Featured

- Get link

- X

- Other Apps

California Health Insurance Penalty 2020

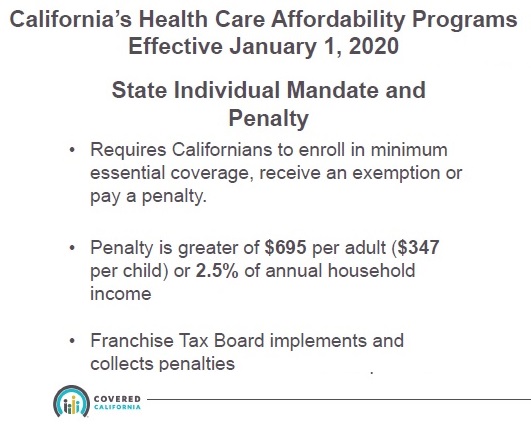

Get an exemption from the requirement to have coverage. The tax penalty was eliminated in 2017 by the Trump administration but the state of California has reinstated it for 2020.

California Franchise Tax Board Individual Mandate Penalty Flyer

California Franchise Tax Board Individual Mandate Penalty Flyer

31 2020 to enroll for coverage during Covered Californias open enrollment period which ran from Oct.

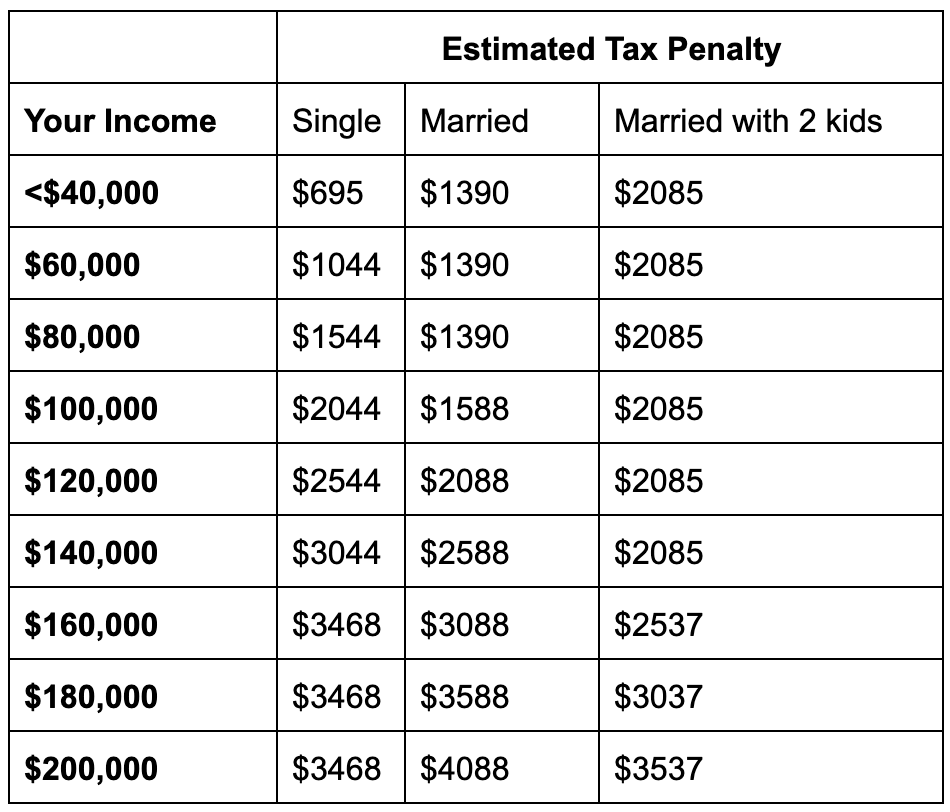

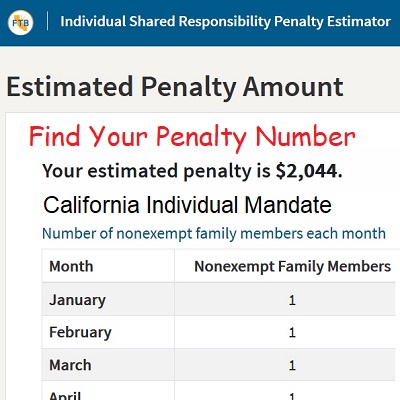

California health insurance penalty 2020. Have qualifying health insurance coverage orPay a penalty when filing a state tax return orGet an exemption from the requirement to have coverageAbout the Penalty Generally speaking the penalty will be 695 or more when you file your 2020 state income tax return in 2021. Lee said the threat of a penalty drove a 41 increase in people newly signing up for health insurance through Covered California bringing that total to 418052 residents. According to the California Franchise Tax Board FTB the penalty for not having health insurance is the greater of either 25 of the household annual income or a flat dollar amount of 750 per adult and 375 per child these number will rise every year with inflation in the household.

Obtain an exemption from the requirement to have coverage. Effective January 1 2020 a new state law requires California residents to maintain qualifying health insurance throughout the year. You will begin reporting your health care coverage on your 2020 tax return which you will file in the spring of 2021.

