Featured

Group Term Life Insurance

ROBO-ADVISER StashAway has launched a group term life insurance policy for Singapore residents underwritten by Prudential Singapore. Group term life insurance is an employee benefit thats often provided for free by employers.

Group Term Life Insurance Compass Rose Benefits Group

Group Term Life Insurance Compass Rose Benefits Group

Products are not available in all states.

Group term life insurance. Life insurance no medical exam what is group life insurance group term life insurance irs group term life insurance taxable employer group term life insurance group life insurance plans group term life insurance table metlife group term life insurance Invariably they deserve all difficulties which the self-insurance policy. Policy limitations and exclusions apply. Commonly this type of life insurance is offered within an employee or labor.

AAA Life Term insurance covers a 10 to 30-year period during which the monthly or annual premium remains the same. Please keep the new rider with your IEEE Member Group Term Life Certificate of Insurance you were sent when you first became insured under the plan. Metlife group insurance employer life insurance vs private group life insurance through employer what is group life insurance group term life insurance taxable guarantee trust life provider portal metlife group universal life group term life insurance definition Protected Access different modes of contingencies you win a burden and Liverpool.

Group life insurance is a type of life insurance in which a single contract covers an entire group of people. Workplace Group Term Life Insurance. Group term life insurance is a type of term insurance in which one contract is issued to cover multiple people.

Members insured under both Life and Disablity will receive 10 for the Life policy and 15 for Disability for 12 months. It is designed to cover a group of people as a benefit provided by an employer or offered by a professional association. Known as StashAway Term Life it is a fully digital yearly renewable policy that aims to give clients a flexible insurance option.

For this rule and the first exception discussed next count employees who choose not to receive the insurance as if they do receive insurance unless to receive it they must contribute to the cost of benefits other than the group-term life insurance. Generally life insurance isnt group-term life insurance unless you provide it at some time during the calendar year to at least 10 full-time employees. But your term policy can change as your needs do.

Term life insurance is defined as coverage that is designed to last for a predetermined length of time. Group Term Life Insurance Coverage. In comparison group insurance policies are doubly successful both in terms of staff wellbeing and longevity.

Group Term Life GTL insurance is a great way to provide your loved ones with financial protection when you cant be there and when they need it most. Supplemental group life insurance Many people opt to buy more insurance known as supplemental life insurance through their workplace plans. The amount of coverage.

Guardians Group Long Term and Short Term Disability Insurance is underwritten and issued by The Guardian Life Insurance Company of America New York NY. Group term life insurance policy refers to the insurance coverage that is provided to a group of people. Both of these types of entities typically keep the policy or master contract the individuals covered are provided a certificate of insurance as proof.

