Featured

- Get link

- X

- Other Apps

Hsa Accounts California

It is estimated that employer contributions on behalf of. Under Covered California both spouses have to buy the same Health insurance.

All About Medical Savings Accounts California Employee Benefits Advisors Aeis Advisors Employee Benefits Insurance Broker In San Mateo

All About Medical Savings Accounts California Employee Benefits Advisors Aeis Advisors Employee Benefits Insurance Broker In San Mateo

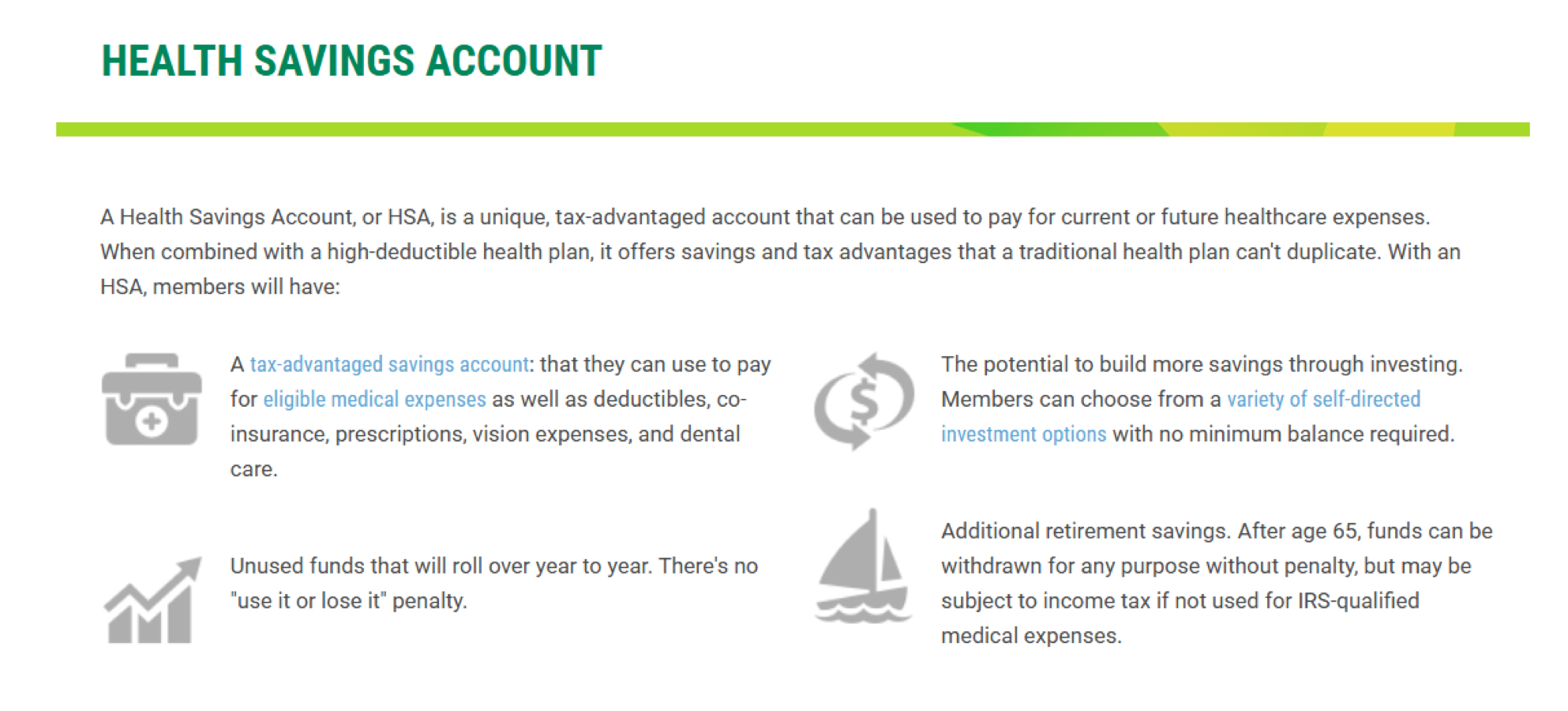

How do HSAs work.

Hsa accounts california. The interest earned on an HSA is tax-free. However after 65 an HSA account owner can take out funds for non medical expenses without a 20 penalty. What is an HSA Account.

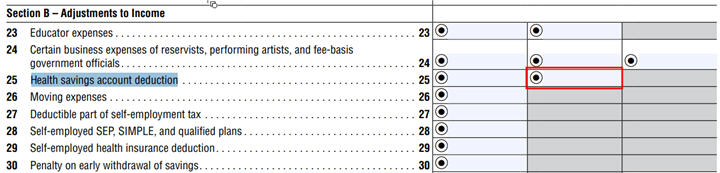

Interest or earnings in a HSA are taxable in the year earned. An HSA is tax-favored savings account that is used in conjunction with a high-deductible HSA-compatible health insurance plan to make healthcare more affordable and to save for retirement. That is you report the HSA just as if it were an after-tax investment account for your federal return.

