Featured

- Get link

- X

- Other Apps

Who Pays Medicare Part A Deductible

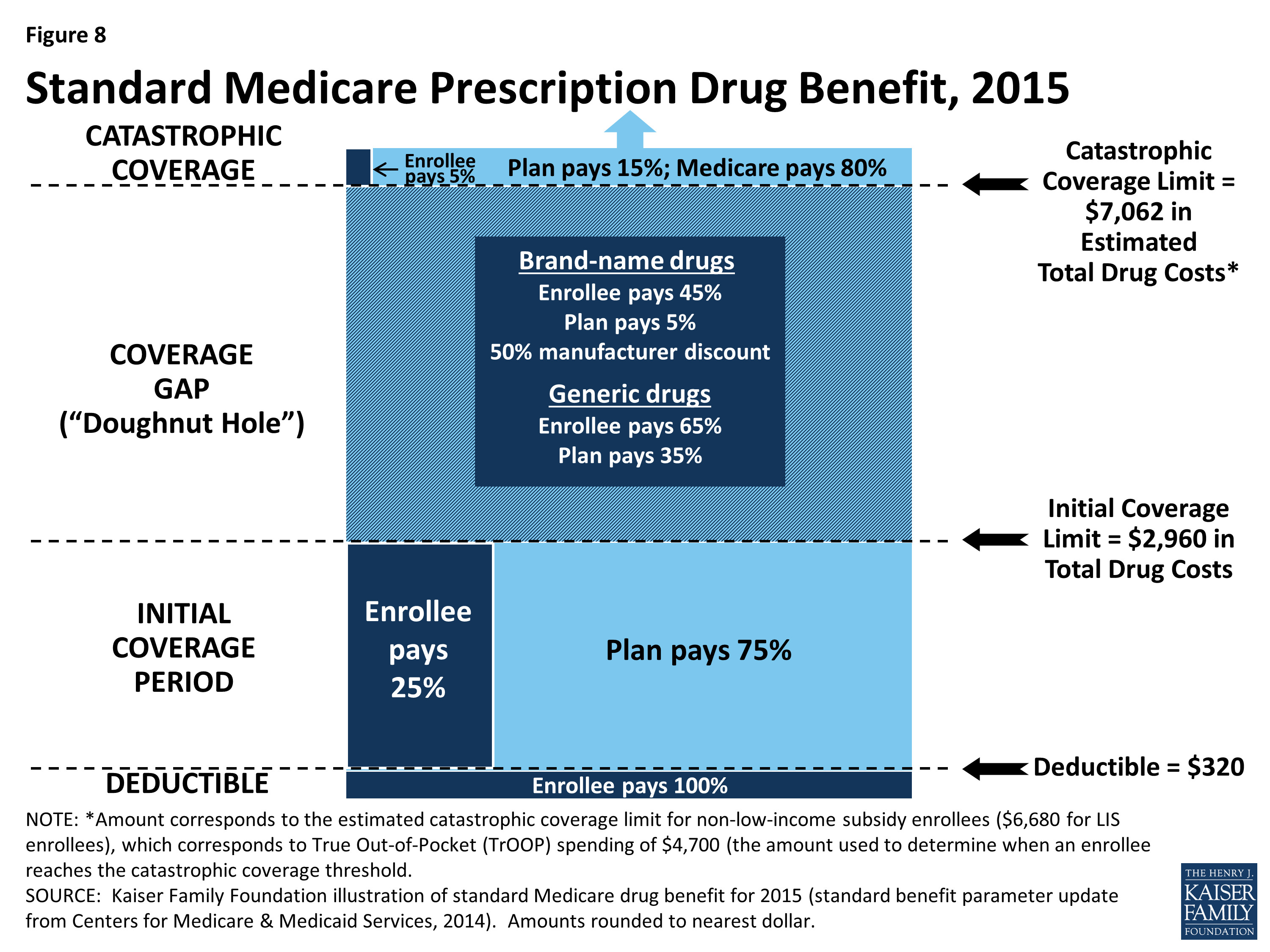

That means that in addition to the 160 medical deductible we used as an example above you might also have a Part D prescription drug deductible that youll need to meet before. There are eight standardized plans across 47 states and the District of Columbia.

