Featured

- Get link

- X

- Other Apps

Healthcare Form 8962

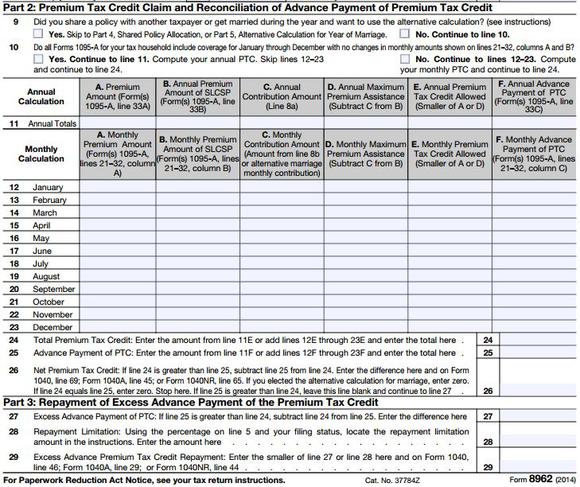

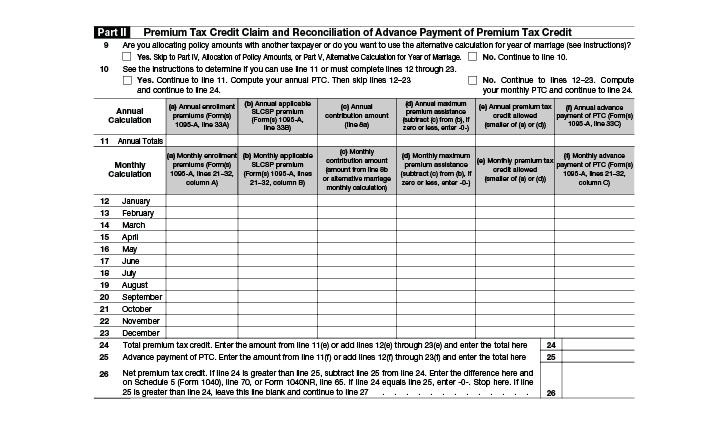

In the case where your client does have a shared policy the three amounts reported on Form1095-A enrollment premiums SLCSP premiums and APTC must be allocated between their tax return and the tax return of the other individual s for each month they had the policy. This will affect the amount of your refund or tax due.

