Featured

- Get link

- X

- Other Apps

Copayment With Deductible

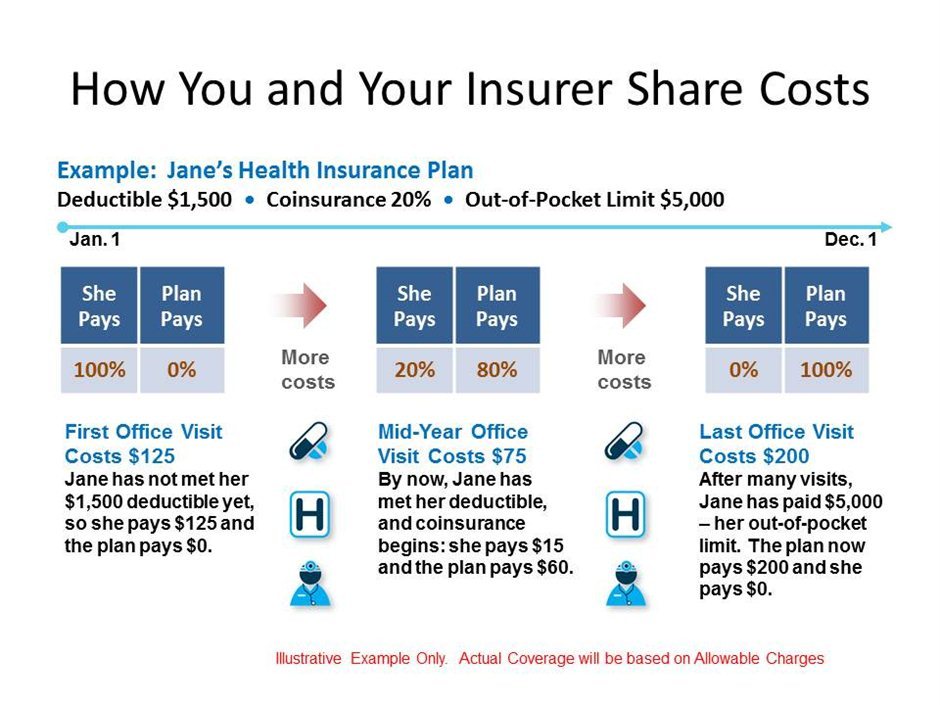

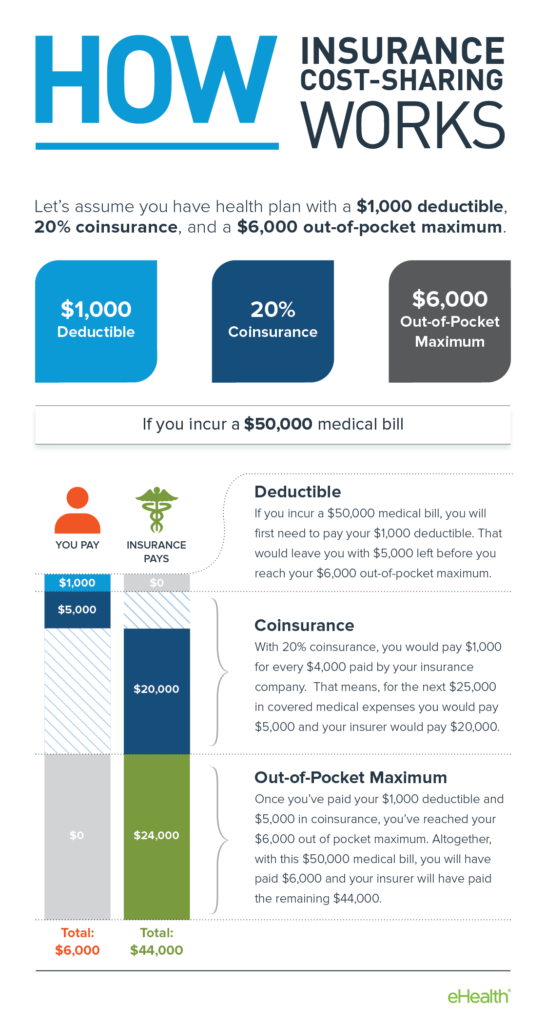

Deductibles can work differently depending on your health insurance plan. Deductibles coinsurance and copays are all examples of cost sharing.

Copay Vs Deductible How Does Insurance Work Aeroflow Healthcare

Copay Vs Deductible How Does Insurance Work Aeroflow Healthcare

Your plan determines what your copay is for different types of services and when you have one.