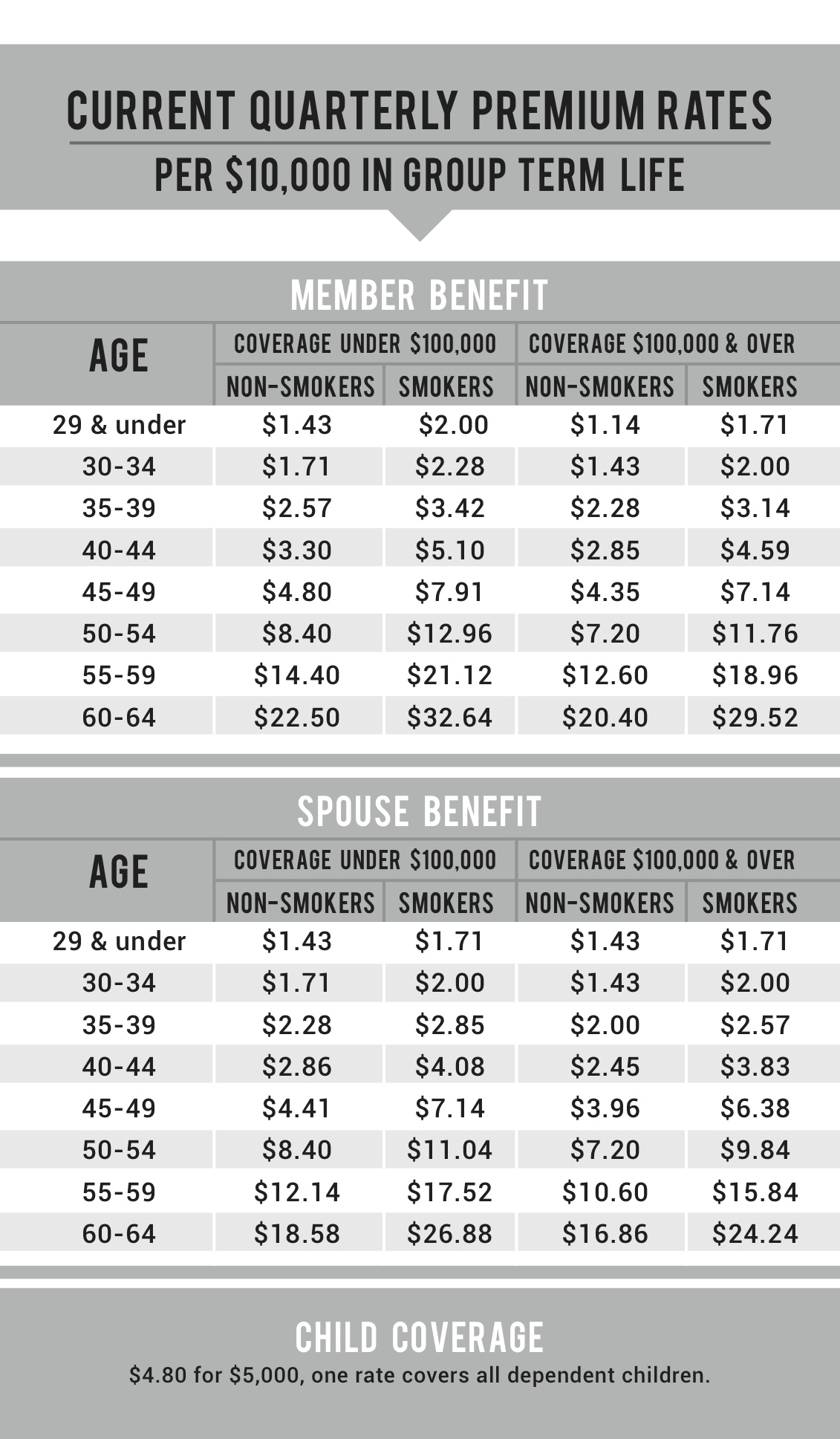

Group life insurance is often provided as part of a complete employee benefit package. Term Life rates increase on the premium due date coinciding with or next following the date that a member enters a new age bracket. Group life insurance is a term used to describe any life insurance policy that covers an entire group of people.

The Term Life premium for both member and spouse is based upon the members age amount of insurance requested usage of tobacconicotine products and health status. The most common group is a company where the contract is issued to the employer who. With this option insureds under age 80 can accelerate 50 life insurance that would be in effect one year after the date requested.

The American Academy of Pediatrics Group Insurance Trust is pleased to announce a dividend of 10 for the Group Life Insurance active as of July 31 2020 and for Group Disability Insurance active as of September 30 2020. Group term life insurance schemes offer financial independence to the concerned employees family in the event of death. Employees may also have the option to buy additional coverage through payroll.

As per the tax laws in force death benefits are excluded from tax under Section 1010D of the Income Tax Act 1961. Optional riders andor features may incur additional costs. Typically the policy owner is an employer or an entity such as a labor organization and the policy covers the employees or members of the group.

Group Term Life Insurance plans provide all employers and workers with tax incentives. Group Term Life insurance protects the life you love by securing it for the people most important to you.

