Featured

How Does Medicare Work With Retiree Insurance

Retiree coverage will work with your Medicare. Retiree coverage isnt the same thing as a Medigap policy but like a Medigap policy it usually offers benefits that fill in some of Medicares gaps in coveragelike Coinsurance and deductibles.

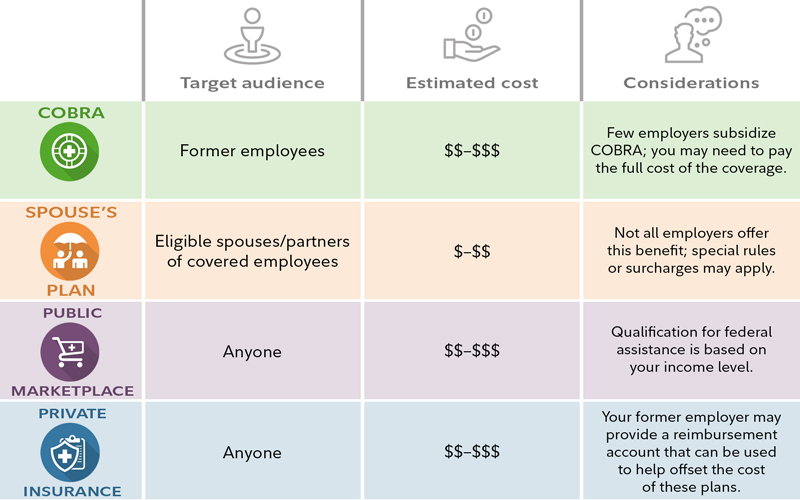

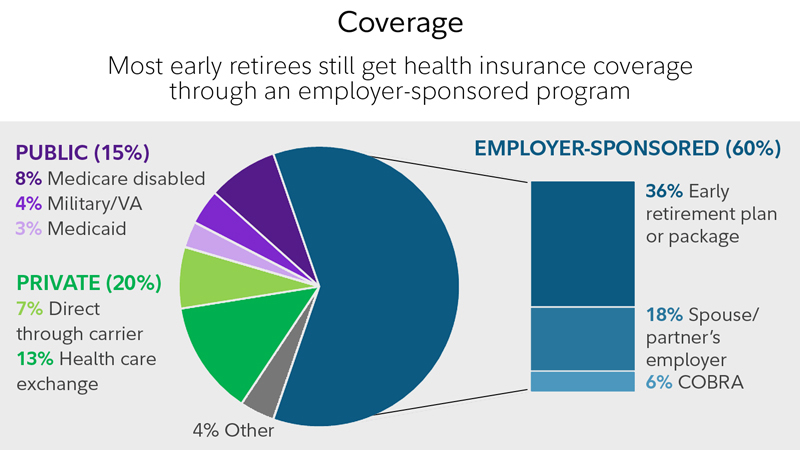

Bridging The Health Care Coverage Gap Fidelity

Bridging The Health Care Coverage Gap Fidelity

Retiree health benefits Medicare Parts A and B are always primary to retiree coverage provided by a former employer or union.

How does medicare work with retiree insurance. Most people pay monthly for Part B. There are four parts to MedicareA B C and Dthat cover different healthcare needs. If you do not sign up for Medicare you may have problems accessing coverage.

Does My FEHB Plan or Medicare Pay Benefits First. If you are eligible for Medicare you may have choices in how you get your health care. This basically functions as a separate health plan offered through private insurers.

In this case your group coverage is your secondary insurance. Part B medical insurance. Medicare law and regulations determine whether Medicare or FEHB is primary that is pays benefits first.

Medicare Part D covers prescription drugs. Premiums for this plan depend largely on your income. These plans provide all the same coverage as Original Medicare Parts A B and often additional benefits and features such as prescription drug coverage.

Deciding whether to keep retiree coverage after you enroll in Medicare is a personal one that depends on your costs and anticipated health care needs. How Does Retiree Health Coverage Work with Medicare. This means that Medicare pays first for your health care and then your retiree coverage pays for some or all of the costs that Medicare did not cover.

