Featured

Life Insurance 30 Day Grace Period

Literal Meanings of Days Of Grace Or Grace Period Days. As a result of COVID-19 most insurance providers extended grace payment periods to.

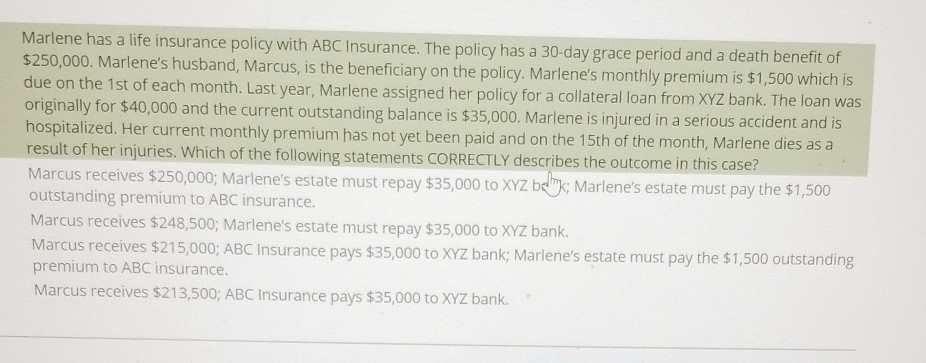

Solved Marlene Has A Life Insurance Policy With Abc Insur Chegg Com

Solved Marlene Has A Life Insurance Policy With Abc Insur Chegg Com

Companies send reminders on SMS and emails to make sure the customer pays their premiums on or before the due date.

Life insurance 30 day grace period. You also get notice one month in advance to pay your due premium. The life insurance grace period typically ranges from 30 to 31 days though some insurers are more generous. Many life insurance providers offer a 30-day grace payment period as a customer incentive.

The provider will inform you before your due date and also afterwards to inform you have now entered your grace period. It varies by insurance policy and state. Life insurance grace period is depends on the company however the standard is 30 days.

However for unit linked insurance plans ULIPs the grace period is 75 days during the 5-year lock-in period. A grace period of 30 days will be allowed for payment of Yearly or Half-Yearly or Quarterly premiums and 15 days for Monthly through ECS premiums. Understandably the insurance company wants the.

A life insurance grace period refers to the period of time after premium payments are due during which the policy is still active. If you had an annual premium on a policylets say it was 700 a year or whatever the annual premium wasand the payment wasnt sent in the insurance company will generally give a 31-day grace period. This is a period of time usually 30 days where despite the missed payment the insurance policy will still provide coverage and make a full payout if the insured dies.

A life insurance policy shall contain a provision that a grace period of 30 days or at the option of the insurer of one month of not less than 30 days or of four weeks in the case of industrial life insurance policies the premiums for which are payable more frequently than monthly shall be allowed within which the payment of any premium after the first may be made during which. How long is the grace period for an individual life insurance policy. Life living benefits and personal accident disability insurance policies offer a grace period of 30 days for paying your premium.

Days Of Grace Or Grace Period Days Of Grace Or Grace Period. If you make annual payments the maximum grace period available for renewal is 30 days. To reach more about the grace period read our reference here.

If your policy has a grace period it could be short as 24 hours or as long as 30 days. This is true for traditional life insurance products and term life insurance policies. If you know you wont be able to pay your.

The grace period is defined in the contract of your policy and provides you with the opportunity to maintain coverage even if you miss a payment. Each of the twenty-four periods from one midnight to the. If payment is not received within that period your policy will be at risk of lapsing and no longer being in effect.

During this time your coverage stays in force. Thats where the grace period kicks in. There is not a standard grace period offered by all insurance carriers.

Grace period may vary based on payment mode and providerIt is usually 30 days for annual premium payment mode but can be less for more frequent payment modes such as 15 days for monthly premium. An insurance grace period is the amount of time after your premium is due during which you can still make the payment without your coverage lapsing. However if you make monthly payments you are eligible for only 15 days of grace period.

We have discussed different facts that you must know in this post. While an insurance company is not legally required to provide a grace period most policies include one. 1 you have until Aug.

Grace Period of Payments Term Insurance Policies. It is also commonly referred to as a lapsation grace period as it is technically delaying an insurance policy lapse by the length of the grace period typically 30 days from the premium due date. However insurers will stop accepting claims a few weeks after your premium is due.

For example if your premium is due Aug. Know about the latest circular of IRDAI in which you will get additional 30 days Grace Period to pay your life insurance premiumAlso know about the settleme. Alternatively you may reach out to your insurance agent for payment.

When you pay your premium they unlock claim payments says Matt Tassey past chairman of the Life and Health Insurance Foundation for Education. Every life insurance company provide a grace period of 30 days for paying the premium after the due date is over. Generally grace periods are 30 days although this period is governed by state laws.

But if they forget to pay the premiums on time still they get 30 days of grace period. Life and health insurance provisions that allow insurers to pay premiums 30 or 31 days after the end of the premium period for the insurance to remain valid.

Will Life Insurance Pay If You Die During A Grace Period It Depends

Life Insurance Policyholders Get 30 More Days To Pay Premium Amid Lockdown

Life Insurance Policyholders Get 30 More Days To Pay Premium Amid Lockdown

What Is A Life Insurance Policy Lapse Policygenius

What Is A Life Insurance Policy Lapse Policygenius

What To Do When Your Life Insurance Policy Lapses Life Insurance Canada

What To Do When Your Life Insurance Policy Lapses Life Insurance Canada

What Is Insurance Grace Period Max Life Insurance

What Is Insurance Grace Period Max Life Insurance

Life Insurance Grace Period Facts To Consider Mason Finance

Life Insurance Grace Period Facts To Consider Mason Finance

Coronavirus Lockdown Life Insurance Policyholders Get 30 Days More To Pay Premium

Coronavirus Lockdown Life Insurance Policyholders Get 30 Days More To Pay Premium

Coronavirus Irdai Asks Insurance Firms To Allow A 30 Day Grace Period For Paying Life Insurance Policies Premium

Coronavirus Irdai Asks Insurance Firms To Allow A 30 Day Grace Period For Paying Life Insurance Policies Premium

Life Insurance Policyholders Get Additional 30 Days To Pay Premium

Life Insurance Policyholders Get Additional 30 Days To Pay Premium

Grace Period In Term Life Insurance Explained Fgili

Grace Period In Term Life Insurance Explained Fgili

Buying Life Insurance In The Time Of Covid 19

Buying Life Insurance In The Time Of Covid 19

Is There A 30 Day Grace Period For Your Employer To Carry You On Health Insurance Life Insurance Policy Insurance Quotes Compare Quotes

Is There A 30 Day Grace Period For Your Employer To Carry You On Health Insurance Life Insurance Policy Insurance Quotes Compare Quotes

/GettyImages-184985261-64004cc8e7c9472aa69098df1d225d14.jpg) What Is Insurance Grace Period

What Is Insurance Grace Period

Comments

Post a Comment