Featured

Can I Change From Hmo To Ppo

Are prescription drugs covered. You can do this from January 1 through March 31 2021.

How To Make Changes To Your Health Plan

How To Make Changes To Your Health Plan

You just cant add new deposits to the account.

Can i change from hmo to ppo. The monthly premiums for an HMO and a PPO are not all that different. Getting married or divorced having a baby or a death in the family. Likewise if you had a significant change in cost mid-year such as if your renewal was mid-year rather than calendar.

Each insurer makes different deals with different networks. If you choose to go back to Original Medicare you have until March 31 2021 to enroll in a Part D plan if you leave a Medicare Advantage plan with drug coverage and wont have prescription drug coverage with your new Medicare Advantage plan. If you have a Medicare HMO plan and your doctor is out-of-network your MA plan does not cover these doctor bills.

You cannot simply quit your plan and move to another in the plan year without reason. Posted April 20 2016 A change in residence such that the participant becomes out of network in the PPO is given as an example in the regs. I was on an HMO my first pregnancy and the overall cost was MUCH lower than PPO which was nice.

Considering PPOs provide more choice and flexibility they typically have higher premiums and higher deductibles than HMOs. For both HMOs and PPOs seeing providers inside your network is much more cost effective. The first thing to know is that you cant set up an HSA account unless you have an HSA compatible health policy in place.

If you do go outside of your network HMO coverage will be more expensive than going outside of your network with a PPO. As long as you keep the same PCP you only have to do this step once. In some cases you will have to pau a doctor for services directly And then file a claim to get reimbursed.

The difference in cost. Hello If your Blue Access account does not show your new plan information after that plan becomes effective you may need to register for a new account for that new plan. You can pick any PCP that is in your HMO network.

HMOs and PPOs also have many of the same required payments. Barring these qualifying events you must wait until open enrollment to make policy changes. Money deposited in the HSA is deducted from your income saving on taxes.

The policy that is designated to go with an HSA could have a PPO. In other words theres no downside. Ask about the next available enrollment period and find out if you must wait until then to change health insurance coverage from your HMO to a PPO.

Contact your insurance agent or see your company human resources representative to discuss your health insurance coverage. Generally speaking an HMO might make sense if lower costs are most important and if you dont mind using a PCP to manage your care. My copays for appointments were 515 depending on if an ultrasound was involved and my out of pocket expense for the actual birth was only 150.

Each plan gives you flexibility to go to doctors specialists or hospitals that arent on the plans list but it will usually cost more. We can check and see if this is needed if youd like to send us a private message with your plan ID and contact information. You dont have to choose a primary care provider with a Medicare PPO but you do with an HMO.

In most cases prescription drugs are covered in PPO Plans. Your PCP is your family doc the one you see for regular check-ups and general health problems. Moving creates a SQE.

The short answer is no. You can change your plan if your reason falls under special qualifying event like turning 26 and having to leave your parents plan. Remember if you join a PPO.

This is most common when you seek services from out-of-network providers. There are few circumstances that qualify you to change your health insurance plan mid-year. For better coverage you may want to change your MA plan now from HMO to PPO.

Drug coverage is another reason to change. All the same rules apply for using existing HSA funds after leaving a HDHP--even if you become uninsured. Along with premiums there are co.

The PPO premium was 596 a month. However Medicare PPO plans do cover doctors out-of-network at higher costs. If you dont have an HDHP but add one that would count as a coverage change.

Once you are enrolled in a Medicare supplement plan you can change that plan any time of year. And you can also let the funds roll over from year to year with no penalty if you dont have medical expenses just like when you do have a HDHP. If you want Medicare drug coverage you must join a PPO Plan that offers prescription drug coverage.