Since Medicare pays first after you retire your retiree coverage is likely to be similar to coverage under Medicare Supplement Insurance Medigap. For Americans 65 and older conversations about health insurance should include Medicare. On the surface most people are.

Retiree insurance is almost always secondary to Medicare meaning it pays after Medicare and may provide coverage for Medicare cost-sharing like deductibles copayments and coinsurance. Keep FEHB AND Enroll in Medicare Part B. Medicare also provides incentives to help employer and union plan sponsors continue to offer drug coverage to their Medicare-eligible retirees.

Some retiree plans are Medicare Advantage plans. That said each plan has its own costs and benefits. There are a few things to consider.

Since your employer has less than 20 employees Medicare calls this employer health insurance coverage a small group health plan. In general if you have Medicare and retiree insurance Medicare will pay your health care bills first. Generally Part B premiums are withheld from your monthly Social Security check or your retirement check.

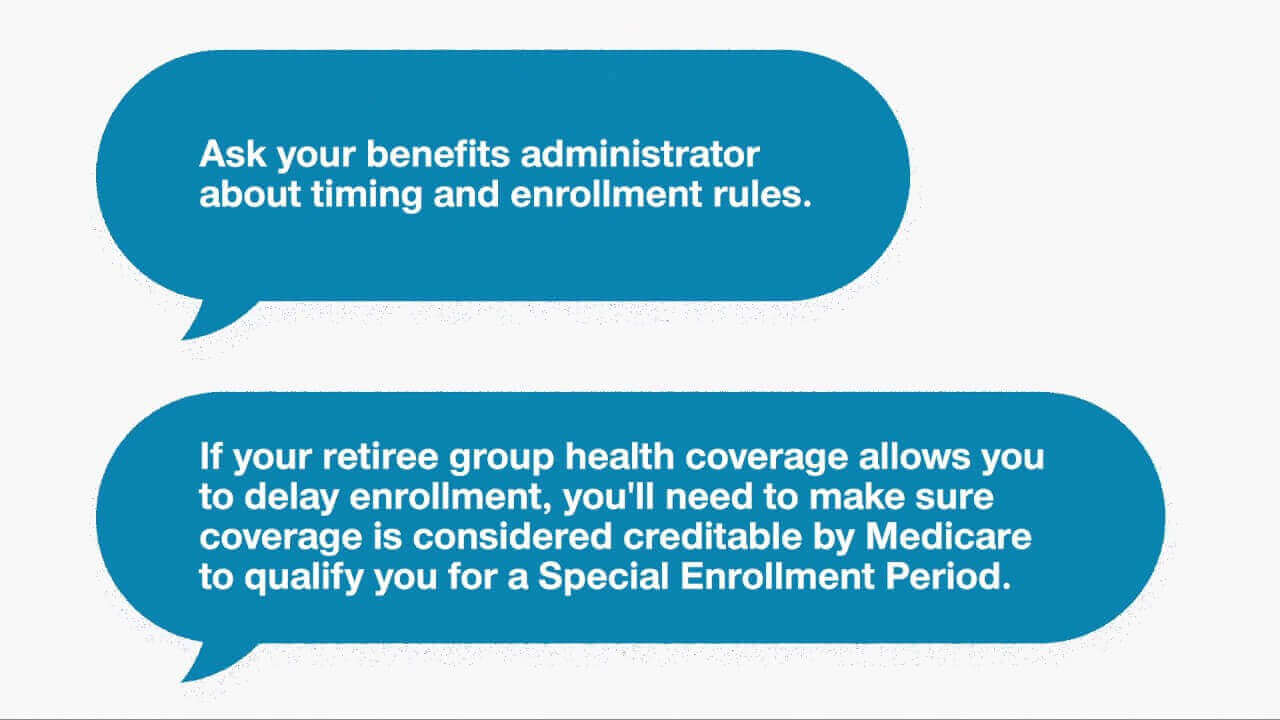

Regardless of your retiree insurance you must make sure to enroll in Medicare Parts A and B because Medicare will always pay first after you retire called primary insurance and your retiree plan will pay second called secondary insurance. Depending on your employers size Medicare will work with your employers health insurance coverage in different ways. Retiree health coverage may help cover some of the costs that Medicare doesnt.