HSA earnings taxable in California. This amount was grown to reflect changes in the economy over time resulting in an estimated 600 million HSA deduction in taxable year 2020. You would not report unrealized gains or losses because you havent incurred them yet.

People who choose to enroll in one can add funds to their HSA that arent subject to. The HSA allows the account owner to pay for current and future health care expenses with either pre-tax dollars or tax-deductible dollars. Interest or other earnings earned from a Health Savings Account HSA are not treated as taxed deferred.

Health savings accounts HSAs give applicants a tax-advantaged way to do just that although you need to have an eligible health insurance plan to qualify. California residents can pay for qualified medical expenses with pre-tax dollars and save for retirement on a tax-deferred basis. What are my options.

Even if the contribution is made by the employer the money within it belongs to the account owner. Health Savings Accounts HSAs allow enrollees to save money on a tax favored basis to pay for medical expenses. The 2021 Best HSAs logo and accolade are available for licensing through Investors Business Dailys partner The YGS Group at email protected or 800-290-5460.

Interest or earnings in a HSA are taxable in the year earned httpswwwftbcagovforms201818-540CA-instructionsshtml But I see no similar language from New Jersey. An HSA is something like a medical IRA. And you may withdraw the funds tax-free for use to pay qualified.

Tax Treatment of Health Savings Accounts HSAs in California. He has a free HSA at the bank so he would like to keep it. Employers must contribute an equal dollar amount or equal percentage to ALL employees with HSAs if the employer contributes to ANY employees HSA.

Most of the carriers offer these HSA qualified plans and youll see the HSA type next to these plans when running your California health insurance quote for both the individualfamily or Group market. A business can allow employees to open a California HSA account only after the employee has enrolled in a qualified high deductible medical insurance plan. Very simply the HSA generally refers to two separate parts.

Best HSA Accounts Licensing. The first is an underlying high deductible health insurance plan. As an example in California HSA contributions are not tax deductible yet they are fully tax-deductible Arizona Georgia and most other states.

If your health plan qualifies using an HSA is. Any withdrawals for qualified medical expenses can be taken tax-free. While it can be used to pay off qualified medical expenses of the person who died and owned the account anything left over is taxed as income.

Covered California offers these plans at the Bronze level. You contribute funds to the HSA plan which are tax-deductible. HSA stands for health savings account.

For example my Husband needs a Bronze HSA and I would like the Silver since I dont have an HSA account. To qualify for an HSA health savings account your health plan needs to have a minimum deductible of 1350 for yourself or 2700 for your family. So will my brokerage send me 1099s for interest dividends and capital gains in my HSA.

California treats an HSA as a regular financial investment vehicle. Using FTB data it was determined that California taxpayers contributed 450 million to Health Savings Accounts HSAs in 2017. Additionally according to Instructions for Schedule CA 540.

Its offered to people who have high-deductible health plans HDHP. California is pretty clear about it. BUT those funds will be taxed as income just like a 401k.

Interest or other earnings earned from a Health Savings Account HSA are not treated as taxed deferred.

Health Savings Account The Benefits Store

Health Savings Account The Benefits Store

Best And Worst Health Savings Accounts For Singles Families Benefits Broker California Aeis Advisors Employee Benefits Insurance Broker In San Mateo

Best And Worst Health Savings Accounts For Singles Families Benefits Broker California Aeis Advisors Employee Benefits Insurance Broker In San Mateo

Hsa Really Worth It In California Bogleheads Org

Hsa Really Worth It In California Bogleheads Org

Health Savings Account Hsa Plans California

Health Savings Account Hsa Plans California

Hras Hsas And Health Fsas What S The Difference Employee Benefits California Aeis Advisors Employee Benefits Insurance Broker In San Mateo

Hras Hsas And Health Fsas What S The Difference Employee Benefits California Aeis Advisors Employee Benefits Insurance Broker In San Mateo

Best Hsa Health Insurance Plans In California Hsa Insurance Plans Ca

Best Hsa Health Insurance Plans In California Hsa Insurance Plans Ca

California And New Jersey Hsa Tax Return Special Considerations

California And New Jersey Hsa Tax Return Special Considerations

The Problem With The Hsa Health Savings Account Isn T The Hsa Our Next Life

The Problem With The Hsa Health Savings Account Isn T The Hsa Our Next Life

California Health Savings Account

California Health Savings Account

The Great Health Savings Account Scam

The Great Health Savings Account Scam

Irs Announces Hsa Limits For 2020 California Benefits Advisors Aeis Advisors Employee Benefits Insurance Broker In San Mateo

Irs Announces Hsa Limits For 2020 California Benefits Advisors Aeis Advisors Employee Benefits Insurance Broker In San Mateo

California And New Jersey Hsa Tax Return Special Considerations

California And New Jersey Hsa Tax Return Special Considerations

Best Hsa Health Insurance Plans In California Hsa Insurance Plans Ca

Best Hsa Health Insurance Plans In California Hsa Insurance Plans Ca

Https Www Blueshieldca Com Sites Ssl Documents Winning 20with 20an 20hsa 20 20ee 20 20bsc Pdf

Comments

Post a Comment