Featured

2019 Ca State Tax Form

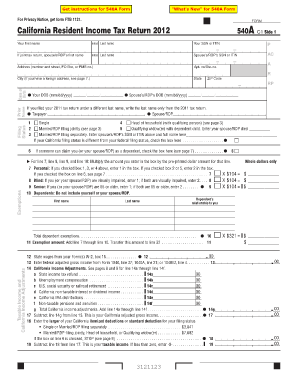

Part I Income Adjustment Schedule Section A Income from federal Form 1040 or 1040-SR A Federal Amounts taxable amounts from your federal tax return B Subtractions See instructions C Additions. For Privacy Notice get FTB 1131 ENGSP.

2019 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

2019 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

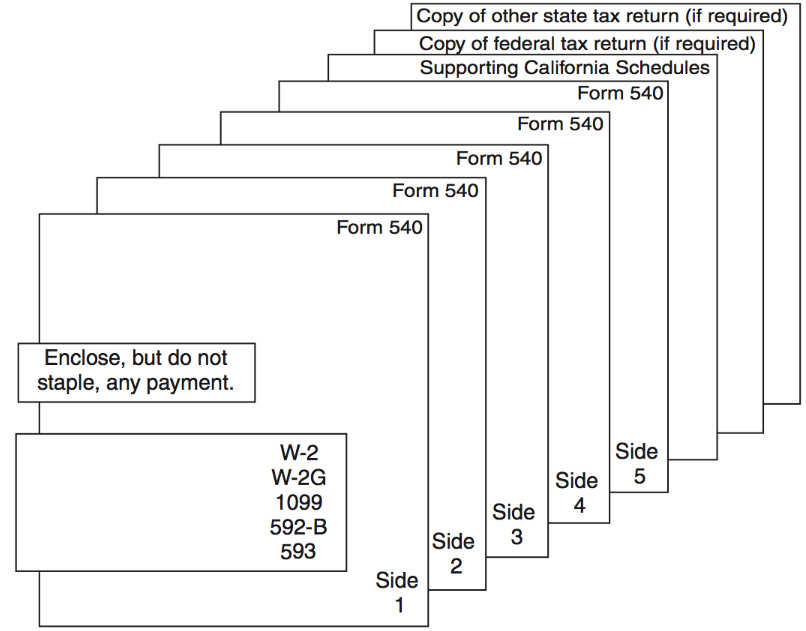

Attach this schedule behind Form 540 Side 5 as a supporting California schedule.

2019 ca state tax form. We support all major tax forms and there are no hidden fees. Follow the links to popular topics online services. Tax on a lump-sum distribution.

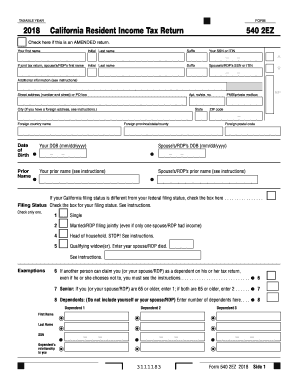

All calculations are guaranteed 100 accurate and youll get a copy of your tax return to download print or save as a PDF file. If your California filing status is different from your federal filing status check the box here. The undersigned certify that as of June 22 2019 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version June 22 2019 published by the Web Accessibility Initiative of the World.

Additional information see instructions Street address number and street or PO box. Most state tax forms will refer to the income. The undersigned certify that as of June 22 2019 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version June 22 2019 published by the Web Accessibility Initiative of the World Wide Web.

Printable 2020 state tax forms are grouped below along with their most commonly filed supporting schedules worksheets 2020 state tax tables and instructions booklet for easy one page access. State 2019 tax filing is only 1499. We believe in high value and low cost for our customers.

Other Situations When You Must File If you have a tax liability for 2019 or owe any of the following taxes for 2019 you must file Form 540. 2019 Instructions for Schedule CA 540 Get Form. 2020 State Income Tax Forms.

State income tax form preparation begins with the completion of your federal tax forms. 2019 California Adjustments Residents SCHEDULE CA 540 Important. Log in to your MyFTB account.