Aca Affordable Care Act Information Vita Resources For Volunteers

Aca Affordable Care Act Information Vita Resources For Volunteers

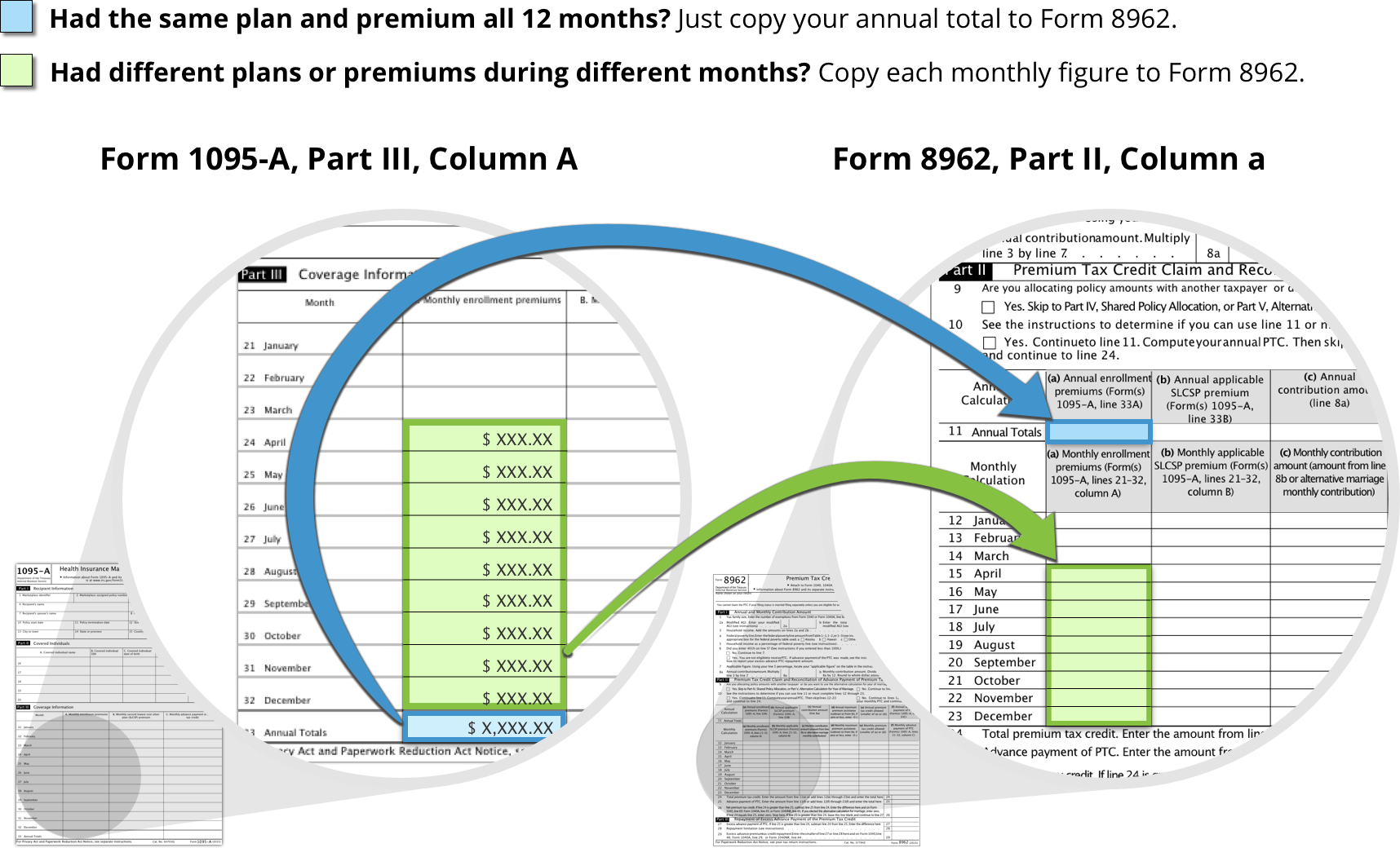

If anyone included on a tax return purchased health insurance through a Health Insurance Marketplace they will received Form 1095-A Health Insurance Marketplace Statement from the Marketplace after the end of the yearThis statement must be entered on Form 8962 Premium Tax Credit PTC to calculate the Premium Tax Credit and reconcile the tax credit received.

Healthcare form 8962. Form 8962 and Shared Policy Allocation. Form 8962 - Premium Tax Credit. Learn more about your taxes if you paid full price for a Marketplace plan.

