Featured

- Get link

- X

- Other Apps

How Does Covered California Tax Credit Work

You will only pay the net premium after the tax credit which is 89 per month. Average tax credit of 302.

Metallic Plan Benefits Covered California Health For Ca

Metallic Plan Benefits Covered California Health For Ca

Use the California Franchise Tax Board forms finder to view this form.

How does covered california tax credit work. Put simply the Tax Credit means 1000year in savings. If were under the tax credit cap well have to pay back a percentage of the tax credit that we we were not eligible for. The premium tax credit was available immediately when you enrolled in a plan through the Marketplace.

Premium assistance also called Advanced Premium Tax Credits APTC can lower the cost of health care for individuals and families who enroll in a Covered California health plan and meet certain income requirements. One notewhen enrolling in Covered California you essentially confirm that you will file taxes as required by law and on time if you are required to. If at tax time the next year it turns out that you made less money than predicted then you will get a tax credit.

However the interesting thing about this tax credit is you are allowed to start receiving it more than a year before you file your tax return. Whether or not you get a subsidy from the government is based on several things. Calculate your tax refund or credit or the tax amount you owe.

Furthermore the IRS only recovers tax credits that have been overpaid. In your case there would not have been an overpayment that is a person received more tax credit than their income justified so in your case no tax would be due Hope this helps you to sleep better. If someones Medi-Cal coverage is cancelled due to increased income or decreased household size does that person qualify for special enrollment into Covered California.

Again as certified Covered California agents there is no cost for our services. If you are a low- or moderate-income Californian you may get help buying insurance from Covered California through monthly subsidies that lower your premium costs so that you pay less for top-quality brand-name insurance. Many people make mistakes with the income piece.

It worked like a discount so you could get help paying for coverage throughout the year rather than having to wait until you filed your 2017 taxes. A government agency created to help citizens and legal residents apply for health care coverage it is a state-run healthcare insurance exchange. The price is based on your estimated income for the coverage year your ZIP code your household size and your age.

For example if your familys insurance premium before the subsidy is 1000 and you qualify for a subsidy or advanced tax credit of 700. With most tax credits you receive it when you file your tax return. After you pay that amount and after any federal Premium Tax Credit none for those with.

51 of Enrollees qualify for Enhanced Silver Plans. 88 of Californians qualify for a tax credit. A Covered California subsidy is properly known as an Advance Premium Tax Credit APTC ie a tax credit that is intended to pay part of your insurance premium if you qualify.

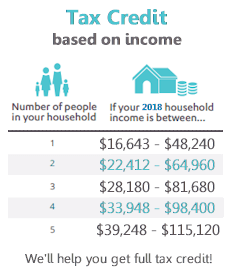

The amount of credit you are eligible to receive works on a sliding scale. From Covered California with the help of premium tax credits. The amount of premium assistance you receive is based on how much money you make your tax household size and where you live.

The Covered California Health Exchange offers subsidized Obamacare plans for the Golden State. Your household income number of dependents and you being on a Covered California exchange plan. The smaller your business or the lower your annual average wage or both the larger your credit will.

When it is time to file your tax returns the federal government needs to know if you got the right amount of premium tax credits. While the premium subsidy is called an advanced tax credit it works differently than you are assuming. It increases to 120 for marriedRDP taxpayers who file jointly and whose annual incomes fall below 85864.

Before the American Rescue Plan California helped people who made too much money qualify for the premium tax credit with a state subsidy. With Covered California for Small Business CCSB you decide the level of coverage and provide employees with health insurance that fits your budget. Some people do not need to file taxes since their income is below the threshold.

But the American Rescue Plan expanded who can get this help covering everyone who has been receiving the California state subsidy. These forms are used when you file your federal and state tax returns to. This all occurs at tax filing time.

The State Premium Assistance follows the same structure as the federal Premium Tax Credit see ACA Health Insurance Premium Tax Credit Percentages. This fact sheet explains how the IRS will figure out if you got the right amount of premium tax credits. Based on the 1000s of successfully enrolled Covered Ca members a quick snapshot.

This is a 60 credit for single renters whose annual incomes fall below 42932 as of 2020. The state says based on your income you are supposed to pay this percentage of your income toward a second lowest-cost Silver plan in your area. The credit is nonrefundable and you must pay rent in the state of California for half the year or more.

If you made more then your taxes will increase to make up for the governments overpayment on your subsidy. Payments of the premium tax credit went directly to the insurance company to pay a share of the monthly health insurance premiums charged to you. Small businesses that purchase coverage through CCSB may be eligible to receive a federal tax credit to help offset the cost of providing health insurance.

If we go over the tax credit cap see amounts above well have to pay back the entire tax credit. Show that you were insured so that you dont pay a state penalty for the months you were covered.

