Featured

Health And Savings Plan

Save all or part of a certain type of income. Pretax Health Savings Account contributions that rollover and can be used for health expenses now and later.

Health Savings Account Habits Fidelity

Health Savings Account Habits Fidelity

The HSA is yours to save for current and future healthcare-related expenses such as your deductible coinsurance and prescription medications.

Health and savings plan. Updated Dec 21 2020 A Health Savings Account HSA is like a personal savings account but it can only be used for qualified healthcare expenses. HSA helps you pay for covered expenses now and save for medical expenses you may have in the future especially in your retirement years. A health savings account HSA is a tax-advantaged medical savings account available to taxpayers in the United States who are enrolled in a high-deductible health plan HDHP.

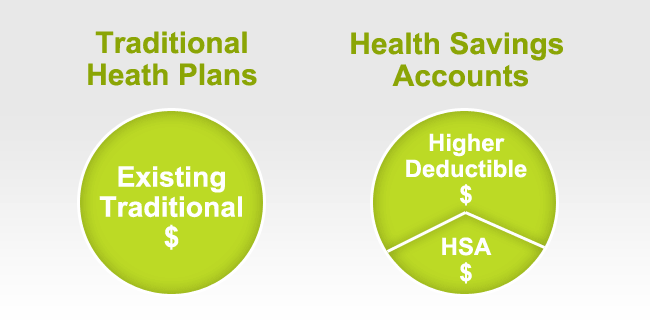

They reduce out-of-pocket costs of medical care by allowing you to pay with. If you enroll in an HDHP you may pay a lower monthly premium but have a higher deductible meaning you pay for more of your health care items and services before the insurance plan pays. Establish savings buckets and watch these goals get closer as savings grow.

No cost for preventive care. The people who are the most successful at something have a strong why behind what they are doing. You not your employer or insurance company own and control the money in your HSA.

HSA stands for health savings account. Health savings plan HSA offers you health insurance cover as well as premium savings to pay for your future medical expenses. One benefit of an HSA is that the money you deposit into the account is not taxed.

You can open an HSA with any HSA eligible health plan and use those tax deductible funds to pay for eligible medical costs. So why do you want to save money. Health savings accounts are intended to help people with high-deductible health insurance plans pay for medical expenses.

Options Available with the Health Savings Plan Health Savings Account HSA. From forms and documents to manuals and consulting we are the. Investing involves risk including risk of loss.

And typically is cheaper than non-HSA eligible plans. Your HSA is an important component of retirement savings. Set up an automatic transfer from your checking account to a savings account each month.

So if youre one of those people who want to save more money this year check out these savings tips on how to set your plan and avoid getting off track. The availability of HDHPs for private industry workers participating in medical care plans increased from 24 percent in 2010 to 45 percent in 2018. Designate your tax refund annual bonus tip money or proceeds from garage sales to savings.

By using untaxed dollars in a Health Savings Account HSA to pay for deductibles copayments coinsurance and some other expenses you may be able to lower your overall health care costs. This savings plan acts as an alternative to a traditional Insurance health plan. No tax is levied on contributions to an HSA.

Its separate from the type of network options of a PPO HMO etc. As one of the industrys leading providers we offer education compliance and administration for HSAs. The funds contributed to an account are not subject to federal income tax at the time of deposit.

7 tips to a successful savings plan 1. How High Deductible Health Plans and Health Savings Accounts can reduce your costs. Offers low premiums.

A Health Savings Account is a tax-advantaged account to help people save for medical expenses that are not reimbursed by high-deductible health plans. HSAs have become an integral savings component for many of todays savers. To be eligible you must be enrolled in a.

2021 Health Plans At-a-Glance Health Savings Plan. This factsheet highlights High Deductible Health Plans HDHP and Health Savings Accounts HSA estimates for private industry workers from the National Compensation Survey NCS. You can find IRS Publication 969 Health Savings Accounts and Other Tax-Favored Health Plans and IRS Publication 502 Medical and Dental Expenses online or you can call the IRS to request a copy of each at 800-829-3676.

Earned LiveWELL Incentives go pretax into the Health Savings Account. Health savings accounts HSAs are like personal savings accounts but the money in them is used to pay for health care expenses. Health Savings Account HSA A type of savings account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses.

Health Savings Account Thrive Credit Union

Health Savings Account Thrive Credit Union

Health Savings Plan Accounts Paris Insurance Services

Health Savings Plan Accounts Paris Insurance Services

How Do Hsa Plans Work Is A Health Savings Account Health Plan Right For You New Hampshire Health Insurance Blog

How Do Hsa Plans Work Is A Health Savings Account Health Plan Right For You New Hampshire Health Insurance Blog

Why You Should Enroll In A Health Savings Plan For 2021

Why You Should Enroll In A Health Savings Plan For 2021

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Hsa 2021 Limits Millennium Medical Solutions Inc

Hsa 2021 Limits Millennium Medical Solutions Inc

Save Your Money And Your Health Choosing The Right Health Savings Plan Account Infographic

Save Your Money And Your Health Choosing The Right Health Savings Plan Account Infographic

Best Hsa Health Insurance Plans In California Hsa Insurance Plans Ca

Best Hsa Health Insurance Plans In California Hsa Insurance Plans Ca

Are You Taking Advantage Of A Health Savings Account Vanguard

Are You Taking Advantage Of A Health Savings Account Vanguard

The Pros And Cons Of A Health Savings Account Hsa

The Pros And Cons Of A Health Savings Account Hsa

Comments

Post a Comment