According to Medicare rules retiree insurance pays secondary to Medicare. Joining a Medicare drug plan could affect a. If you are eligible for Medicare you may choose to enroll in and get your Medicare benefits from a Medicare.

Sometimes retiree coverage includes extra benefits like coverage. Retiree insurance is a form of health coverage an employer may provide to former employees. The BCRC will gather information about any conditional payments Medicare made related to your no-fault insurance or liability insurance claim.

Your employer is not required to offer you the same coverage as when you were. A retiree enrolls in Medicare Part B AND keeps his FEHB coverage in place. Medicare works with plan sponsors to offer a variety of options for people with Medicare who have retiree drug coverage.

Medicare Choice is the term used to describe the various health plan choices available to Medicare beneficiaries. You will receive an Explanation of Benefits EOB from your FEHB plan and an EOB or Medicare Summary Notice MSN from Medicare. The BCRC will determine the final repayment amount if any on your recovery case and send you a letter asking for.

So if your employer offers health insurance as a retiree benefit you can choose to accept it and still. Medicare can work alongside other health insurance plans including retiree health benefits. The final combination that we have is a hybrid between these two programs Part B and FEHB.

If you get a settlement judgment award or other payment you or your representative should contact the BCRC. Having zero options in retirement for health coverage does not sounds like a great position to be in for anyone. Medicare automatically transfers claims information to your FEHB plan once your claim is processed so you generally dont need to file a claim with both.

How Does Medicare Work with Retiree Insurance. How Medicare works with other plans If you or your spouse continue working or you have a retiree or self-funded health insurance plan you can use this alongside your Medicare benefit. Retiree coverage premiums can be.

So its important to shop around for one that works best for your retirement budget. It may also help cover some services that Medicare doesnt cover. Retiree insurance is almost always secondary to Medicare meaning it pays after Medicare and may provide coverage for Medicare cost-sharing like deductibles copayments and coinsurance.

If your company has 20 employees or less and youre over 65 Medicare will pay primary. In effect your plan becomes supplemental insurance that improves on Medicare maybe covering some services that Medicare doesnt or paying some of Medicares out-of-pocket costs.

