Featured

How To Get 1095 A

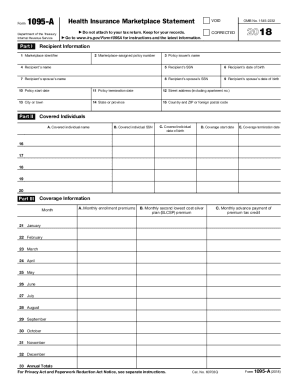

Under Your Forms 1095-A for Tax Filing click Down-load PDF and follow these steps based on your browser. You will receive a Form 1095-A if you had qualified coverage through Access Health CT.

Breakdown Form 1095 A Liberty Tax Service

Breakdown Form 1095 A Liberty Tax Service

The form is informational and is used to report whether they offered.

How to get 1095 a. Click Save at the bottom and then Open. Log in to your HealthCaregov account. Select Tax Forms from the menu on the left.

The federal IRS Form 1095-A Health Insurance Marketplace Statement. If anyone in your household had Marketplace health coverage in 2020 you should have already received Form 1095-A Health Insurance Marketplace Statement. You should expect a Form 1095-C if you had coverage through your employer or through Medicare.

Pay Centers are required to provide 1095-C forms. The California Form FTB 3895 California Health Insurance Marketplace Statement. ALE members must report that information for all twelve months of the calendar year for each employee.

These forms are used when you file your federal and state tax returns to. Form 1095-B is used to report certain information to the IRS and to taxpayers about individuals who are covered by minimum essential coverage and therefore are not liable for the individual shared responsibility payment. Form 1095-C is filed and furnished to any employee of an Applicable Large Employers ALE member who is a full-time employee for one or more months of the calendar.

When the pop-up appears select Open With and then OK. If someone in your household had HUSKYMedicaid coverage in 2020 they can request a form called a Form 1095-B from the Connecticut Department of Social Services. Form 1095-A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Health Insurance Marketplace.

Click the green Start a new application or update an existing one button. Click here if you purchased your plan via healthcaregov. How to find Form 1095-A online.

You can find a copy of your 1095-A form in your MNsure account. How to find your 1095-A online Log in to your HealthCaregov account. If you are the sponsor or annuitant or need to request a 1095.

Calculate your tax refund or credit or the tax amount you owe. However you dont have to wait until then to file your return as you might get your information in a different way from your employer. Contact them directly ONLY your insurer will have access to it and can provide you with a copy.

Under Your Existing Applications select your 2020 application not your 2021 application. Click your name in the top right and select My applications coverage from the dropdown. Theres only one place where you can get a copy of your 1095 tax form.

Download all 1095-As shown on the screen. Log into your HealthCaregov account. About Form 1095-B Health Coverage.

The downloaded PDF will appear at the bottom of the screen. Form 1095-A is also furnished to individuals to allow them to take the premium tax credit to reconcile the credit on their returns with advance payments of the premium tax credit advance credit payments and to file an accurate tax return. Use the California Franchise Tax Board forms finder to view this form.

Expect to receive your 1095-B form by mail on or before March 2 2021. About Form 1095-C Employer-Provided Health Insurance Offer and Coverage. However Pay Centers are no longer required to provide 1095-B forms unless you request one.

Pay Centers must provide your 1095-B form within 30 days of your request. If you didnt get the form online or by mail contact the Marketplace Call Center How to use Form 1095-A If your form is accurate youll use it to reconcile your premium tax credit. Select Tax Forms from the menu on the left.

Internet Explorer users. VA and Other Health Insurance If you have other forms of health care coverage such as a private insurance plan Medicare Medicaid or TRICARE you can continue to use VA along with these plans. Under Your Existing Applications select your 2019 application not your 2020 application.

Under Your existing applications select your 2017. To find your 1095-A online follow these steps. IRS Form 1095-A You should receive your IRS Form 1095-A by mid-February.

If you andor your family receive health insurance through an employer the employer will provide Form 1095-C by early March 2021. If you have questions about your form see these frequently asked questions or call our Contact Center.

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

Corrected Tax Form 1095 A Katz Insurance Group

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Understanding Your Form 1095 A Youtube

Understanding Your Form 1095 A Youtube

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

1095 A Form Fill Out And Sign Printable Pdf Template Signnow

1095 A Form Fill Out And Sign Printable Pdf Template Signnow

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Didn T Get A 1095 A Or Ecn You Can File Taxes Without Them

Didn T Get A 1095 A Or Ecn You Can File Taxes Without Them

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png) About Form 1095 A Health Insurance Marketplace Statement Definition

About Form 1095 A Health Insurance Marketplace Statement Definition

2020 Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

2020 Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

Comments

Post a Comment