Featured

Proof Of Health Insurance For Taxes

Proof of Health Insurance. Form 1095-B only applies if you live in states or districts that require proof of coverage.

Group S Obamacare Tax Form Evades Facts Factcheck Org

Group S Obamacare Tax Form Evades Facts Factcheck Org

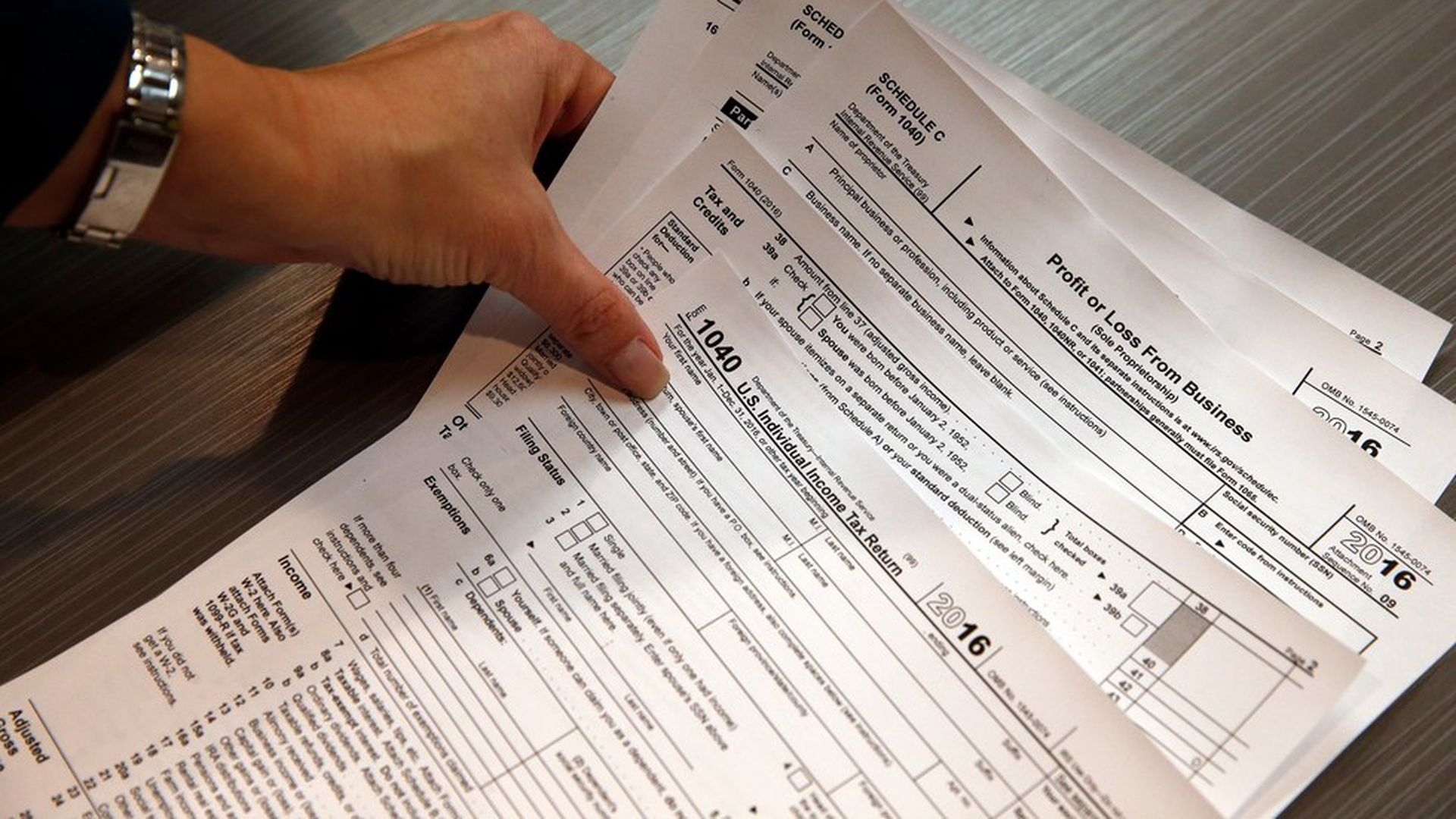

The move announced last month reverses course from this year when the IRS said it would not require filers to indicate on 1040 tax forms whether they had health insurance.

Proof of health insurance for taxes. Filers were still required to have medical insurance or pay a penalty but the IRS accepted and processed returns even if taxpayers didnt indicate coverage status. Pursuant to the Affordable Care Act and the California Health Mandate most people are required to maintain health insurance coverage that meets MEC requirements every year. Individual Responsibility line on Form 1040.

If youre claiming a net Premium Tax Credit for 2020 including if you got an increase in premium tax credits when you reconciled and filed you still need to include Form 8962. The 1095 form provides documentation of your individual health insurance information. Must file a tax return and reconcile the advance payments with the amount of the premium tax credit allowed on your return.

