Featured

Form 8962 Instructions 2020

Enter a term in the Find Box. The Marketplace is required to send Form 1095-A by January 31 2021 listing the advance payments and other information you need to complete Form 8962.

Form 8962 Fill Out And Sign Printable Pdf Template Signnow

Form 8962 Fill Out And Sign Printable Pdf Template Signnow

15 Zeilen 2020 Inst 8962.

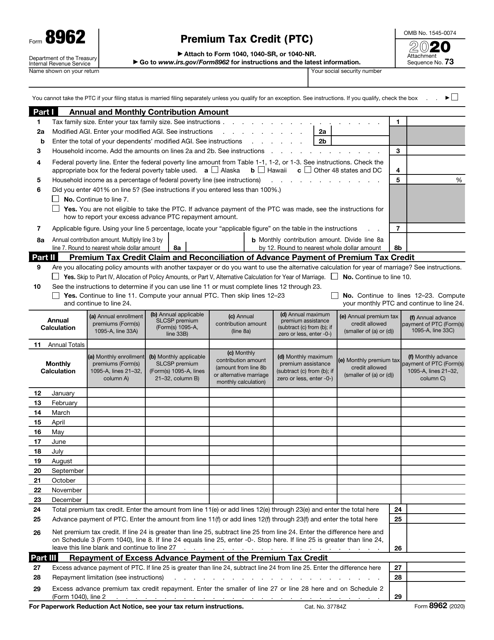

Form 8962 instructions 2020. Premium Tax Credit PTC 2020 11172020 Inst 8962. The IRS continues to process prior year tax returns and correspond for missing information. Your social security number.

2019 Form IRS 8283 Fill Online Printable Fillable Blank. Instructions for Form 8959 2020 Instructions for Form 8959 2020 i8959pdf. Who must file a form 8962.