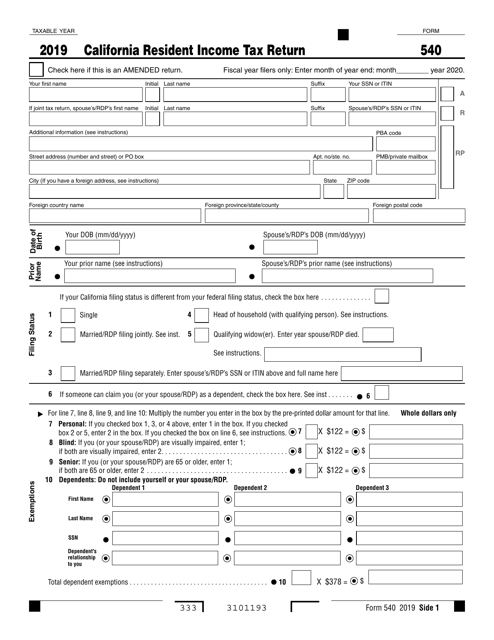

California Resident Income Tax Return. Federal tax filing is free for everyone with no limitations. The undersigned certify that as of June 28 2019 the internet website of the California Department of Tax and Fee Administration is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version June 28 2019 published by the Web.

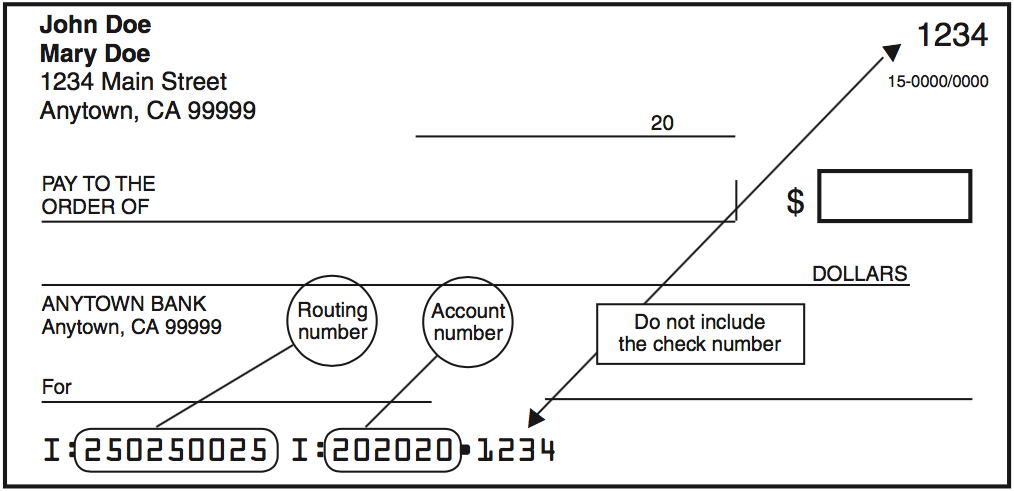

California estimated tax payments you made using 2019 Form 540-ES electronic funds withdrawal Web Pay or credit card. Line 72 2019 CA Estimated Tax and Other Payments. Check one box below to identify your marital status.

And Publications or go to ftbcagovforms. You file a joint tax return and either spouseRDP was a nonresident in 2019. Enter the total of any.

Simplified income payroll sales and use tax information for you and your business. File a return make a payment or check your refund. Use Form 540NR California Nonresident or Part-Year Resident Income Tax Return.

If you want to pre-pay tax on income reported on federal Form 1099-MISC use Form 540-ES Estimated Tax for Individuals. Not legally marriedRDP during 2019. 2019 Head of Household Filing Status Schedule.

You are marriedRDP and file a separate tax return. 21 rows California state income tax Form 540 must be postmarked by April 15. This form is available online at ftbcagovforms or file online using e-file.

Your DOB mmddyyyy SpousesRDPs DOB mmddyyyy Your prior name see instructions SpousesRDPs prior name see instructions Single. Form 540 Schedule CA INS. Tax on a qualified retirement plan including an Individual Retirement.

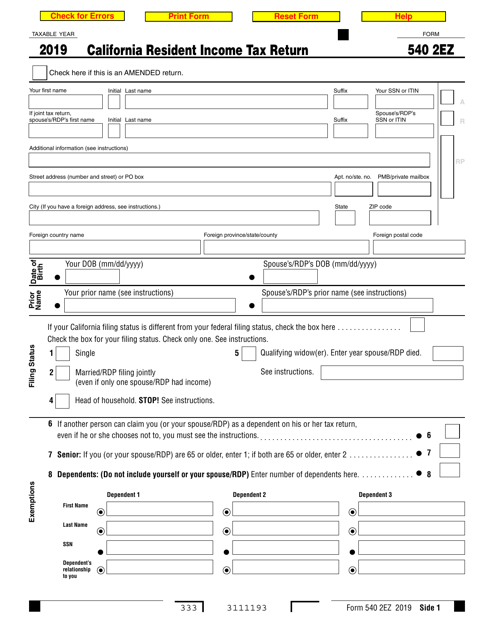

333 3111193 Form 540 2EZ 2019 Side 1 Check here if this is an AMENDED return. The undersigned certify that as of June 22 2019 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version June 22 2019 published by the Web Accessibility Initiative of the World. California Franchise Tax Board.