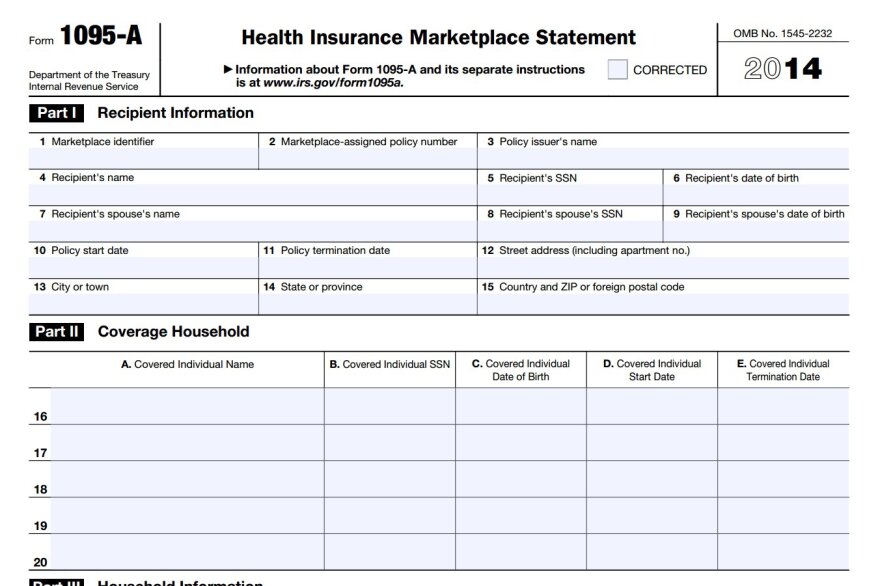

Will use the form to determine if you are eligible for the premium tax credit. You will receive Form 1095-A Health Insurance Marketplace Statement which provides you with information about your health care coverage. Common Forms of Proof of Health Insurance.

The forms of qualified coverage include qualified health plans employer-sponsored insurance Medicare Advantage Original Medicare Medicaid and CHIP. Or click on CorrespondenceDocumentation and choose Proof of Coverage Your coverage letter will be generated and available for download. If you live in a state that requires you to have health coverage and you dont have coverage or an exemption youll be charged a fee when you file your 2020 state taxes.

You should wait to file your income tax return until you receive that form. Click on the Obtain proof of health coverage button. Received a Form 1095-A Health Insurance Marketplace Statement and did not receive advance payments of the credit.

Form 1095-B Transmittal of Health Coverage Information Returns is sent to enrollees directly from insurance carriers as proof you received the minimum health insurance coverage required for last year. Check with your state or tax preparer. Individuals can use the information on the 1095 to complete the Health Care.

Do I need to show proof of health insurance when filing my taxes. According to the IRS Internal Revenue Service you are not required to show proof of health insurance when filing taxes. The Form 1099-HC is a Massachusetts state tax document which is sent to members by their health insurance carriers.

Every Commonwealth of Massachusetts resident who has health insurance will receive a 1099-HC form. You dont need to file an amended return or do anything else if you already filed your 2020 taxes and reported excess APTC or made an excess APTC repayment. This form is sent to you annually by your insurance provider.

Check the full-year coverage box on your tax return if the form shows. However it is still recommended that you hold onto documents that verify your health coverage so you are prepared in the event that you do need it. Which months during the calendar year members were enrolled in a health plan that meets the states MCC requirements for at least 15 days.

Form 1095-B is an Internal Revenue Service IRS document that may be used as proof that a person had qualifying health care coverage that counts as Minimum Essential Coverage MEC during a tax year. Form 1095-C Employer-Provided Health. Use the information from Form 1095-A to complete Form 8962 to reconcile advance payments of the premium tax credit or if you are eligible to claim the premium tax credit on your tax return.

The Form 1099-HC shows. Form 1095-C Employer-Provided Health Insurance Offer and Coverage or proof of coverage at the time you file your Most full-time employees will receive from their employing agency the IRS Form 1095-C that contains information about the health insurance coverage offered to you by your employing agency. The 1099-HC form is a Massachusetts tax document which provides proof of health insurance coverage for Massachusetts residents.

The status of the taxpayer makes a difference in the documents needed and the best forms of proof of health insurance coverage. Log in to milConnect. You will NOT get Form 1095-A unless you or someone in your household had Marketplace coverage for all or part of 2020.

How to Show Proof of Health Insurance When Filing Your Taxes Insurance cards Explanation of benefits W-2 or payroll statements that show insurance deductions Records or advance payments of the premium tax credit and other statements indicating that the taxpayer or a member of.

Https Www Irs Gov Pub Irs Pdf F14095 Pdf

What Is The Sozialversicherungsnummer Or Rentenversicherungsnummer All About Berlin

What Is The Sozialversicherungsnummer Or Rentenversicherungsnummer All About Berlin

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png) Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Tax Changes You Need To Know For 2014

Tax Changes You Need To Know For 2014

Free 8 Sample Health Insurance Tax Forms In Ms Word Pdf

Free 8 Sample Health Insurance Tax Forms In Ms Word Pdf

Irs Form 1095 A Health For California Insurance Center

Irs Form 1095 A Health For California Insurance Center

How Does The Irs Know If An Individual Didn T Have Health Insurance All Year In Order To Apply A Penalty Fee During Tax Season Or Is It More Of A Trust Based System

How Does The Irs Know If An Individual Didn T Have Health Insurance All Year In Order To Apply A Penalty Fee During Tax Season Or Is It More Of A Trust Based System

Help With Taxes And Health Insurance Kera News

Help With Taxes And Health Insurance Kera News

Proof Of Insurance For Taxes Payment Proof 2020

Proof Of Insurance For Taxes Payment Proof 2020

Annual Health Care Coverage Statements

Annual Health Care Coverage Statements

How Does The Irs Know If An Individual Didn T Have Health Insurance All Year In Order To Apply A Penalty Fee During Tax Season Or Is It More Of A Trust Based System

How Does The Irs Know If An Individual Didn T Have Health Insurance All Year In Order To Apply A Penalty Fee During Tax Season Or Is It More Of A Trust Based System

Irs Will Decline Tax Returns Without Proof Of Health Insurance Axios

Irs Will Decline Tax Returns Without Proof Of Health Insurance Axios

Comments

Post a Comment