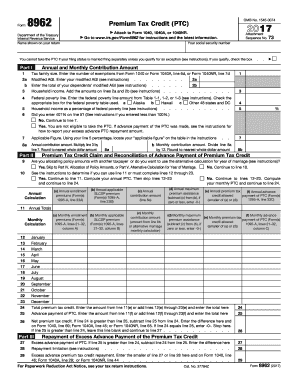

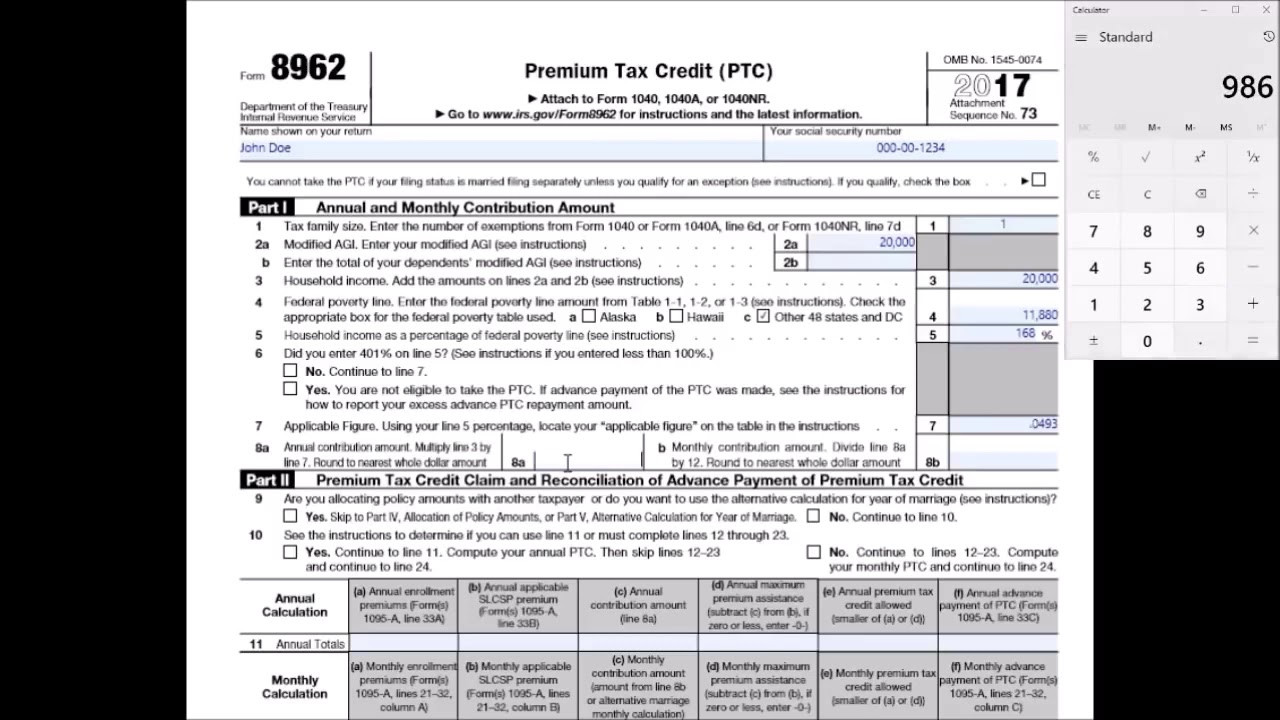

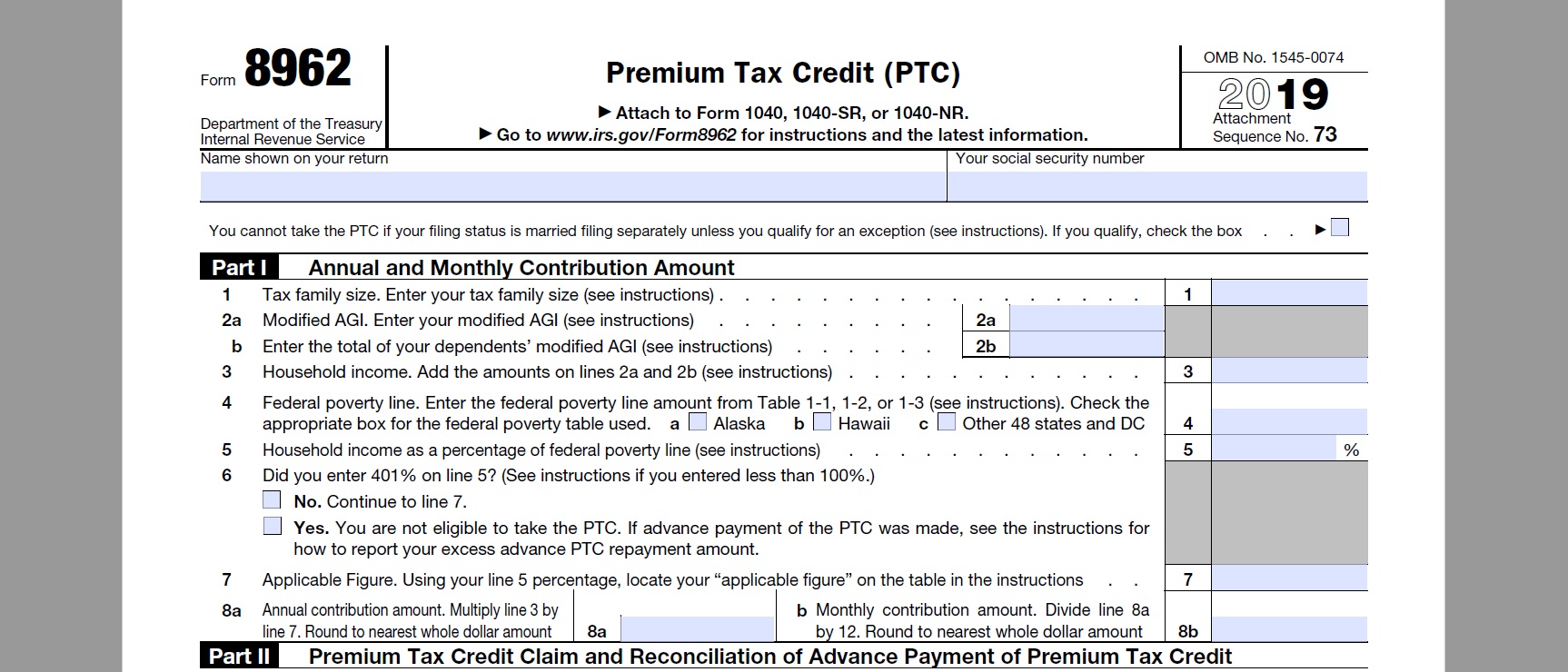

Form 8962 Premium Tax Credit is required when someone on your tax return had health insurance in 2020 through Healthcaregov or a state marketplace and took the Advance Premium Tax Credit to lower their monthly premium. How to complete any Form Instructions 8962 online. Form 8962 Premium Tax Credit PTC is the form you will need to report your household Modified AGI MAGI your Federal Poverty Level amount your familys health insurance premium exemptions and the cost assistance you received.