Enter an estimate of your itemized deductions for California taxes for this tax year as listed in the schedules in the FTB Form 540 1. Names as shown on tax return. City If you have a foreign address see instructions Foreign country name.

Enter 9202 if married filing joint with two or more allowances unmarried head of household or qualifying widower. If joint tax return spousesRDPs first name.

Form 540 Download Fillable Pdf Or Fill Online California Resident Income Tax Return 2019 California Templateroller

Form 540 Download Fillable Pdf Or Fill Online California Resident Income Tax Return 2019 California Templateroller

Form 540 2ez Download Fillable Pdf Or Fill Online California Resident Income Tax Return 2019 California Templateroller

Form 540 2ez Download Fillable Pdf Or Fill Online California Resident Income Tax Return 2019 California Templateroller

540 Form California Resident Income Tax Return

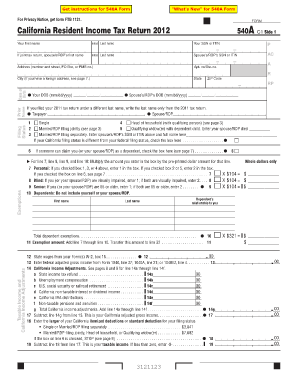

California Tax Forms 540a Fill Out And Sign Printable Pdf Template Signnow

California Tax Forms 540a Fill Out And Sign Printable Pdf Template Signnow

Irs California Form 540 2ez Pdffiller

Irs California Form 540 2ez Pdffiller

California Tax Forms H R Block

California Tax Forms H R Block

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png) Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