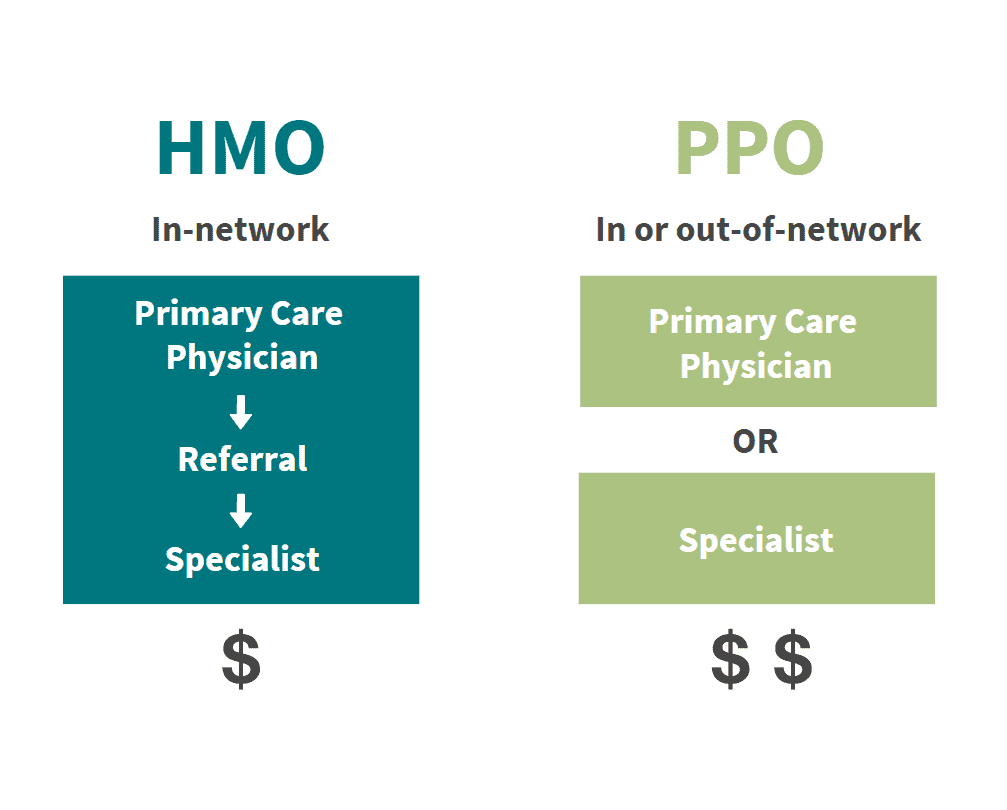

In most cases you can get your health care from any doctor other Health care provider or hospital in PPO Plans. However most people only change when there is a motive to do so. If you want to see a specialist an HMO generally requires you to get a referral.

The average HMO premium last year was 572 a month for one person according to the Kaiser Family Foundation. To switch to a new Medicare Advantage Plan simply join the plan you choose during one of the enrollment periods. Usually this occurs in the form of a rate increase.

To avoid the expense of out-of-network doctors make sure your doctor is in-network. Your mileage may vary but you can definitely find out this info before making the switch. You cannot change from an HMO to a PPO.

Youll be disenrolled automatically from your old plan when your new plans coverage begins. A PPO typically lets you see a specialist without a referral. To switch to Original Medicare contact.

However often a insurer will offer similarly priced HMO and PPO.

