Featured

What Does Catastrophic Insurance Mean

Prior to the ACA catastrophic coverage was a generic term that referred to any sort of health plan with high out-of-pocket costs and limited coverage for routine health needs. Catastrophic insurance is basically a type of fee-for-service health insurance policy that has been designed to provide protection against a catastrophe.

Catastrophic health insurance is a type of health plan that offers coverage in times of emergencies as well as coverage for preventive care.

What does catastrophic insurance mean. Many are designed to supplement existing insurance coverage ensuring that someone is covered in the event of a fire flood earthquake tornado or major accident. Catastrophic health insurance plans have low monthly premiums and very high deductibles. What is a Catastrophic Cap.

An individual can buy the coverage as a stand-alone. Catastrophic coverage is a form of insurance which is specifically designed to cover catastrophes. Catastrophe insurance can either be a commercial product sold to businesses or personal insurance sold to homeowners.

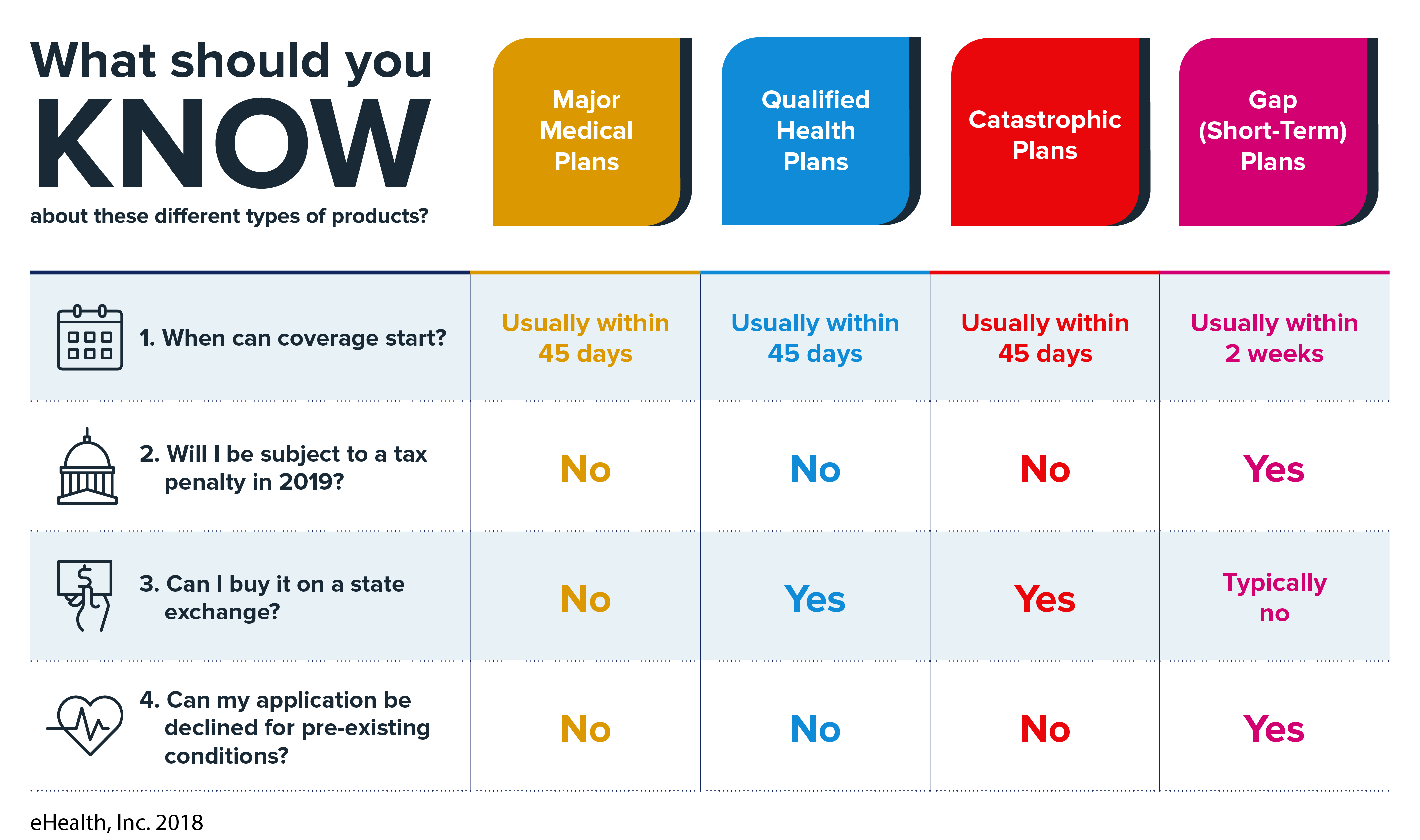

Prior to the ACA the term catastrophic health insurance was used more liberally to describe a much wider variety of health insurance plans and medical indemnity plans all of which were constructed to provide an emergency safety net to protect you against unexpected medical costs. Major Medical Catastrophic Health Plans. Catastrophic health insurance is a specific type of health coverage defined under the Affordable Care Act.

