomer Benefits

Penalties For Not Signing Up For Medicare Boomer Benefits

What Is Medicare Part D Senior Market Solutions

What Is Medicare Part D Senior Market Solutions

How To Avoid The Medicare Part D Late Penalty Medicare Solutions Blog

How To Avoid The Medicare Part D Late Penalty Medicare Solutions Blog

Medicare You How The Part D Penalty Is Calculated Youtube

Medicare You How The Part D Penalty Is Calculated Youtube

2019 Medicare Part D Late Enrollment Penalties Will Decrease By 5 23 But Maximum Penalties Can Reach 601 Per Year

2019 Medicare Part D Late Enrollment Penalties Will Decrease By 5 23 But Maximum Penalties Can Reach 601 Per Year

Medicare Part D Late Enrollment Penalty Calculator Reconsideration

Medicare Part D Late Enrollment Penalty Calculator Reconsideration

Medicare Part D Late Enrollment Penalties Explained Youtube

Medicare Part D Late Enrollment Penalties Explained Youtube

Understanding The Part D Late Enrollment Penalty

Understanding The Part D Late Enrollment Penalty

Medicare Don T Wait Until It S Too Late

Medicare Don T Wait Until It S Too Late

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

Medicare Part D Late Enrollment Penalty Youtube

Medicare Part D Late Enrollment Penalty Youtube

Part D Late Enrollment Penalty Maximus Appeals Lep Learn How To Fight It

Comments

Post a Comment