Are Medicare Advantage Plans Worth The Risk

Are Medicare Advantage Plans Worth The Risk

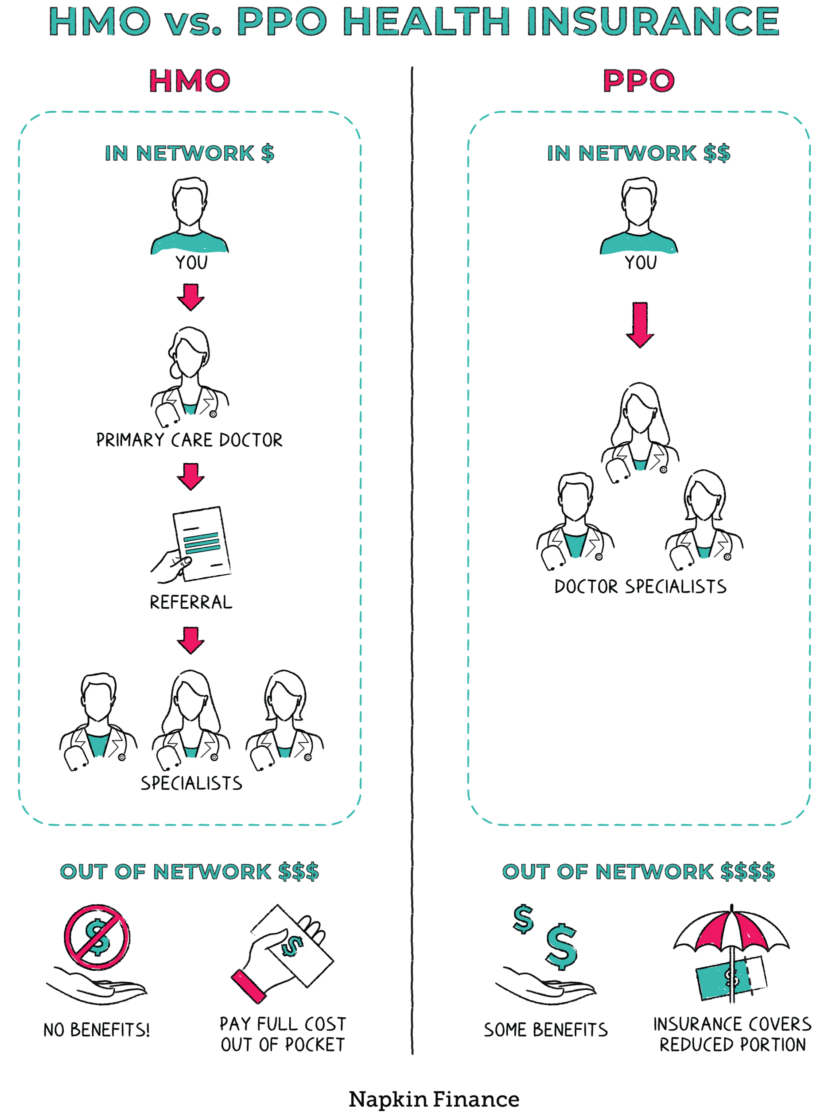

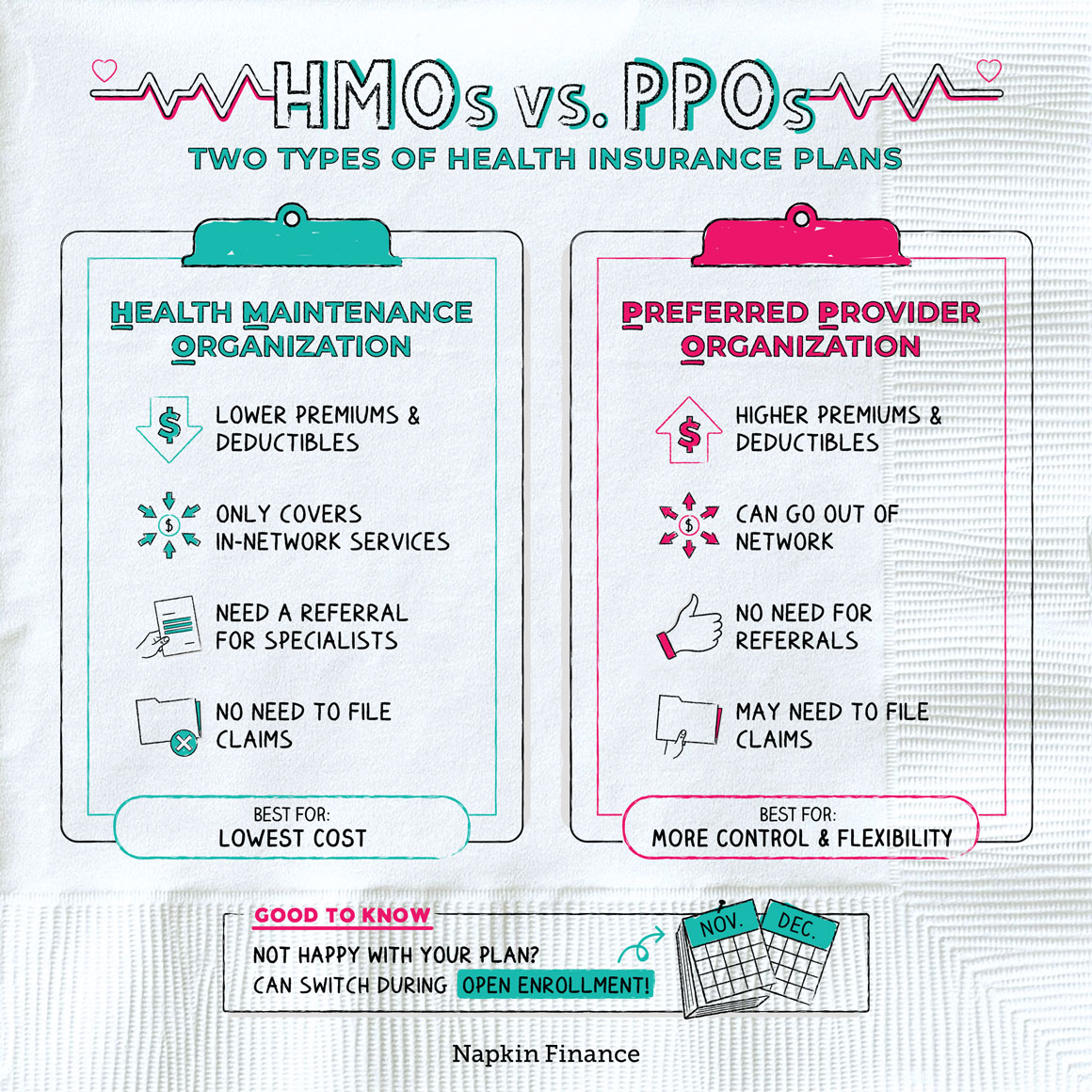

Hmo Vs Ppo Health Insurance Plans Napkin Finance

Hmo Vs Ppo Health Insurance Plans Napkin Finance

Hmo Vs Ppo What S The Difference

Hmo Vs Ppo What S The Difference

Difference Between Hmo And Ppo Difference Between

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

Hmo Vs Ppo Health Insurance Plans Napkin Finance

Hmo Vs Ppo Health Insurance Plans Napkin Finance

Hmo Vs Ppo Benefits Cost Comparison

Hmo Vs Ppo Benefits Cost Comparison

Frequently Asked Questions About Health Net Health Net

Frequently Asked Questions About Health Net Health Net

What S The Difference Between An Hmo And A Ppo Aspen Wealth Management

What S The Difference Between An Hmo And A Ppo Aspen Wealth Management

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Hmo Vs Ppo What S The Difference

Hmo Vs Ppo What S The Difference

Hmo Vs Ppo Is Ppo Better Than Hmo Is It Worth It

Hmo Vs Ppo Is Ppo Better Than Hmo Is It Worth It

How Does An Hmo Plan Work 3 Tips For Switching From A Ppo To An Hmo Plan Ibx Insights

How Does An Hmo Plan Work 3 Tips For Switching From A Ppo To An Hmo Plan Ibx Insights

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Comments

Post a Comment