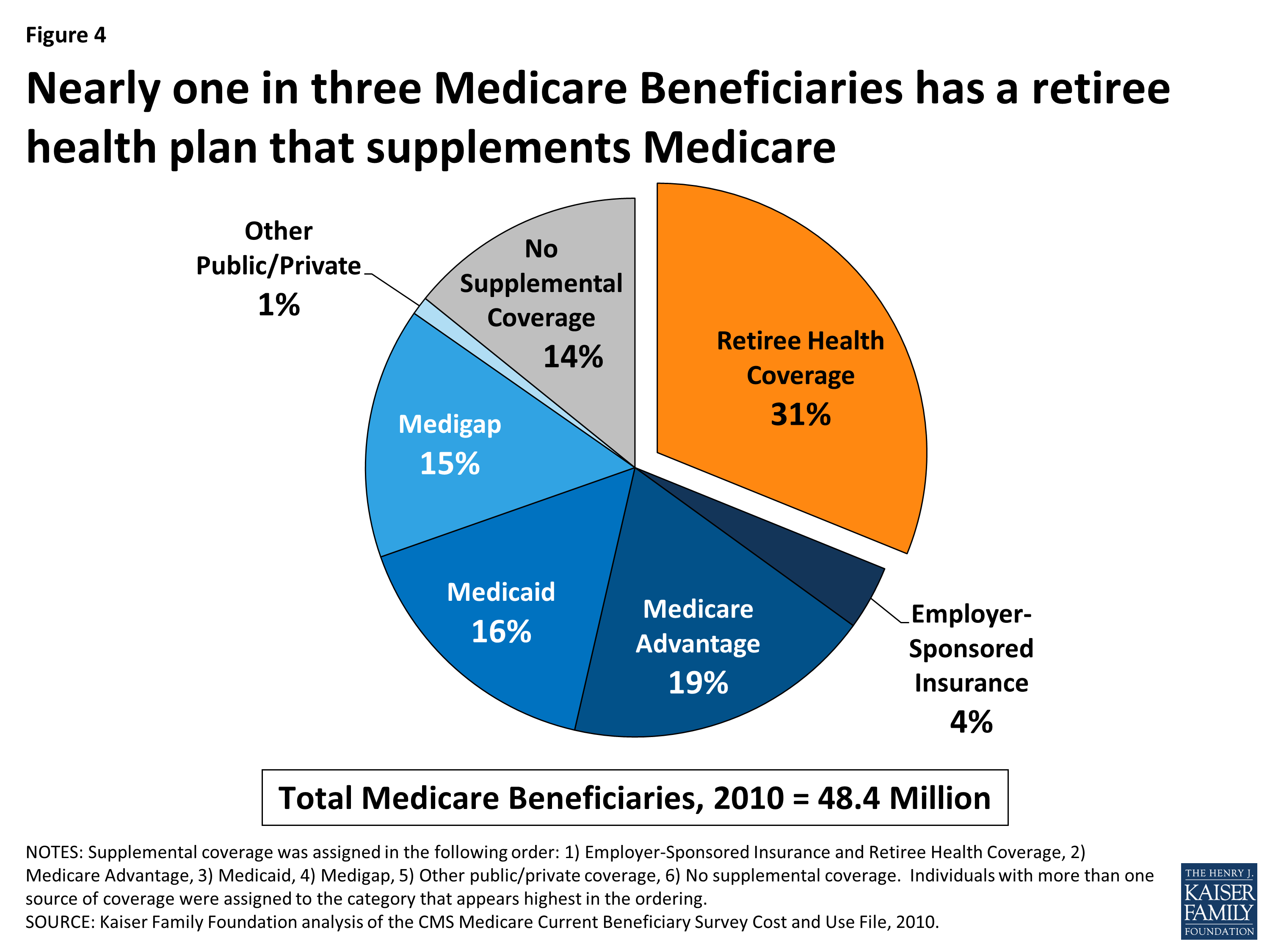

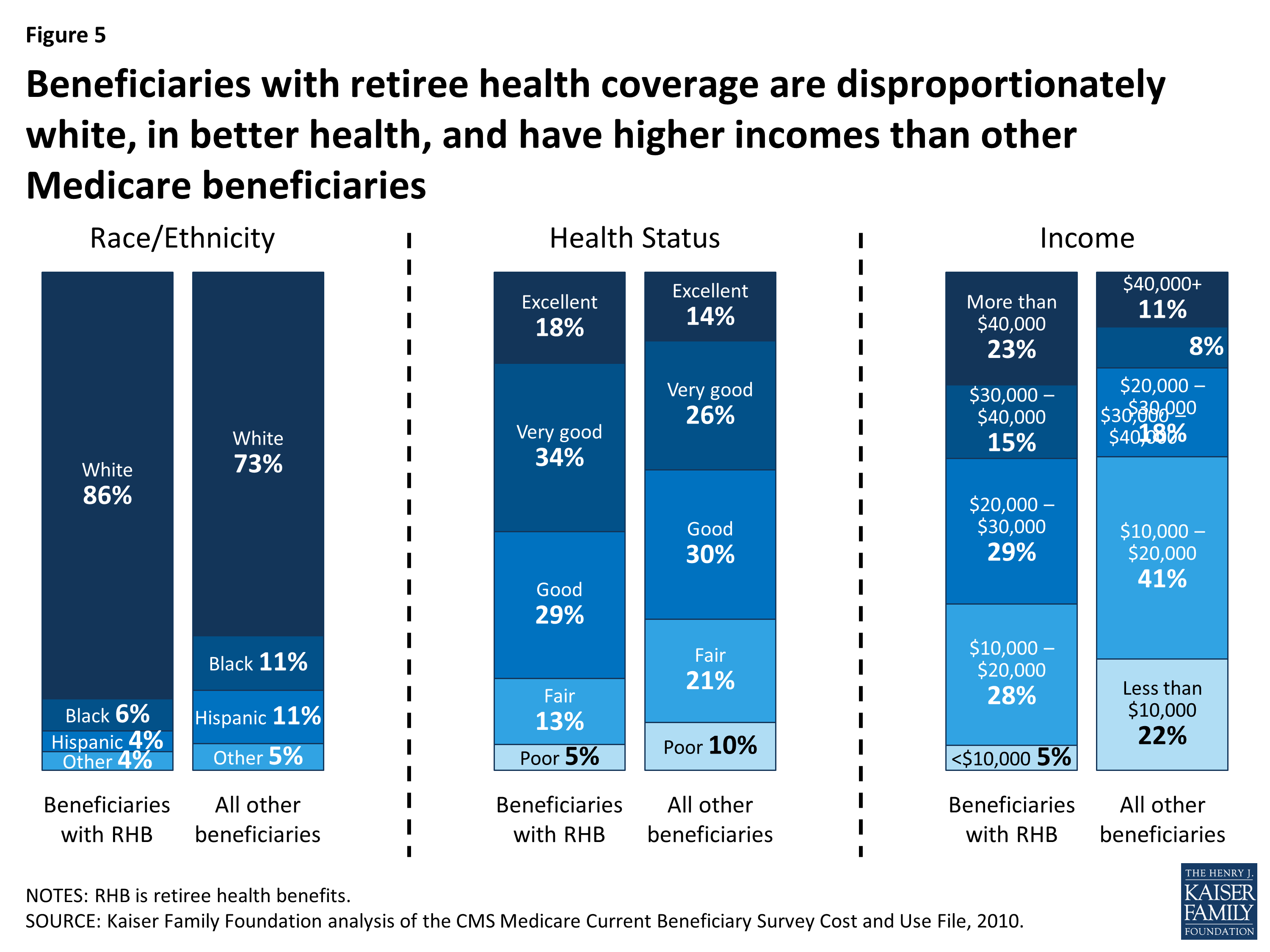

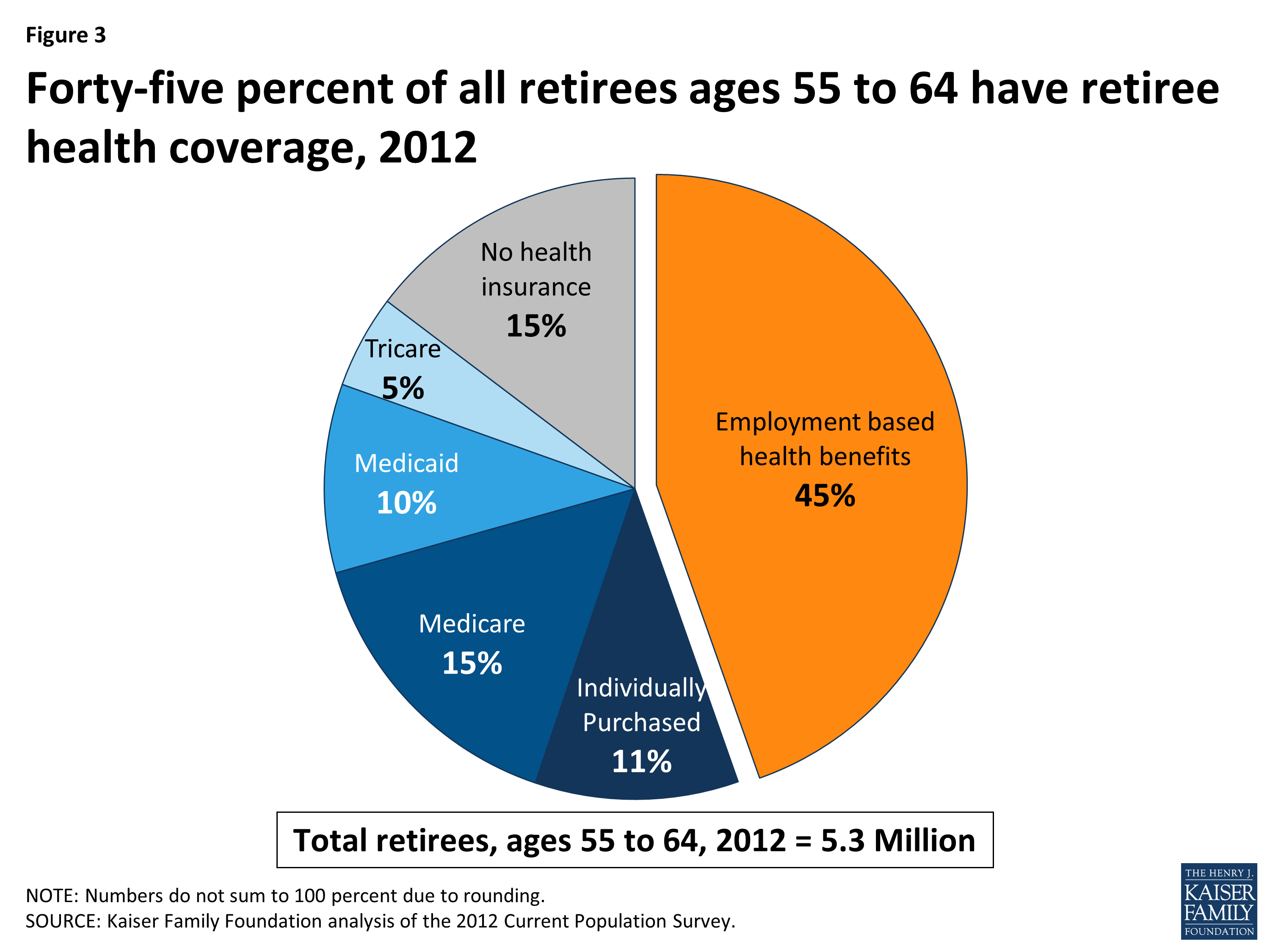

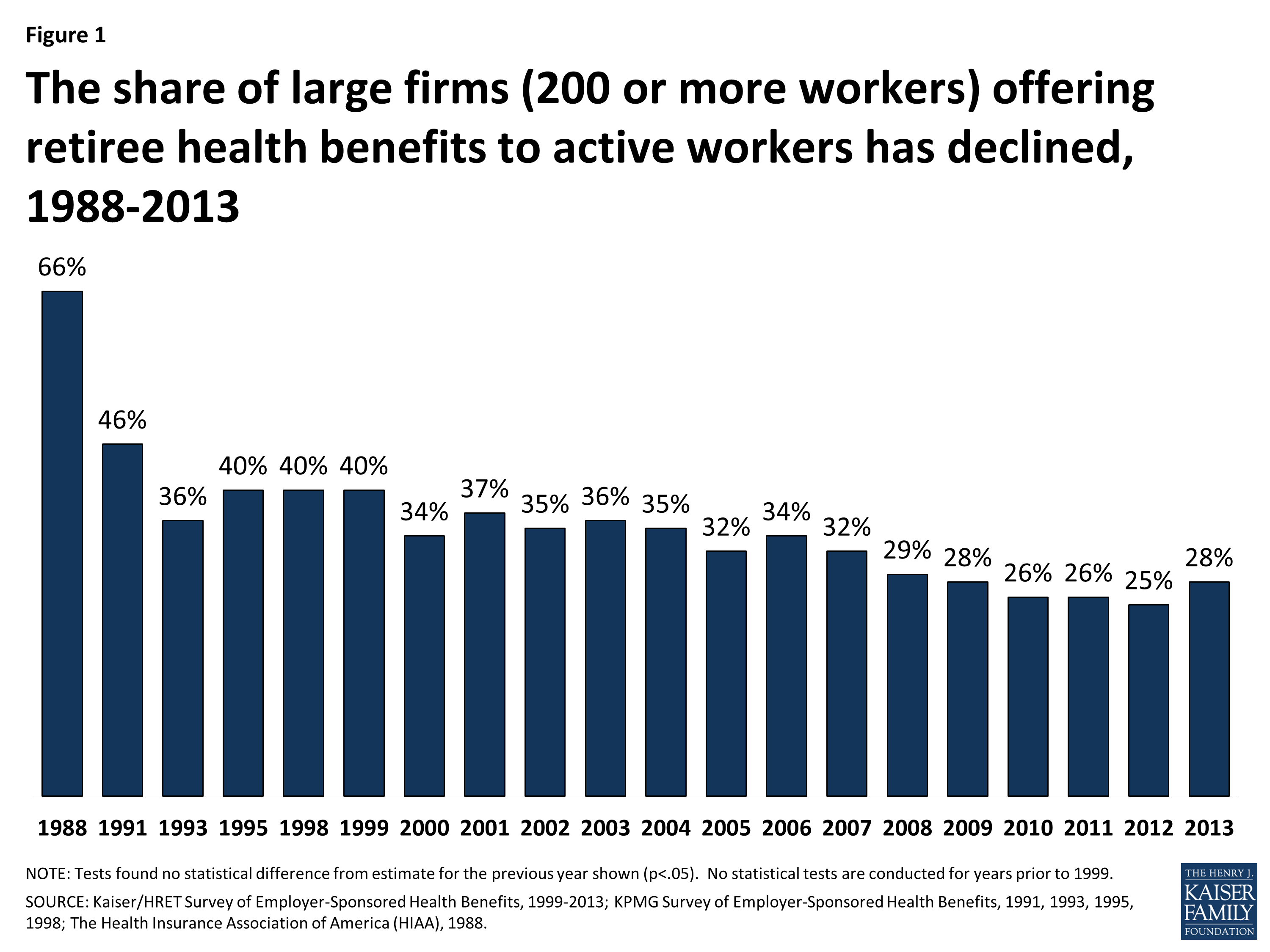

Retiree Health Benefits At The Crossroads Overview Of Health Benefits For Pre 65 And Medicare Eligible Retirees 8576 Kff

Retiree Health Benefits At The Crossroads Overview Of Health Benefits For Pre 65 And Medicare Eligible Retirees 8576 Kff

But I Repeat Myself You Should Offer A Fully Insured Retiree Pay All Employer Sponsored Medicare Advantage Option To Retirees Plan Sponsor Council Of America