Here S What You Need To Know About Your 2020 Medicare Costs

Here S What You Need To Know About Your 2020 Medicare Costs

However if you do not become a hospital inpatient in 2021 you do not pay the Part A deductible.

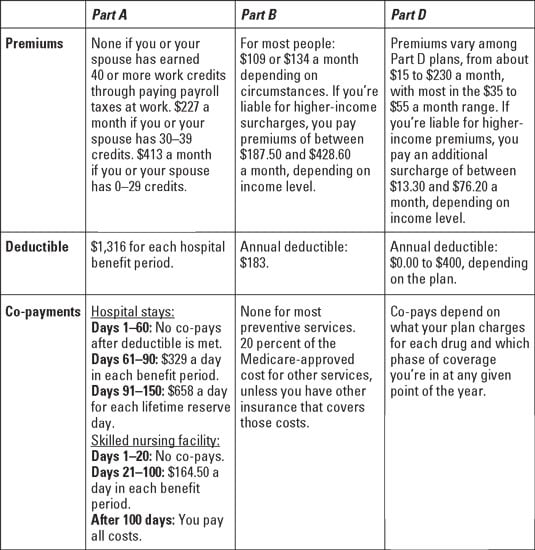

Who pays medicare part a deductible. Unlike Part A your deductible isnt tied to a benefit period or other complicated formulas. The Part A inpatient hospital deductible covers beneficiaries share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period. Medicare Supplements Medicare Supplement or Medigap insurance plans are sold by private insurance companies to help pay some of the costs that Original Medicare.

The full cost of the drug determines how much a beneficiary must pay when the plan has a deductible. You typically pay a 1484 Part A deductible in 2021 before Medicare pays anything for a hospital or skilled nursing facility SNF stay. That leaves you on the hook for only 20.

Weve outlined them below. As an enrollee in Original Medicare Parts A and B youre responsible for certain out-of-pocket costs including deductibles. If you already met your deductible youd only have to pay for 20 of the 80.