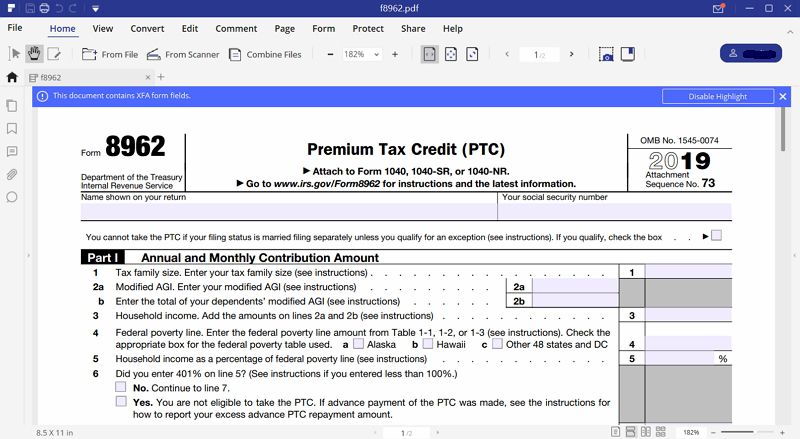

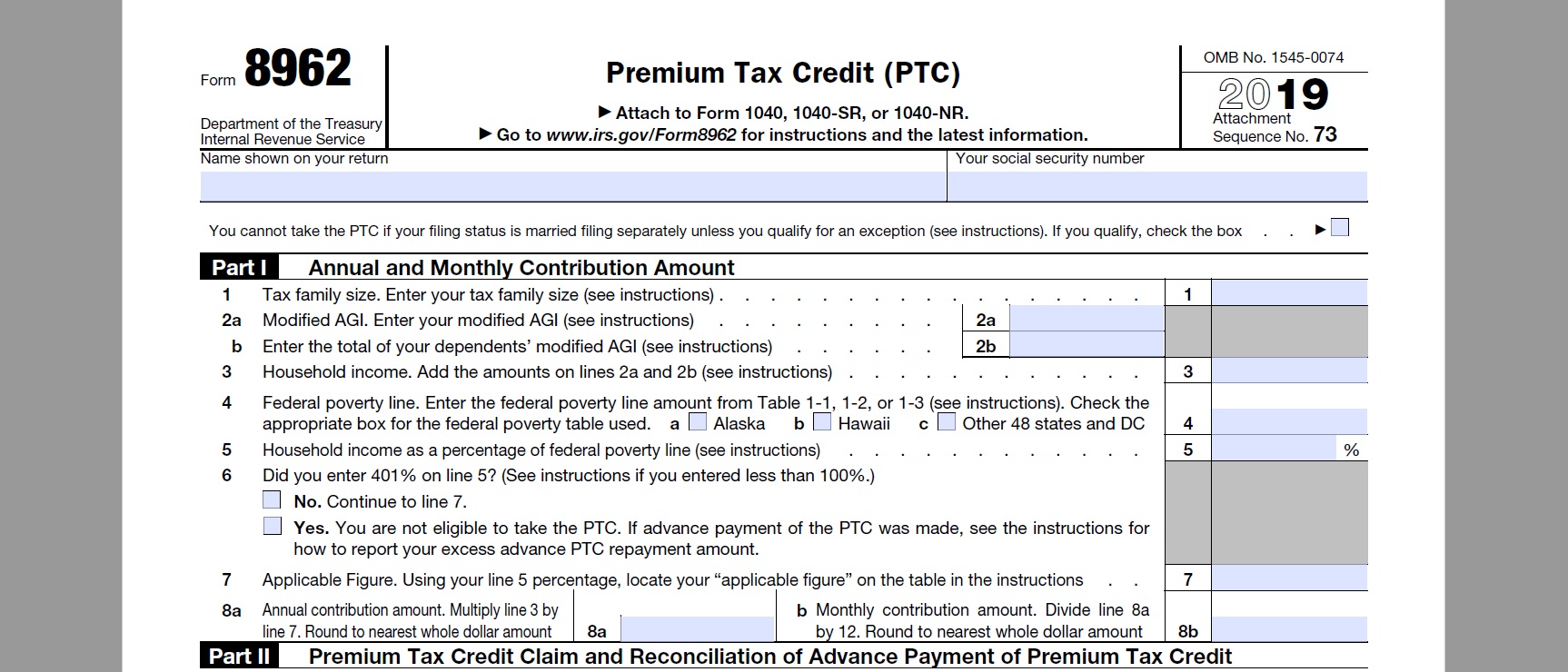

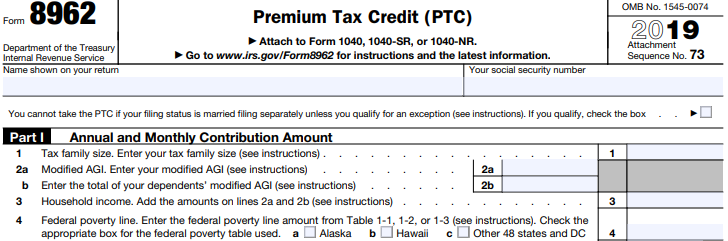

Your social security number. People who have already filed a 2020 tax return and repaid excess advance premium tax credits do not need to file an amended return. Form 8962 Department of the Treasury Internal Revenue Service Premium Tax Credit PTC Attach to Form 1040 1040-SR or 1040-NR.

This form is only used by taxpayers who purchased a health plan through the Health Insurance Marketplace including healthcaregov. Form 1095-C Employer Provided Health Insurance. If you dont qualify for a premium tax credit you dont have to include Form 8962 when you file your income taxes.

However there are only certain instances in which the combined amounts from Column B of those forms should be transferred to the Monthly Calculation section Lines 12-23 of the Form 8962 Premium Tax Credit PTC. On Line 26 youll find out if you used more or less premium tax credit than you qualify for based on your final 2020 income. Your family may have received multiple Forms 1095-A Health Insurance Marketplace Statements.

Your social security number. If you used healthcaregov or your states health insurance exchange to get coverage you may qualify. If youre claiming a net Premium Tax Credit for 2020 including if you got an increase in premium tax credits when you reconciled and filed you still need to include Form 8962.

