Featured

Pros And Cons Of Ppo Health Insurance

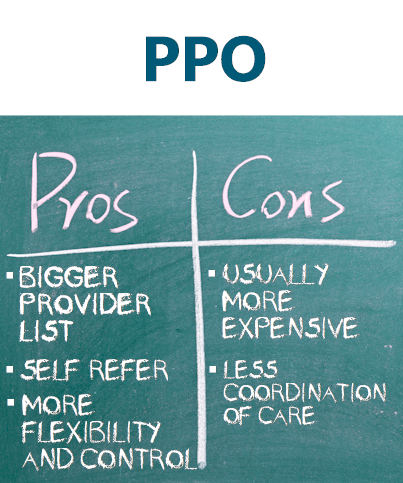

Health Insurance Pros Health Insurance Cons. Pros Cons of PPO Insurance Programs Pro.

Not all insurance companies may accept you.

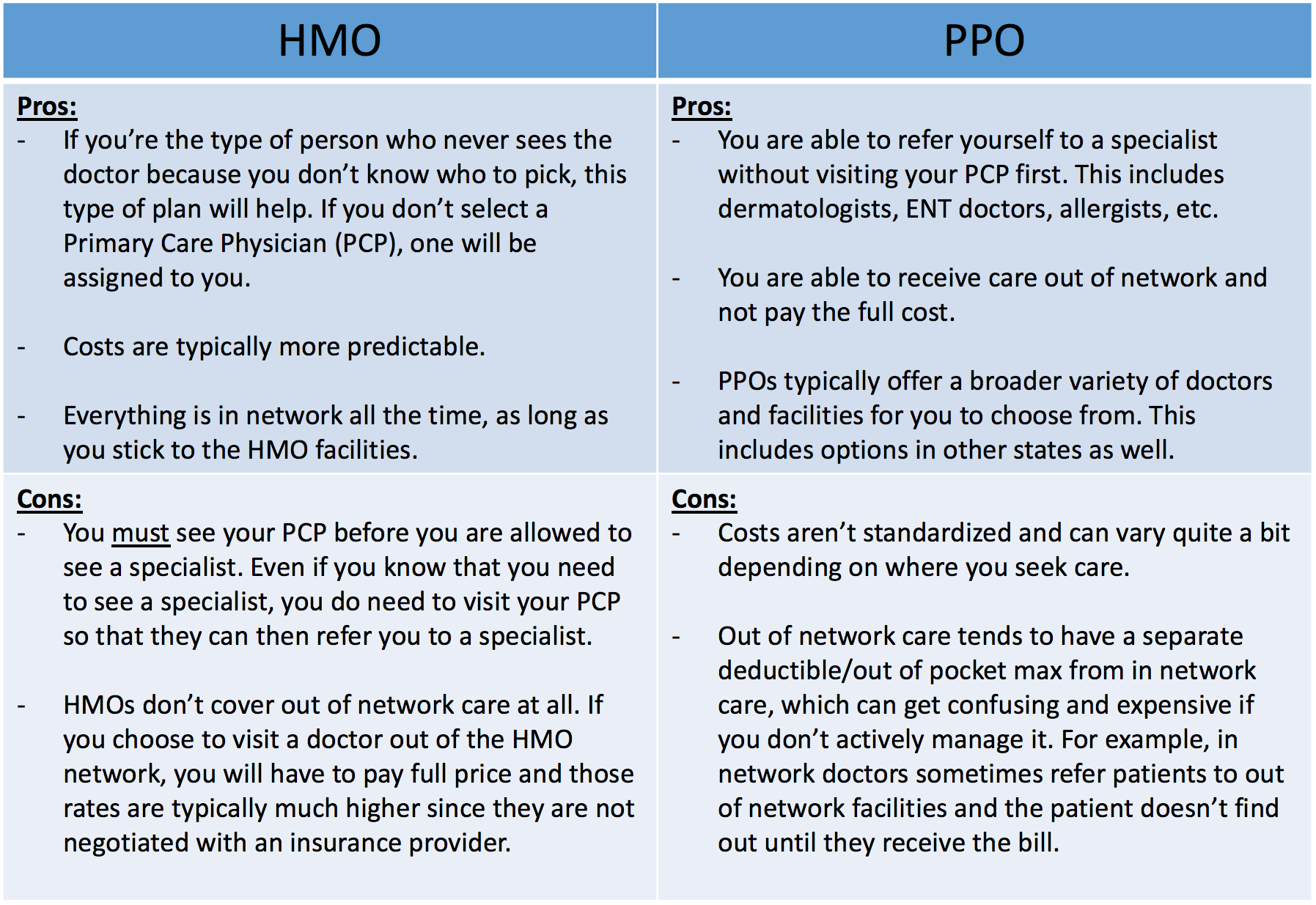

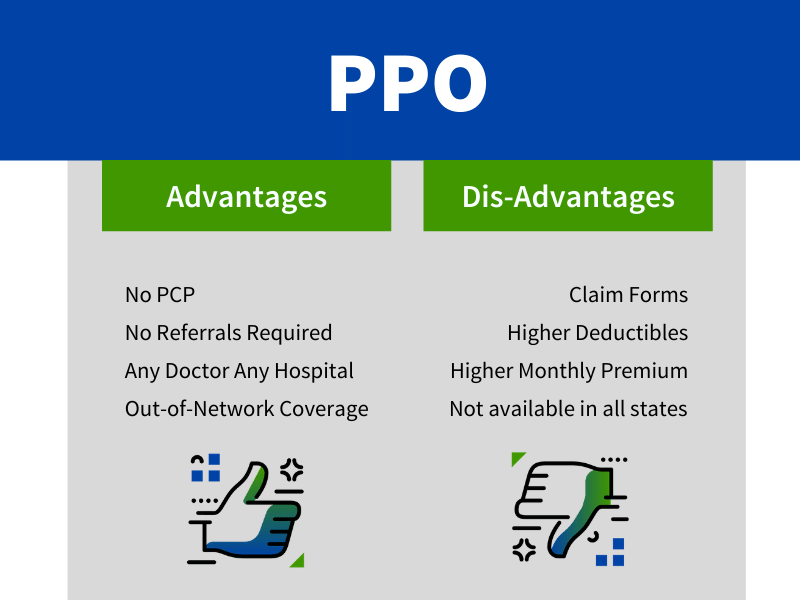

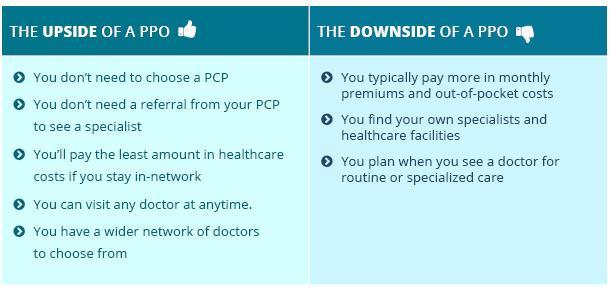

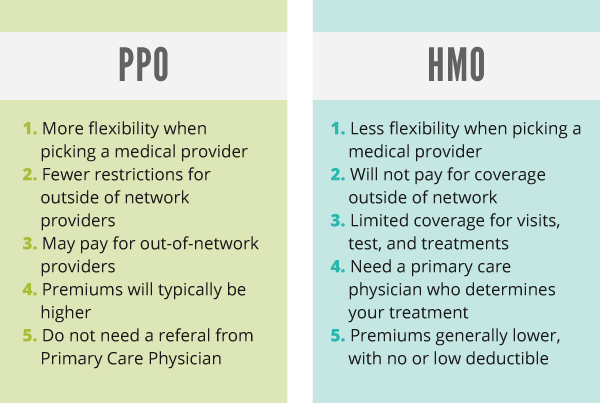

Pros and cons of ppo health insurance. A Preferred Provider Organization PPO typically offers a broad. In sum PPOs are virtually having all the advantages of managed care health insurance and fee-for-service health insurance. PPO stands for Preferred Provider Organization.

After the deductible is met there is a co-insurance amount that you are responsible for paying the average being 30 of the cost. But in a PPO the. You do not need to get a referral from your primary physician to see a medical specialist.

Weve provided a brief but substantive outline below of some of the pros and cons associated. The only disadvantage is that you must have to pay full rate for physicians and hospitals outside the network. Overall PPO plans cost you more between the deductible and co-insurance and other out-of-pocket expenses.

HMOs Offer Lower Cost. With PPO coverage you can approach any physician you desire inside the network and some outside. Health care is guaranteed to be covered under HMO insurance not including any co-payment agreement.