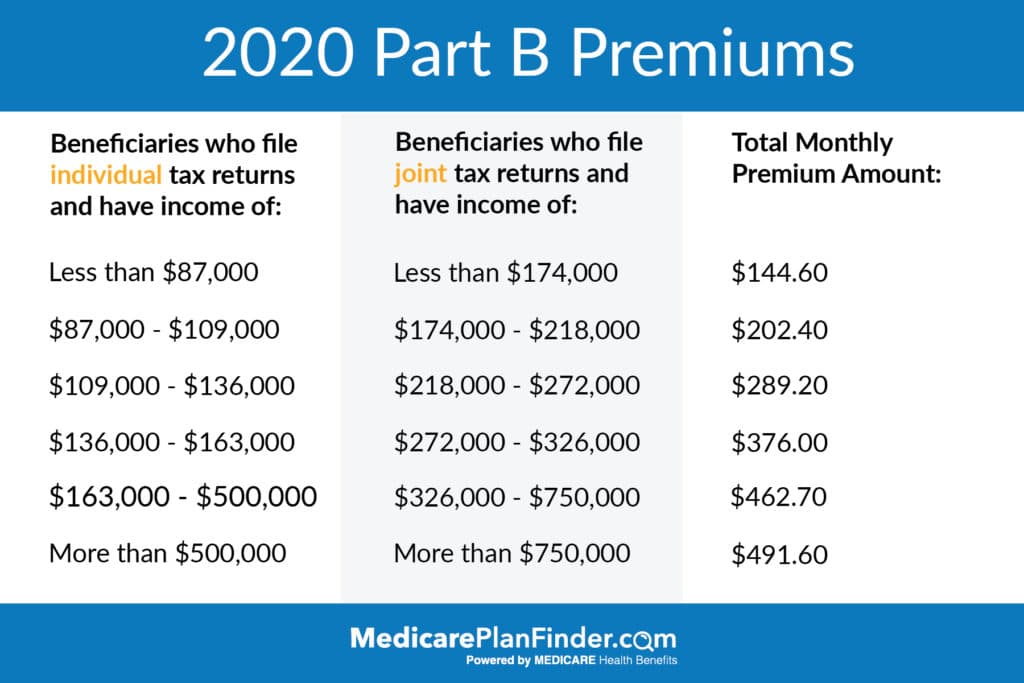

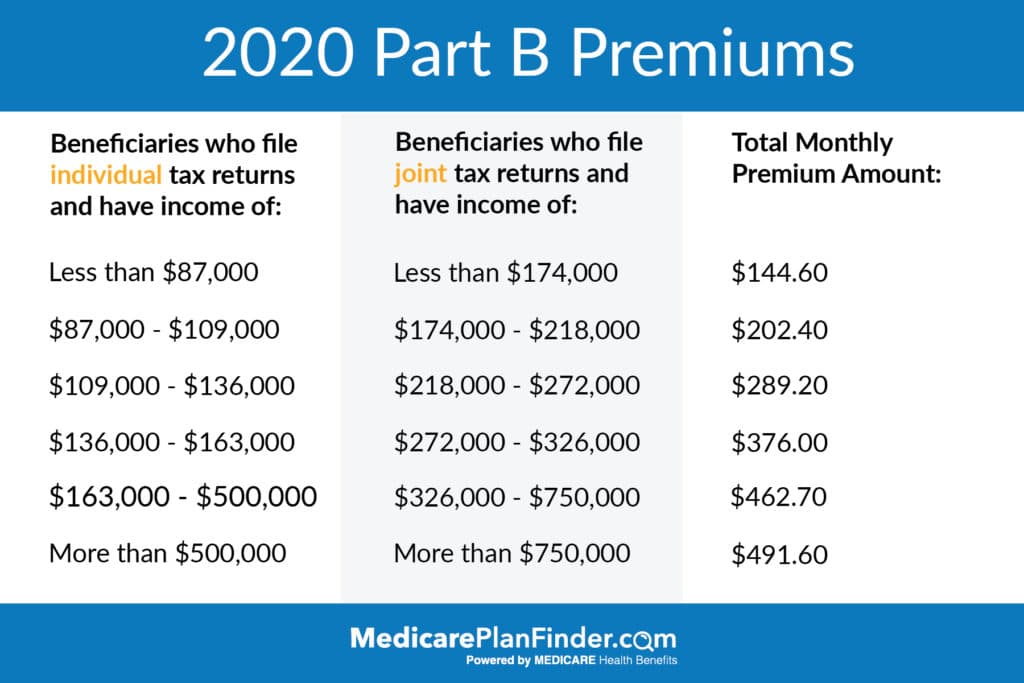

Medicare Part A benefit periods are based on. Medicare defines a deductible as. Deductibles vary between plans but CMS sets a maximum deductible each year 435 in 2020.

These plans are sold through private insurers. In addition Medicare will only help pay for expenses related to a hospital stay for a certain period of time before the costs become the full responsibility of the beneficiary. The deductible is the amount you must pay out of pocket each year before the Part D plan kicks in and starts to help cover the costs of prescriptions.

7 That means you might have a lower deductible or even no deductible but you wont have one higher than the. Medicare Part A deductibles work as follows during a hospital stay. A deductible is the amount you must pay before your Medicare coverage kicks in The Medicare Part A Deductible Part A is your hospital insurance.