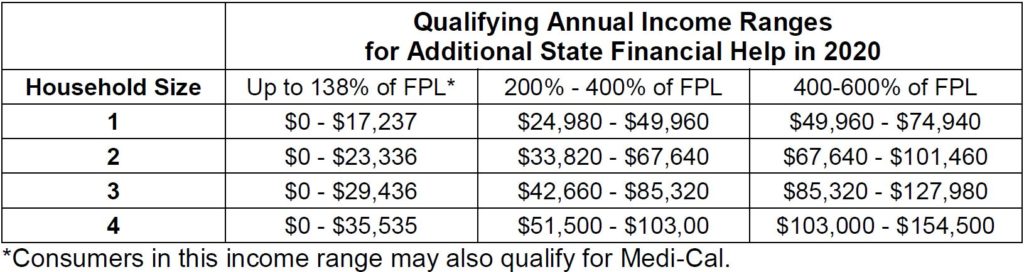

Though in 2019 the Trump administration rescinded the tax penalty established by the Affordable Care Act you may still need to pay a tax penalty in 2021 if you live in California and do not have health insurance. Californians will need to verify they have minimum essential coverage or qualify for an exemption or they will be subject to a penalty when they file their 2020 state income tax returns in 2021. Household size If you make less than You may pay.

This requirement applies to each resident their spouse or domestic partner and their dependents. Suspend Federal APTC Reconciliation for Tax Year 2020 For tax year 2020 the American Rescue Plan suspends repayment of excess advance premium tax credit APTC owed to the IRS. FTB is responsible for administering the penalty and validating the reconciliation of financial assistance subsidies received through Covered California.

The money raised from the penalties which is expected to be about 1 billion. California residents with qualifying health insurance and new penalty estimator. Consumers would be eligible for additional APTC when they reconcile for tax year 2020 if they did not receive the maximum allowed APTC during the year.

An individual who makes 14600 and goes uninsured for a year would pay 695. You only had until Jan. A family of four.

Tax Penalty for No Health Insurance 2020. But dont resign yourself to paying that penalty just yet. A taxpayer who fails to get health insurance that meets the states minimum requirements will be subject to a penalty.

Starting in 2020 California residents must either. The penalty for not having coverage the entire year will be at least 750 per adult and 375 per dependent child under 18 in the household when you file your 2020 state income tax return in 2021. If you are a Californian with no health insurance in 2020 you may face a tax penalty in 2021.

Beginning January 1 2020 California residents must either. The penalty is based on the previous federal individual mandate penalty which is 965 per uninsured adult or 25 percent of the individuals household income. Some Small Group Health Insurance carriers have extended their open enrollment periods in response to the 2020 state mandate.

Read our blog to learn more. California residents who do not have health insurance in 2020 will have to pay a tax penalty in 2021. Family of 4 2 adults 2 children 142000.

Beginning in 2020 California residents must either. What is the penalty for not having health insurance. Sample penalty amounts.

For 2019 the threshold is 18241 for a single childless individual under 65 and 58535 for a married couple under 65. The penalty varies based on a taxpayers income level and how long they go without coverage in 2020. As of this date California has not indicated that the penalty will be rescinded for tax year 2020.

Starting in 2020 California has enacted their own individual mandate for the state that requires residents to acquire a healthcare policy or pay a penalty. Pay a penalty when they file their state tax return. However there are exemptions if you are eligible.

Have qualifying health insurance coverage. 15 2019 through the end of January. The 2020 California filing thresholds are not available yet.

Covered California Announces New Law Requiring Health Insurance Susan Polk Insurance Agency Inc San Luis Obispo California

Covered California Announces New Law Requiring Health Insurance Susan Polk Insurance Agency Inc San Luis Obispo California

The Health Insurance Penalty Ends In 2019

The Health Insurance Penalty Ends In 2019

California Penalty For Not Having Health Insurance

California Penalty For Not Having Health Insurance

California Reintroduced Health Insurance Mandate Enforced By New Tax Penalty Solid Health Insurance

California Reintroduced Health Insurance Mandate Enforced By New Tax Penalty Solid Health Insurance

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

Mandate Health Insurance Tax Penalty California Mec Qhp 5000 A

The Health Insurance Penalty Ends In 2019

The Health Insurance Penalty Ends In 2019

Penalty For No Health Insurance 2020 In California Cost U Less Insurance

Penalty For No Health Insurance 2020 In California Cost U Less Insurance

2020 California Health Insurance Tax Penalty How Much Will You Owe Ask Ariana Healthcare Access

2020 California Health Insurance Tax Penalty How Much Will You Owe Ask Ariana Healthcare Access

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

The 2020 Changes To California Health Insurance Ehealth

The 2020 Changes To California Health Insurance Ehealth

California Individual Mandate Penalty Cheap Compared To Cost Of Health Insurance

California Individual Mandate Penalty Cheap Compared To Cost Of Health Insurance

Health Insurance Penalty In The Year 2020 Do I Pay It

Health Insurance Penalty In The Year 2020 Do I Pay It

California Enacts Individual Mandate For 2020 Core Benefits Insurance Services

California Enacts Individual Mandate For 2020 Core Benefits Insurance Services

Comments

Post a Comment