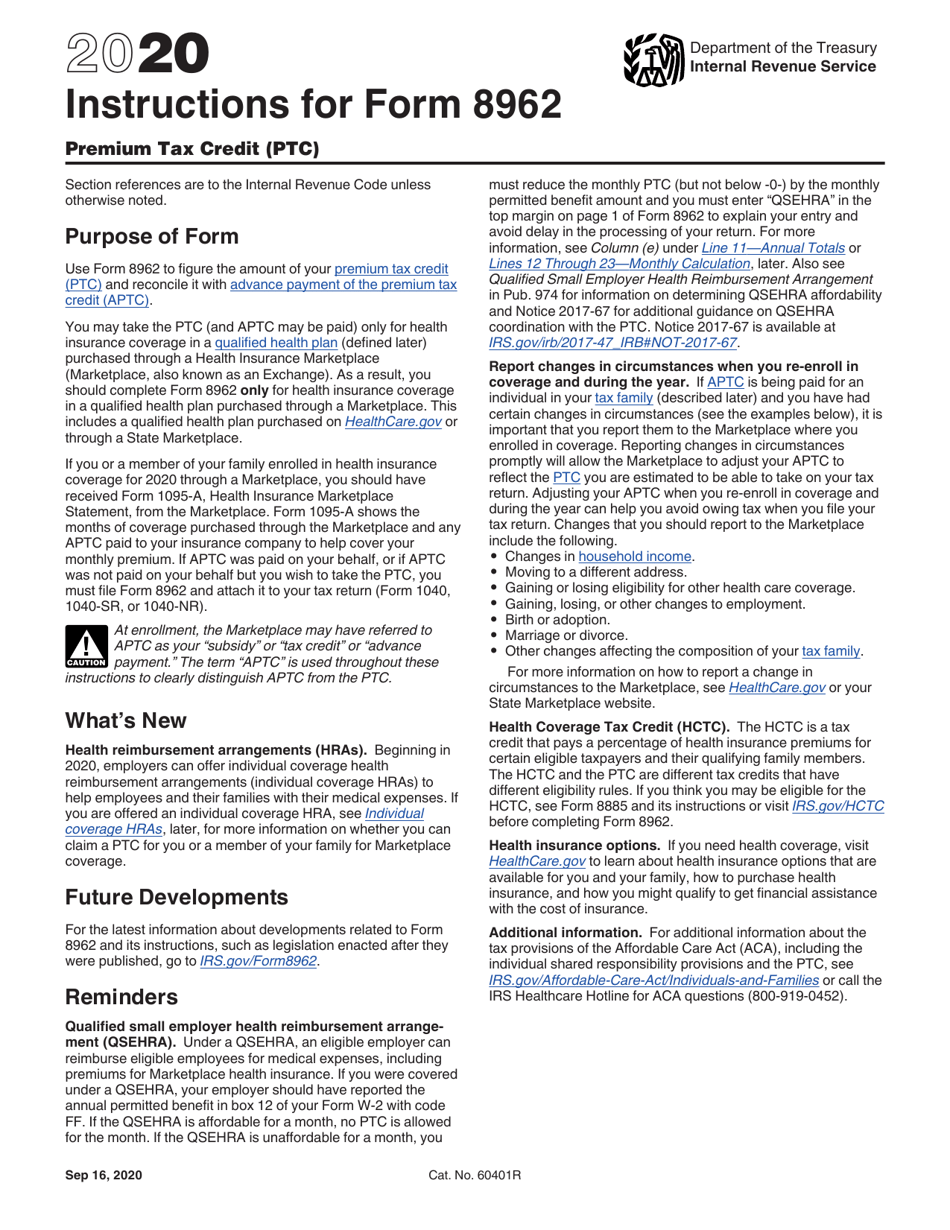

Complete Form 8962 to claim the credit and to. As a result you should complete Form 8962 only for health insurance coverage in a qualified health plan purchased through a Marketplace. Form 8962 is used either 1 to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium or 2 to.

IRS Forms 1099 Are Coming Packing A Tax Punch. Boost your productivity with powerful service. Select a category column heading in the drop down.

Approve forms by using a lawful digital signature and share them via email fax or print them out. Name shown on your return. Form 8621 Instructions 2020 2021 IRS Forms.

73 Your social security number You cannot take the PTC if your filing status is married filing separately unless you qualify for an exception. You may be able to enter information on forms before saving or printing. On the site with all the document click on Begin immediately along with complete for the editor.

Instructions for Form 8962 Premium Tax Credit PTC 2020 12142020. Go to wwwirsgovForm8962 for instructions and the latest information. Form 8962 to your return to reconcile compare the advance payments with your premium tax credit for the year.