But I Repeat Myself You Should Offer A Fully Insured Retiree Pay All Employer Sponsored Medicare Advantage Option To Retirees Plan Sponsor Council Of America

Retiree Health Benefits At The Crossroads Overview Of Health Benefits For Pre 65 And Medicare Eligible Retirees 8576 Kff

Retiree Health Benefits At The Crossroads Overview Of Health Benefits For Pre 65 And Medicare Eligible Retirees 8576 Kff

How Does Retiree Health Coverage Work With Medicare Aarp Medicare Plans

How Does Retiree Health Coverage Work With Medicare Aarp Medicare Plans

Figuring Out The Best Healthcare Option For Early Retirees

Figuring Out The Best Healthcare Option For Early Retirees

How Does Retiree Health Coverage Work With Medicare Aarp Medicare Plans

How Does Retiree Health Coverage Work With Medicare Aarp Medicare Plans

Original Medicare Vs Medicare Advantage 2020 Boomer Benefits

Original Medicare Vs Medicare Advantage 2020 Boomer Benefits

Retiree Health Benefits At The Crossroads Overview Of Health Benefits For Pre 65 And Medicare Eligible Retirees 8576 Kff

Retiree Health Benefits At The Crossroads Overview Of Health Benefits For Pre 65 And Medicare Eligible Retirees 8576 Kff

Retiree Health Benefits At The Crossroads Overview Of Health Benefits For Pre 65 And Medicare Eligible Retirees 8576 Kff

Retiree Health Benefits At The Crossroads Overview Of Health Benefits For Pre 65 And Medicare Eligible Retirees 8576 Kff

How Does Retiree Health Coverage Work With Medicare Aarp Medicare Plans

How Does Retiree Health Coverage Work With Medicare Aarp Medicare Plans

I Have Retiree Insurance Do I Need To Sign Up For Medicare At Age 65 Medicare Pathways

I Have Retiree Insurance Do I Need To Sign Up For Medicare At Age 65 Medicare Pathways

How Does Retiree Insurance Work With Medicare Medicare Rights Center

How Does Retiree Insurance Work With Medicare Medicare Rights Center

Bridging The Health Care Coverage Gap Fidelity

Bridging The Health Care Coverage Gap Fidelity

Comments

Post a Comment