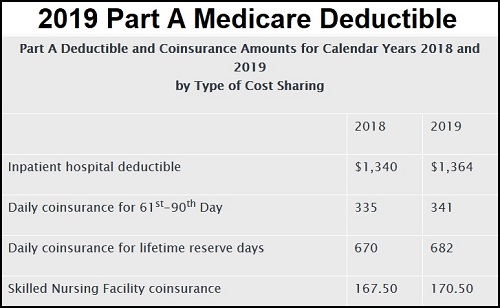

The Part A inpatient hospital deductible covers beneficiaries share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period. The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be 1408 in 2020 an increase of 44 from 1364 in 2019. You must pay the Part A deductible before Medicare covers your hospital expenses.

This works out to 16. In other words one pays the full cost. Because shes now met her deductible she pays 20 percent coinsurance for the crutches.

Medicare Part A The Medicare Part A deductible in 2021 is 1484 per benefit period. Medicare Part A Deductible 2021 In 2021 your Medicare Part A deductible will increase 76 from 1408 in 2020 to 1484 in 2021. Using Medigap to Pay Medicare Deductibles.

The amount you must pay for health care or prescriptions before Original Medicare your prescription drug plan or your other insurance begins to pay In other words a deductible is the amount that you must first pay out of your own pocket for health care before your Medicare insurance coverage kicks in. Most Medicare Advantage plans have separate medical and pharmacy deductibles. Medicare Part A.

- Beneficiary pays deductible of 1100 during days 1-60 of hospital stay - Beneficiary then pays 275 per day for days 61-90 of hospital stay - Beneficiary. You may have various out of pocket costs with Medicare insurance including copayments coinsurance and deductibles. The Medicare Part D deductible is the amount you most pay for your.

Getting Help Paying Deductibles. The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be 1484 in 2021 an increase of 76 from 1408 in 2020. Once you pay your 203 which is likely to happen after your first or second doctor visit or procedure of the year Medicare pays 80 of the Medicare-approved amount.

Medigap also known as Medicare Supplement plans can help pay some of your out-of-pocket costs including your Medicare Part A deductibles. Medicare will pay for your primary insurances deductible IF you have met your Medicare deductible for the year. Medicare would then cover the final 64 for the care.

Generally the lower the deductible the less you are responsible for paying out-of-pocket before your insurance coverage kicks in. This is not an annual Medicare deductible but is per benefit period A benefit period starts the day youre admitted as an inpatient in a hospital or skilled nursing facility SNF. Medicare Part A deductible Original Medicare requires that you pay a deductible for each inpatient hospital benefit period which means you may have to pay a deductible more than once in a single year.

If you havent it will continue to be applied to your Medicare deductible until met. After that Medicare will pay 80 of the amount allowed by Medicare. You must meet this deductible before Medicare pays for any Part A services in each benefit period.

There are a few ways you can go about avoiding having to pay the deductibles for Part A or Part B. Deductible is a common term in insurance.