Copayment with deductible. A copay sometimes called a copayment is a flat fee you pay for a covered health care service. Lets say I got a 2000 ER bill. When health insurance deductibles are often measured in thousands of dollars copaymentsthe fixed amount usually in the range of 25 to 75 you owe each time you go to the doctor or fill a prescriptionmay seem like chump change.

We also help with this for free with our billing service. If your health insurance plan does the same here is what it will mean for you You will have to pay a fixed amount towards your treatment plans. You may also have a copay after you pay your deductible and when you owe coinsurance.

Your Blue Cross ID card may list copays for some visits. So what does Copay with deductible mean. But a few insurance plans also implement copayment and deductible clauses simultaneously.

This makes no sense to me. It can kick start your insurance plan once its finalized. A copay after deductible is a flat fee you pay for medical service as part of a cost-sharing relationship in which you and your health insurance provider must pay for your medical expenses.

In contrast the deductible is a single amount accumulated once a year. A copay is different from coinsurance which only applies after reaching your deductible and is the percentage of your final bill that you pay In 2018 the average deductible for people with employer-sponsored health insurance was 1350 but that included the lucky 15 percent of covered workers who didnt have a deductible at all. I work for a health insurance company and my best guess is after deductible is whats been described above that you pay the contracted rate for the service until youve met the deductible and then you pay just the copay after you meet your deductible.

To better understand this matter lets take a look at our example insurance policyholder Natalie. 100 Copay before deductible40 Coinsurance after deductible. When coverage is described relative to a deductible I presume Im responsible for 100 until I hit the deductible.

The deductible is the amount that you need to pay as a share towards your medical bill upon which your policy comes into effect. Continuing to pay copay after deductible requirements are met is quite common. Generally all payments you make for covered healthcare services will count toward your annual deductible unless the payment is considered a copay.

With a deductible you pay the entire amount allowed for all services provided until the deductible is met. A deductible and coinsurance. You may have a copay before youve finished paying toward your deductible.

To find out their benefits youll need to contact their insurance plan on a call and ask. But copays really add up when you have ongoing health conditions. Pertaining to health insurance what does Copay with deductible mean in contrast to Copay after deductible.

Difference between Copay and Co-insurance. Copay is the fixed amount that you have to pay towards your treatment. Difference between Copay and Deductible.

You almost always pay a copay at the time of service. For example your plan may require a 25 copay if you go to your doctor when youre sick or fill a prescription. Deductibles and coinsurance are clauses that are mostly implemented together under one single insurance plan.

A copayment made up front at the time of the session OR. A deductible is the amount you pay for most eligible medical services or medications before your health plan begins to share in the cost of covered services. It can be a fixed amount per the nature of treatment of a fixed percentage.

If your insurance has a 1000 annual deductible you would pay the entire 85 allowable to the doctor. If your plan includes copays you pay the copay flat fee at the time of service at the pharmacy or doctors office for example. I get Copay after deductible -- you must pay for the service fully out of pocket until your deductible is met after which you must only pay the copay amount and the insurance pays for the rest.

With deductible means that the copay applies to the deductible. If I havent yet met the deductible Id be responsible for all 2000.

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Montana

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Montana

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

Definitions And Meanings Of Health Care And Health Insurance Terms

Definitions And Meanings Of Health Care And Health Insurance Terms

Coinsurance And Medical Claims

Coinsurance And Medical Claims

Understanding Your Health Insurance Deductible Co Pay Co Insurance And Out Of Pocket Maximum Money Under 30

Understanding Your Health Insurance Deductible Co Pay Co Insurance And Out Of Pocket Maximum Money Under 30

Definitions And Meanings Of Health Care And Health Insurance Terms

Definitions And Meanings Of Health Care And Health Insurance Terms

What The Hell Is A Deductible Co Insurance And Co Pay Anyway Robbins Rehabilitation East Physical Therapy In Easton Pa Philipsburg Nj And Lebanon Nj

What The Hell Is A Deductible Co Insurance And Co Pay Anyway Robbins Rehabilitation East Physical Therapy In Easton Pa Philipsburg Nj And Lebanon Nj

Coinsurance And Medical Claims

Coinsurance And Medical Claims

Understanding Cost Sharing Deductibles Coinsurance And Copays Healthtn Com

Understanding Cost Sharing Deductibles Coinsurance And Copays Healthtn Com

Copay With Deductible Vs Copay After Deductible Medical Sciences Stack Exchange

Copay With Deductible Vs Copay After Deductible Medical Sciences Stack Exchange

25 Fresh Copay Coinsurance And Deductible And Out Of Pocket

Comments

Post a Comment