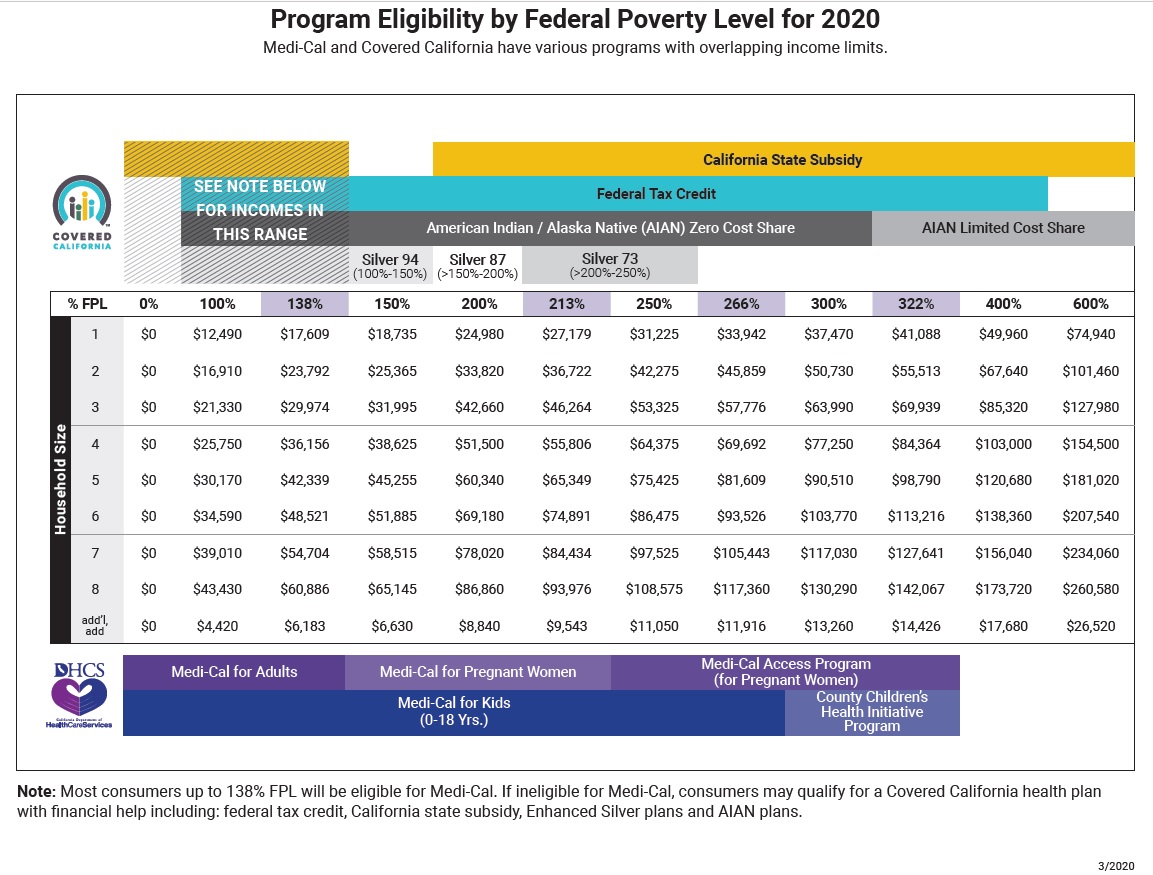

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

2021 Covered California Renewal And Open Enrollment Changes

2021 Covered California Renewal And Open Enrollment Changes

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

How To Get The Most 2018 Covered California Tax Credit

How To Get The Most 2018 Covered California Tax Credit

Health Insurance And Taxes How To Take Advantage Of Financial Help And Avoid Penalties

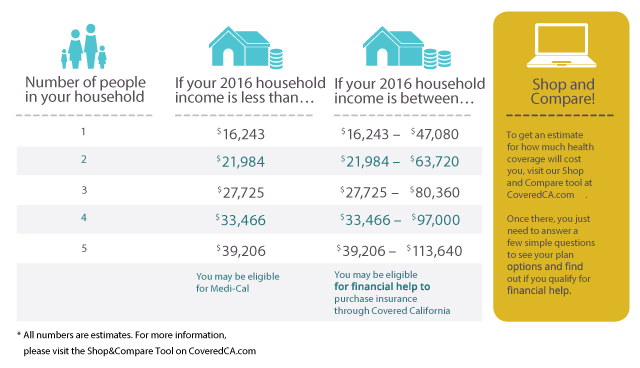

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Covered California Official Website Assemblymember Jim Cooper Representing The 9th California Assembly District

Covered California Official Website Assemblymember Jim Cooper Representing The 9th California Assembly District

Common Tax Credit Mistakes People Make With Covered Ca

Common Tax Credit Mistakes People Make With Covered Ca

Covered California Tax Credit Health For California

Covered California Tax Credit Health For California

How To Get The Most 2018 Covered California Tax Credit

How To Get The Most 2018 Covered California Tax Credit

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Comments

Post a Comment