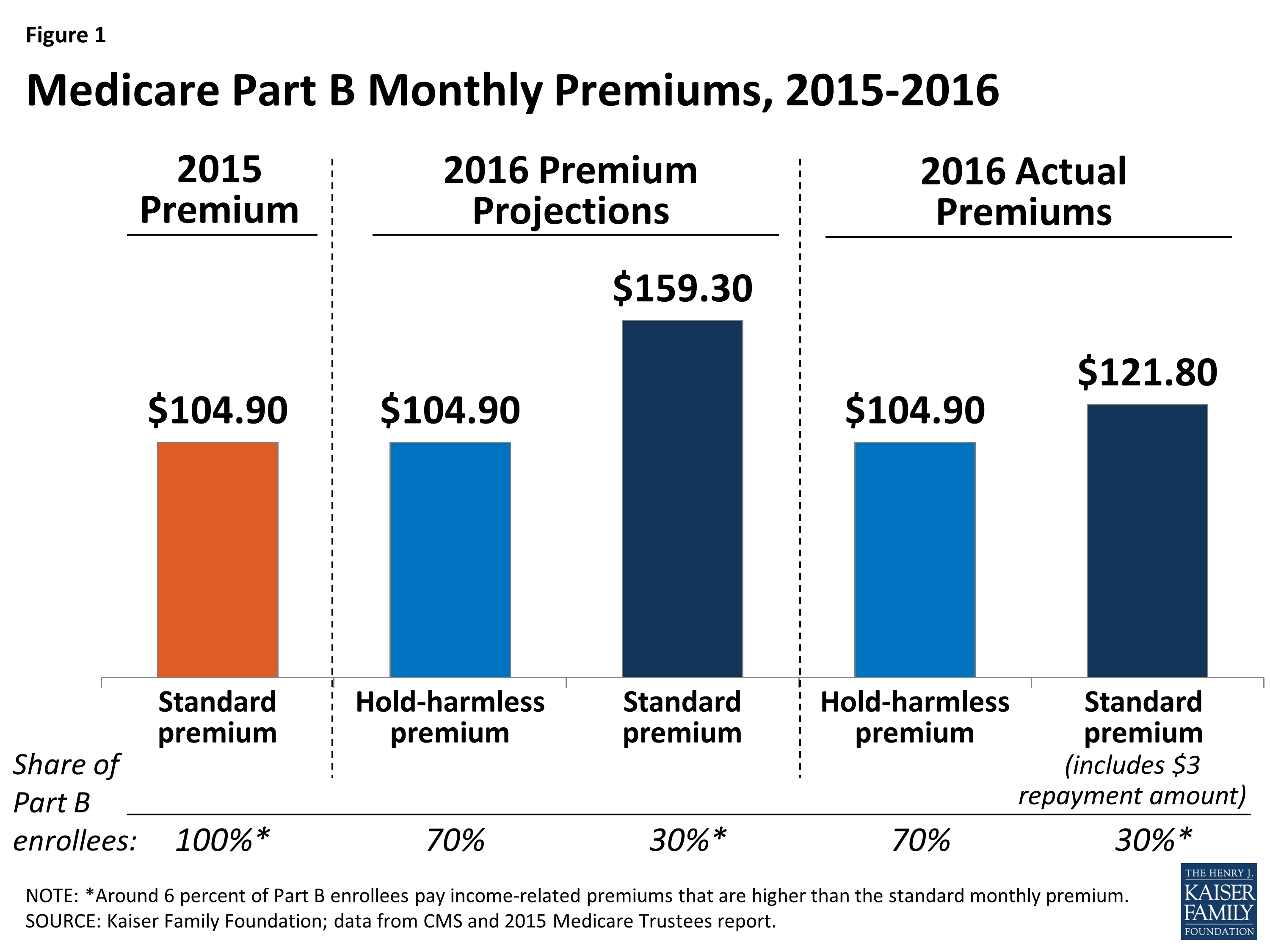

What S In Store For Medicare S Part B Premiums And Deductible In 2016 And Why Kff

What S In Store For Medicare S Part B Premiums And Deductible In 2016 And Why Kff

Medicare Premiums Deductibles And Co Payments Dummies

Medicare Premiums Deductibles And Co Payments Dummies

A Primer On Medicare How Does Medicare Pay Providers In Traditional Medicare Sec 11 7615 04 Kff

A Primer On Medicare How Does Medicare Pay Providers In Traditional Medicare Sec 11 7615 04 Kff