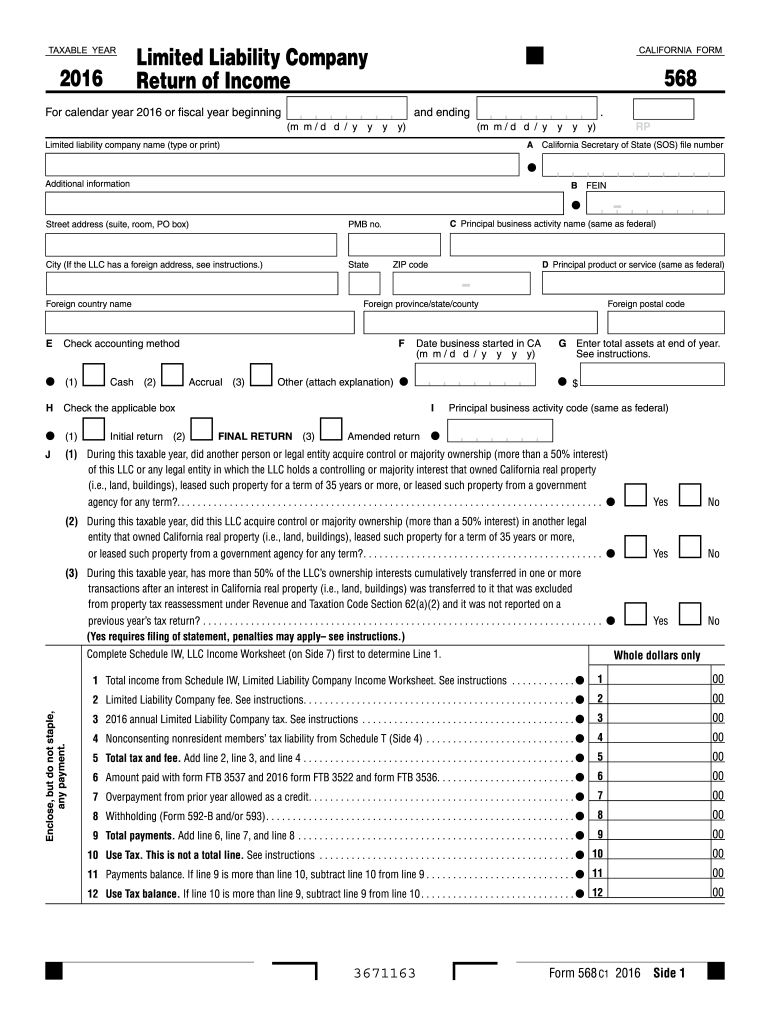

Ca Ftb 568 2016 Fill Out Tax Template Online Us Legal Forms

Ca Ftb 568 2016 Fill Out Tax Template Online Us Legal Forms

2019 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

2019 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

Irs Form 540 California Resident Income Tax Return

Irs Form 540 California Resident Income Tax Return

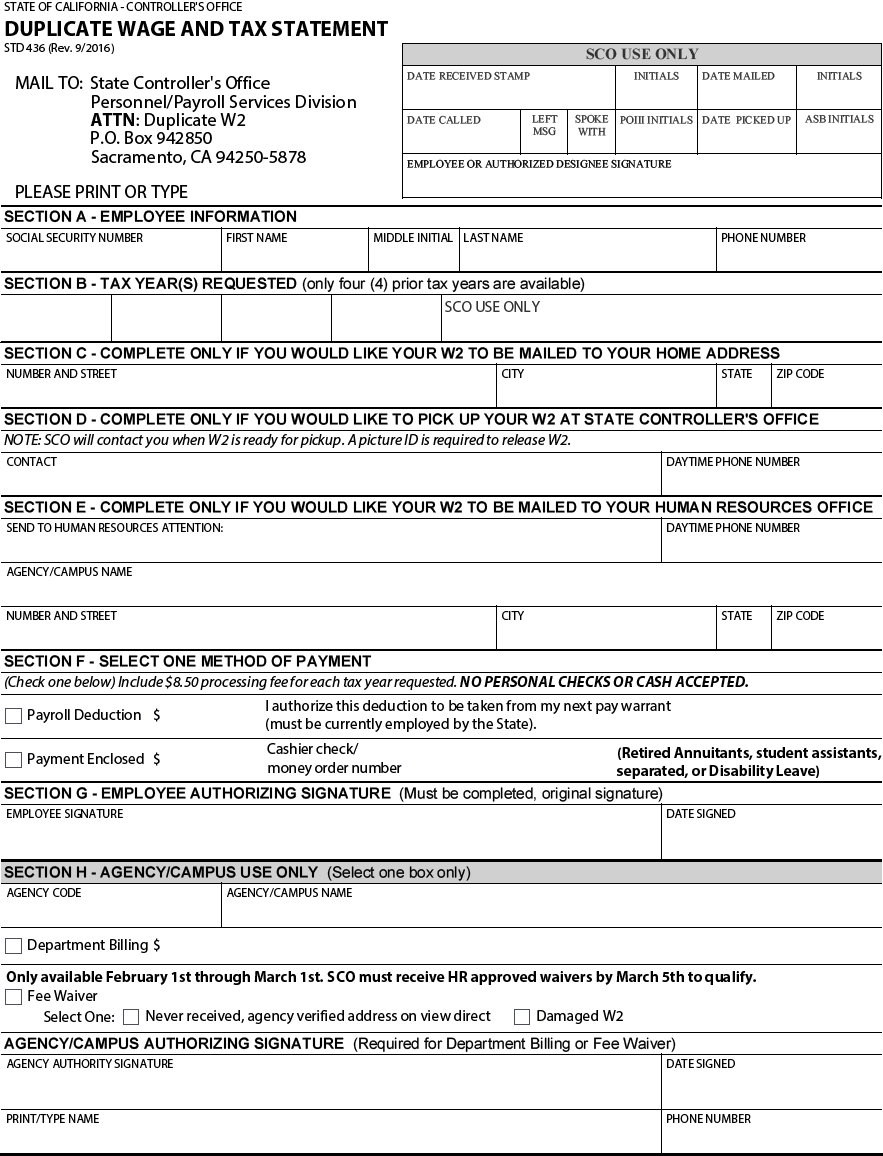

California State Controller S Office Request A Duplicate Form W 2

California State Controller S Office Request A Duplicate Form W 2

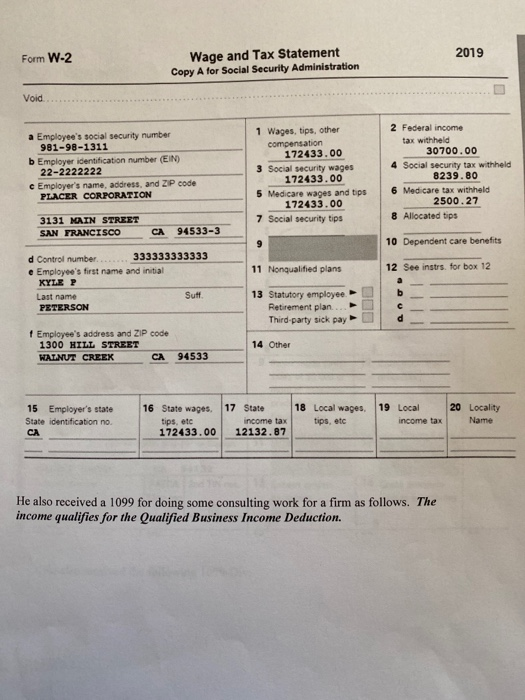

In Addition Kyle Received A 2300 Refund On 5 15 Chegg Com

In Addition Kyle Received A 2300 Refund On 5 15 Chegg Com

Comments

Post a Comment