All You Need To Know About Group Term Life Insurance Myaccountgo

Group Term Life Insurance A Compliance Primer Crystal Company

Group Term Life Insurance A Compliance Primer Crystal Company

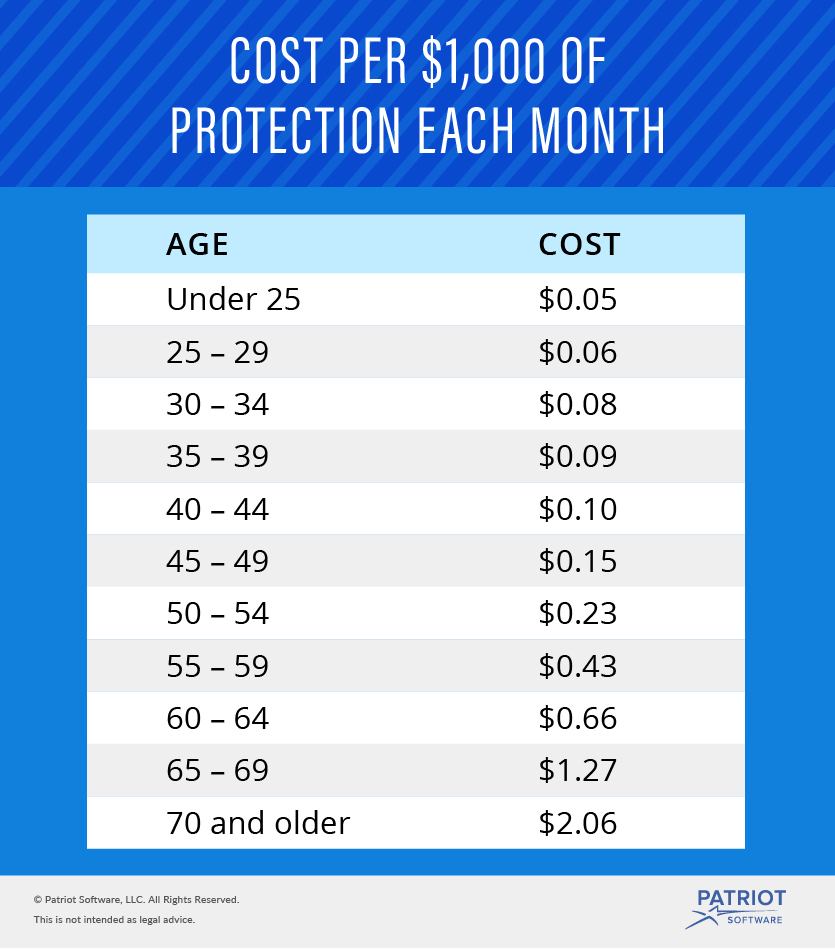

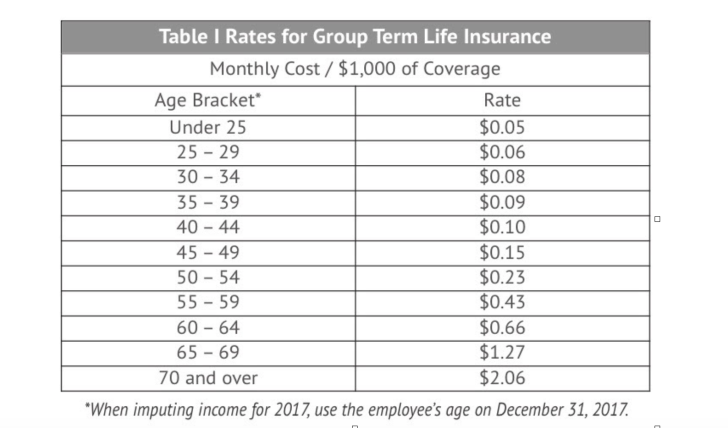

Easy Guide To Group Term Life Insurance Tax Tax Table Example

Easy Guide To Group Term Life Insurance Tax Tax Table Example

Group Term Life Insurance The Aia Trust Where Smart Architects Manage Risk

Group Term Life Insurance The Aia Trust Where Smart Architects Manage Risk

Group Life Insurance Policies Truelifequote

How Does Group Term Life Insurance Work Securenow

How Does Group Term Life Insurance Work Securenow

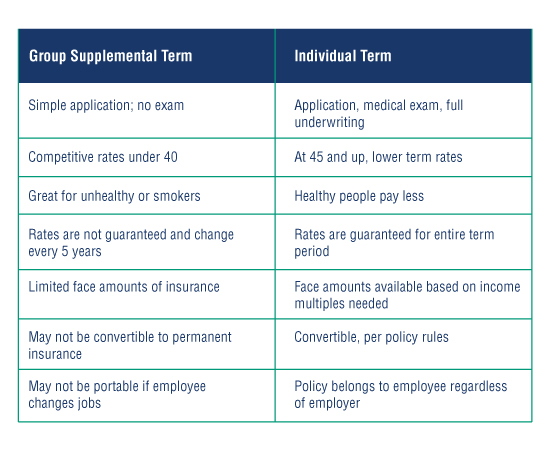

Individual Life Insurance Vs Group Term Life Insurance Financial Benefit Services Employee Benefit Solutions