Catastrophic definition of the nature of a catastrophe or disastrous event. Catastrophe insurance provides coverage in the event of catastrophic events. These include natural disasters such as earthquakes floods and hurricanes as well as man-made disasters such as terrorist attacks.

How much is the Catastrophic Cap. Catastrophic illness insurance is a type of insurance that financially protects the policyholder against specified severe illnesses within a definite period of time. A catastrophic health insurance plan is a private plan that comes with a low monthly premium and high deductible.

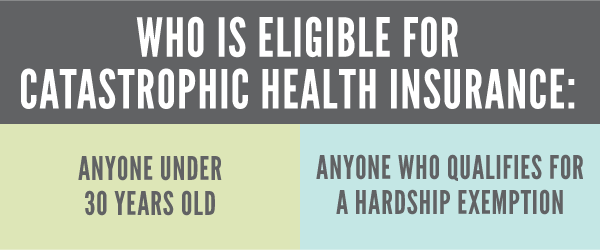

You are only eligible if you are under the age of 30 or if you qualify for a hardship exemption. The Catastrophic Cap is the maximum Out-of-Pocket expenses incurred per fiscalenrollment year. The Out-of-Pocket expenses are defined as.

But you pay most routine medical expenses yourself. Catastrophic insurance is a type of fee-for-service health insurance policy that is designed to give protection against well a catastrophe. A catastrophic failure of the dam.

Catastrophic illness insurance is a type of coverage that protects the insured for a specific and severe health problem over the defined period. Catastrophic health insurance is a low-premium comprehensive health plan for young adults and people who cant afford other health insurance plans and are facing hardships. These plans offer the same coverage as an Affordable Care Act ACA plan but with much lower upfront costsHowever catastrophic health insurance can also result in high out-of-pocket.

Who can buy a Catastrophic plan. It is the amount of money that a person must pay out-of-pocket for health care expenses incurred by a catastrophic illness before the insurer pays bills. It can sometimes be referred to as a High Deductible Health Plan because you pay low monthly premiums in exchange for a.

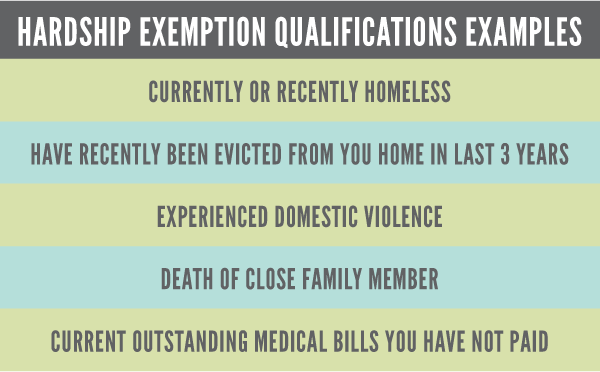

Hardship exemptions are given to those who cannot afford health insurance or face another obstacle to getting coverage like homelessness. They may be an affordable way to protect yourself from worst-case scenarios like getting seriously sick or injured. There are several different types of thi coverage available.

Catastrophic limit refers to the maximum amount of certain covered charges set by the insurance policy to be paid out of pocket of a beneficiary during a year. Catastrophic health plans typically come with low monthly premiums and a high deductible. Enrollment fees deductibles cost shares and co-payments.

It is sometimes referred to as a High Deductible Health Plan because low monthly premiums are traded for a.