Use your indications to submit established track record areas. Instructions for Form 8963 012020 Instructions for Form 8963 012020 i8963pdf. Download blanks on your computer or mobile device.

Go to wwwirsgovForm8962 for instructions and the latest information. The form is used in the event of a qualified health plan. Fill out forms electronically using PDF or Word format.

Form 8962 instructions 2020 - 2021. Add your own info and speak to data. 2020 Instructions for Form 8962 Premium Tax Credit PTC Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted.

2019 Form IRS 8283 Fill Online Printable Fillable Blank. It is used to report your credit amount on your tax return and reconcile the advance credit payments made on your behalf. Taxpayers who received the benefit of APTC prior to 2020 must file Form 8962 to reconcile their APTC and PTC for the pre-2020 year when they file their federal income tax return even if they otherwise are not required to file a tax return for that year.

Get And Sign Instructions For Form 8962 2020-2021 Insurance Marketplace Marketplace also known as an Exchange. If the IRS sends a letter about a 2019 Form 8962. Form 8962 Department of the Treasury Internal Revenue Service Premium Tax Credit PTC Attach to Form 1040 1040-SR or 1040-NR.

Purpose of Form Use Form 8962 to figure the amount of your premium tax credit PTC and reconcile it with advance payment of the premium tax credit APTC. 1545-0074 Premium Tax Credit PTC Department of the Treasury Internal Revenue Service Name shown on your return 2020 Attach to Form 1040 1040-SR or 1040-NR. 2020 Form 8962 Form 8962 OMB No.

Instructions for Form 8966 2020. Make them reusable by creating templates include and fill out fillable fields. Explore The New IRS Form For Net Investment.

Form 8621 Instructions 2020 2021 IRS Forms. IRS 8962 Form Premium Tax Credit 2020-2021 Steps to Fill out Online 8962 IRS Form An individual needs 8962 Form to claim the Premium Tax Credit. Instructions for Form 8962 Premium Tax Credit PTC 2020 Form.

Information about Form 8962 Premium Tax Credit including recent updates related forms and instructions on how to file. Click on the product number in each row to viewdownload. IRS Forms 1099 Are Coming Packing A Tax Punch.

You will need Form 1095-A from the Marketplace. Instructions for Form 8962 2020 Instructions for Form 8962 2020 i8962pdf. Form 8962 is a tax form issued by the Internal Revenue Service which is required to be filed by taxpayers who are getting an exemption for health coverage.

Click on column heading to sort the list. Below we do a walkthrough of filling out the PTC form and we simplify the terms found within. Instructions for Form 8960 2020 Instructions for Form 8960 2020 i8960pdf.

How To Fill Out Irs Form 8962 Accounts Confidant

How To Fill Out Irs Form 8962 Accounts Confidant

Http Www Tsh Co Th 2020 W4 Form

How To Fill Out Form 8962 Step By Step Premium Tax Credit Ptc Sample Example Completed Youtube

How To Fill Out Form 8962 Step By Step Premium Tax Credit Ptc Sample Example Completed Youtube

Aca Affordable Care Act Information Vita Resources For Volunteers

Aca Affordable Care Act Information Vita Resources For Volunteers

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png) Form 8962 Premium Tax Credit Definition

Form 8962 Premium Tax Credit Definition

Irs 2019 Health Insurance Subsidy Tax Credit Reconciliation

Irs 2019 Health Insurance Subsidy Tax Credit Reconciliation

How To Fill Out Irs Form 8962 Correctly

How To Fill Out Irs Form 8962 Correctly

Irs Form 8962 Download Fillable Pdf Or Fill Online Premium Tax Credit Ptc 2020 Templateroller

Irs Form 8962 Download Fillable Pdf Or Fill Online Premium Tax Credit Ptc 2020 Templateroller

How To Fill Out Irs Form 8962 Accounts Confidant

How To Fill Out Irs Form 8962 Accounts Confidant

8962 Form 2021 Irs Forms Zrivo

8962 Form 2021 Irs Forms Zrivo

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

Download Instructions For Irs Form 8962 Premium Tax Credit Ptc Pdf 2020 Templateroller

Download Instructions For Irs Form 8962 Premium Tax Credit Ptc Pdf 2020 Templateroller

Premium Tax Credit Form 8962 And Instructions

Premium Tax Credit Form 8962 And Instructions

How To Fill Out Obama Care 8962 Premium Tax Credit Forms If Single Youtube

How To Fill Out Obama Care 8962 Premium Tax Credit Forms If Single Youtube

Comments

Post a Comment