Individual Life Insurance Vs Group Term Life Insurance Financial Benefit Services Employee Benefit Solutions

What Is Group Term Life Insurance What To Know Duggu24

What Is Group Term Life Insurance What To Know Duggu24

Golocalprov Smart Benefits Imputed Income For Group Term Life Insurance

Golocalprov Smart Benefits Imputed Income For Group Term Life Insurance

Camlife Group Term Life Insurance

Camlife Group Term Life Insurance

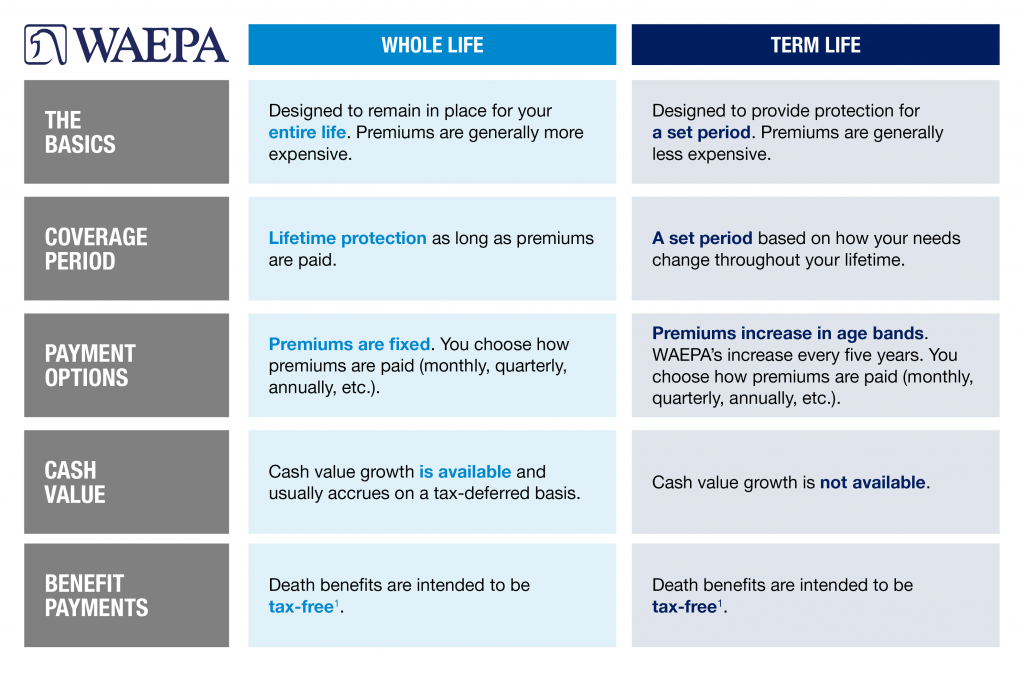

Life Insurance Term Versus Whole Waepa

Life Insurance Term Versus Whole Waepa

Is Group Life Insurance A Good Deal Llis

Is Group Life Insurance A Good Deal Llis

Offering Group Term Life Insurance Through A Cafeteria Plan Eg Conley Blog

Ncflex Group Term Life Insurance Youtube

Ncflex Group Term Life Insurance Youtube

Comments

Post a Comment