People who are owed additional premium tax credit ie the amount that was paid on their behalf in 2020 ended up being too small can still claim it by using Form 8962 just as they normally would. If you purchased health insurance from the Health Insurance Marketplace also known as an Exchange and received advance payments of the premium tax credit Form 8962 is used to reconcile the advance payments with the amount of your credit. Taxpayers use Form 8962 to figure the amount of their PTC and reconcile it with their APTC.

You dont need to file an amended return or do anything else if you already filed your 2020 taxes and reported excess APTC or made an excess APTC repayment. Youll use this form to reconcile to find out if you used more or less premium tax credit than you qualify for. Include your completed Form 8962 with your 2020 federal tax return.

Form 8962 is used to figure the amount of Premium Tax Credit and reconcile it with any advanced premium tax credit paid. Form 8962 is used either 1 to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium or 2 to claim a premium tax credit. Form 8962 Department of the Treasury Internal Revenue Service Premium Tax Credit PTC Attach to Form 1040 1040-SR or 1040-NR.

Only those who have health insurance through the Affordable Care Act health insurance Marketplace also known as the Exchange are eligible to use Form 8962 and not everyone who has Marketplace coverage can qualify. Form 8962 Premium Tax Credit. Shared Policy Allocation - Divorced or Legally Separated.

If you had Marketplace insurance and used premium tax credits to lower your monthly payment you must file this health insurance tax form with your federal income tax return. Form 8962 - Multiple Forms 1095-A. Go to wwwirsgovForm8962 for instructions and the latest information.

Complete all sections of Form 8962. Eligible taxpayers may claim a PTC for health insurance coverage in a qualified health plan purchased through a Health Insurance Marketplace. According to the notice Schenker received people who have already filed their 2019 tax return and Form 8962 dont need to take any action.

Form 1095-A Health Insurance Marketplace Statement. Eligible taxpayers may claim a PTC for health insurance coverage in a qualified health plan purchased through a Health Insurance Marketplace. Form 1095-B Insurance Coverage.

Premium Tax Credit - Overview. Alternative Calculation for Year of Marriage. Get a notice telling you to file and reconcile 2019 taxes.

Shared Policy and Shared Policy Allocation. If you want to see if you qualify for a premium tax credit based on your final income you can complete Form 8962 to find out. About Form 8962 Premium Tax Credit Internal Revenue Service.

Straw recommends a more hands-on approach. Taxpayers use Form 8962 Premium Tax Credit to figure the amount of their PTC and reconcile it with their APTC. Name shown on your return.

Form 8962 is used to calculate the amount of premium tax credit youre eligible to claim if you paid premiums for health insurance purchased through the Health. Go to wwwirsgovForm8962 for instructions and the latest information. Name shown on your return.

If you received a letter from the IRS requesting Form 8962.

Https Www Rappahannockunitedway Org Wp Content Uploads 2018 03 Publication 4012 Rev 12 2017 Aca Pdf

Irs Form 8962 Premium Tax Credit Community Tax

Irs Form 8962 Premium Tax Credit Community Tax

2020 Form Irs 8962 Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 8962 Fill Online Printable Fillable Blank Pdffiller

Premium Tax Credit Form 8962 And Instructions

Premium Tax Credit Form 8962 And Instructions

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png) Form 8962 Premium Tax Credit Definition

Form 8962 Premium Tax Credit Definition

How To Fill Out Irs Form 8962 Correctly

How To Fill Out Irs Form 8962 Correctly

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

Irs Form 8962 Calculate Your Premium Tax Credit Ptc Smartasset

Irs Form 8962 Calculate Your Premium Tax Credit Ptc Smartasset

Irs 2019 Health Insurance Subsidy Tax Credit Reconciliation

Irs 2019 Health Insurance Subsidy Tax Credit Reconciliation

How To Reconcile Your Premium Tax Credit Healthcare Gov

How To Reconcile Your Premium Tax Credit Healthcare Gov

Printable Tax Form 8962 Fill Out And Sign Printable Pdf Template Signnow

Printable Tax Form 8962 Fill Out And Sign Printable Pdf Template Signnow

Aca Affordable Care Act Information Vita Resources For Volunteers

Aca Affordable Care Act Information Vita Resources For Volunteers

How To Fill Out Irs Form 8962 Accounts Confidant

How To Fill Out Irs Form 8962 Accounts Confidant

3 Easy Ways To Fill Out Form 8962 Wikihow

3 Easy Ways To Fill Out Form 8962 Wikihow

Comments

Post a Comment