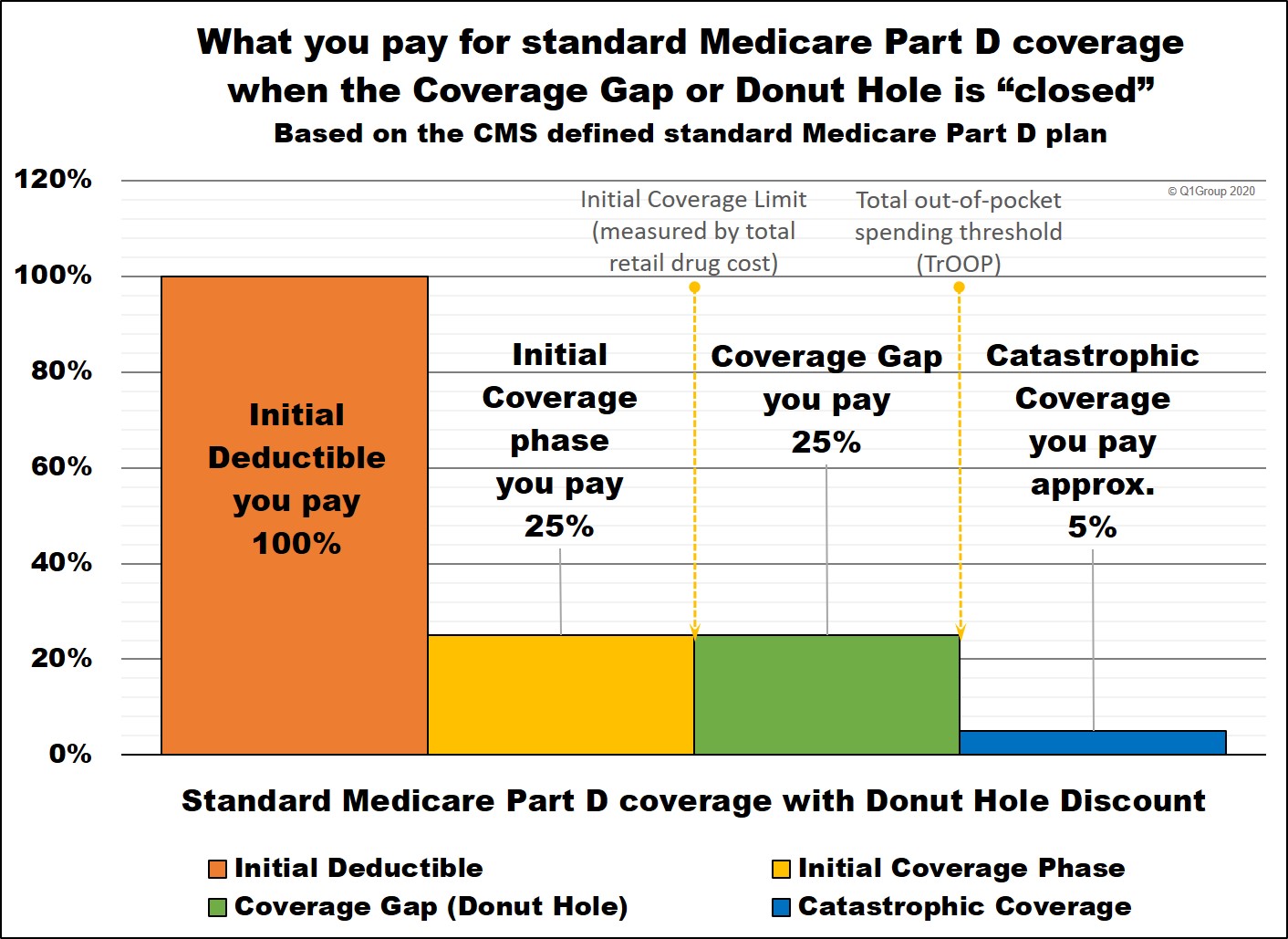

What Is Medicare Part D Catastrophic Coverage

What Is Medicare Part D Catastrophic Coverage

Cat Bonds Cashing In On Catastrophe Road To Paris Icsu

Metallic Health Plan Levels Under Obamacare

Metallic Health Plan Levels Under Obamacare

What Is Catastrophic Ppo Health Insurance

What Is Catastrophic Ppo Health Insurance

What Does Catastrophic Health Insurance Cover

What Does Catastrophic Health Insurance Cover

Catastrophic Plans Healthcare Exchange Medicoverage Com

Catastrophic Plans Healthcare Exchange Medicoverage Com

Medicare Part D And Catastrophic Coverage Costs Rules And Support

Medicare Part D And Catastrophic Coverage Costs Rules And Support

What Is Catastrophic Health Insurance And Do I Qualify

What Is Catastrophic Health Insurance And Do I Qualify

Catastrophic Health Insurance Definitions Plan Costs

Catastrophic Health Insurance Definitions Plan Costs

What Is Catastrophic Ppo Health Insurance

What Is Catastrophic Ppo Health Insurance

Comments

Post a Comment