Both kinds of health plans have a network of providers you can work with to get the best rates. For people who need to see specialists for a variety of reasons. However if you dont need to see specialists at your convenience are ok with your primary physician directing your care and need a more affordable option the HMO might work fine for you.

PPO is another popular form of health insurance that acts almost as the flipside to HMO plans. While they still have a network of doctors that will be the most affordable you can see any provider youd like and still get some coverage. The main downside of a PPO is that youll pay higher monthly premiums.

So if you agree to pay for your choice then PPOs are the best option for you. With this freedom youll still get a level of insurance coverage depending on the situation. HMO Members Must Have a Primary Care Physician PCP.

What Is a PPO Health Plan. And then theres the preferred provider wrinkle. Advantages of a PPO Plan.

If you need flexibility and more options for care a PPO might suit you better assuming you can afford the higher costs. One of the. The PPO plans primary benefit is it includes the things you miss out on with HMO plans.

Better protection against large financial burden. Pros and cons of PPO health insurance plans. Advantages include low premiums and the option of opening an HSA to save for medical procedures that encompass those not covered by your medical insurance.

Some people may not be able to afford it. Preferred provider organization plans also cover a wider ranger of services than an HMO plan. Doctors visits trips to the emergency room and specialist treatments.

The Pros Cons of Different Types of Health Insurance. Pros of a PPO Arguably the biggest pro of a PPO is flexibility. Protection of your wealth.

You may also be able to get in to see a specialist more quickly when you have an urgent care need. Advantages of private health insurance Of course the most obvious advantage is that health insurance can provide coverage for some of your healthcare expenses. A PPO especially one with a low deductible may suit those who expect frequent doctor visits and prescriptions due to something like a chronic condition.

This can save you an extra office visit and co-pay. There is a multitude of different types of health insurance with different features to consider when making your decision. When it comes to health insurance people have more options than ever.

A primary care physician PCP oversees and guides a patients. Whether this is your first time shopping for your own health insurance or youve been with an HMO company for most of your life and youre considering a switch dont jump into a PPO insurance plan before evaluating these pros and cons to see if its right for you and your health care. Preferred provider organization plans are substantially more flexible than other types of health.

Out of Pocket Expenses. PPO stands for Preferred Provider Organization. The Pros and Cons of HMOs and PPOs PPOs Typically Give Consumers More Healthcare Freedom.

Health insurance can be expensive. Higher overall life expectancy. Hard to get in with pre-existing conditions.

Here is a list of the pros and cons of private health insurance that you should know about in order to make the choice that is right for you. This type of plan also comes with a preferred network of healthcare providers. Tips on Reviewing Health Insurance.

September 5 2018. One of the major reasons people like PPO insurance programs is the lack of referral requirements.

The Pros And Cons Of High Deductible Health Plans Hdhps

The Pros And Cons Of High Deductible Health Plans Hdhps

Hmo Vs Ppo Selecting The Right Plan For Your Employees Clarity Benefit Solutions

Hmo Vs Ppo Selecting The Right Plan For Your Employees Clarity Benefit Solutions

Pros Cons And Comparisons Hmo Ppo Cdhp Part 4

Pros Cons And Comparisons Hmo Ppo Cdhp Part 4

Health Insurance Types Hmo And Ppo Pros And Cons

Health Insurance Types Hmo And Ppo Pros And Cons

Kaiser Versus Ppo How To Compare

Kaiser Versus Ppo How To Compare

Difference Between Hmo And Ppo Difference Between

What Your Employees Ask Which Medical Plan Do I Choose

What Your Employees Ask Which Medical Plan Do I Choose

What Is A Ppo About Ppo Health Insurance Medical Mutual

What Is A Ppo About Ppo Health Insurance Medical Mutual

Ppo Insurance Guide Exchange Healthcare

Ppo Insurance Guide Exchange Healthcare

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Pros And Cons Of Most Common Health Insurance Plans Health Insurance Plans High Deductible Health Plan Health Insurance

Pros And Cons Of Most Common Health Insurance Plans Health Insurance Plans High Deductible Health Plan Health Insurance

Ppo Insurance What Is A Preferred Provider Organization Plan

Ppo Insurance What Is A Preferred Provider Organization Plan

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Comments

Post a Comment