What Is Medicare Part B Buy Back Give Back Are You Eligible

What Is Medicare Part B Buy Back Give Back Are You Eligible

Medicare Cost Medicare Costs 2021 Costs Of Medicare Part A B

Medicare Cost Medicare Costs 2021 Costs Of Medicare Part A B

2019 Medicare Part A B Deductibles And Premiums

2019 Medicare Part A B Deductibles And Premiums

Is There A Medicare Deductible Medicare Faqs

Is There A Medicare Deductible Medicare Faqs

Some Medicare Costs Will Be Higher In 2021 Here S How To Cut Them

Some Medicare Costs Will Be Higher In 2021 Here S How To Cut Them

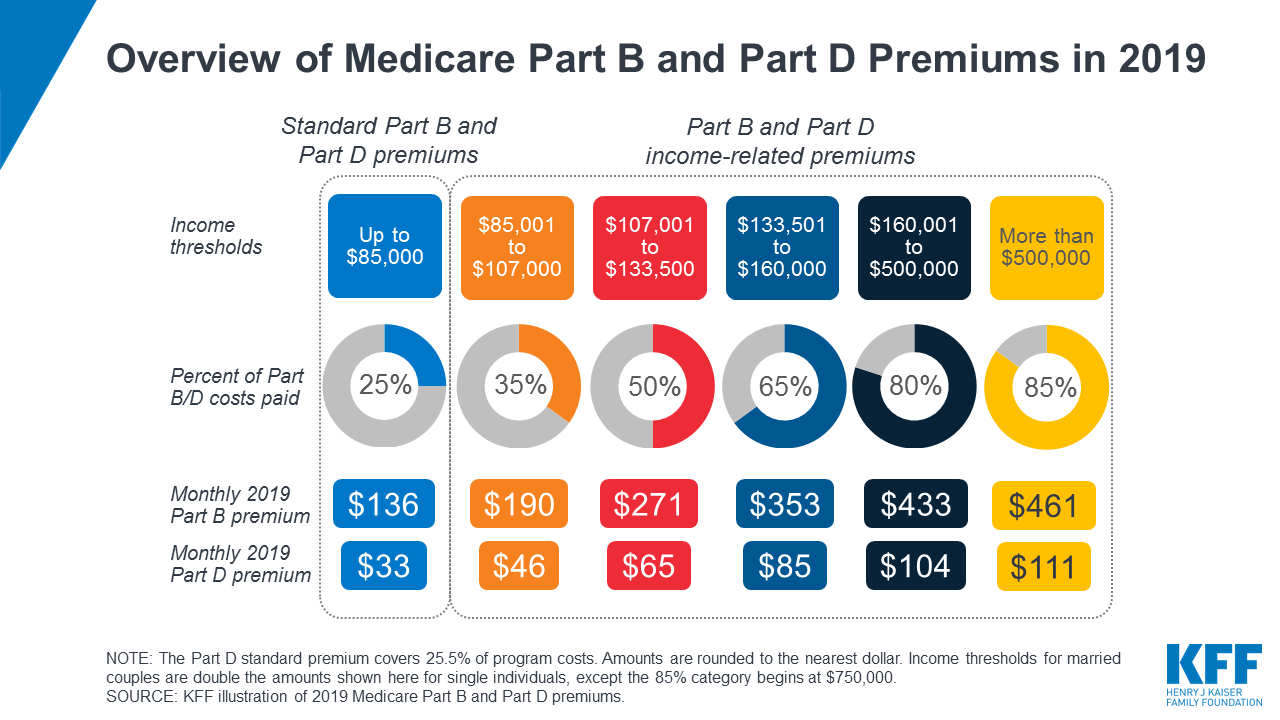

Medicare S Income Related Premiums Under Current Law And Changes For 2019 Kff

Medicare S Income Related Premiums Under Current Law And Changes For 2019 Kff

Medicare Premiums For Prescription Drugs Will Be Lower In 2020 Silver Healthcare Center

Medicare Premiums For Prescription Drugs Will Be Lower In 2020 Silver Healthcare Center

Medicare Cost Medicare Costs 2021 Costs Of Medicare Part A B

Medicare Cost Medicare Costs 2021 Costs Of Medicare Part A B

High Deductible Medigap Plan Makes Sense For Some

High Deductible Medigap Plan Makes Sense For Some

Medicare Coverage And Cancer What You Need To Know Onco Zine

Medicare Coverage And Cancer What You Need To Know Onco Zine

Medicare Cost Medicare Costs 2021 Costs Of Medicare Part A B

Medicare Cost Medicare Costs 2021 Costs Of Medicare Part A B

Comments

Post a Comment