Featured

Irs Form For Health Insurance 8962

Usually if the tax deadline is near any tax credit and refund may. My parents paid my ACA health insurance for 6 months until I had employer paid health insurance but did not claim me as a dependent.

How To Fill Out Obama Care 8962 Premium Tax Credit Forms If Single Youtube

How To Fill Out Obama Care 8962 Premium Tax Credit Forms If Single Youtube

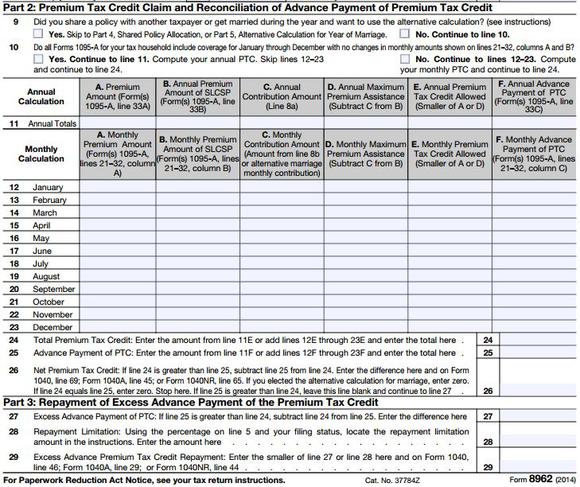

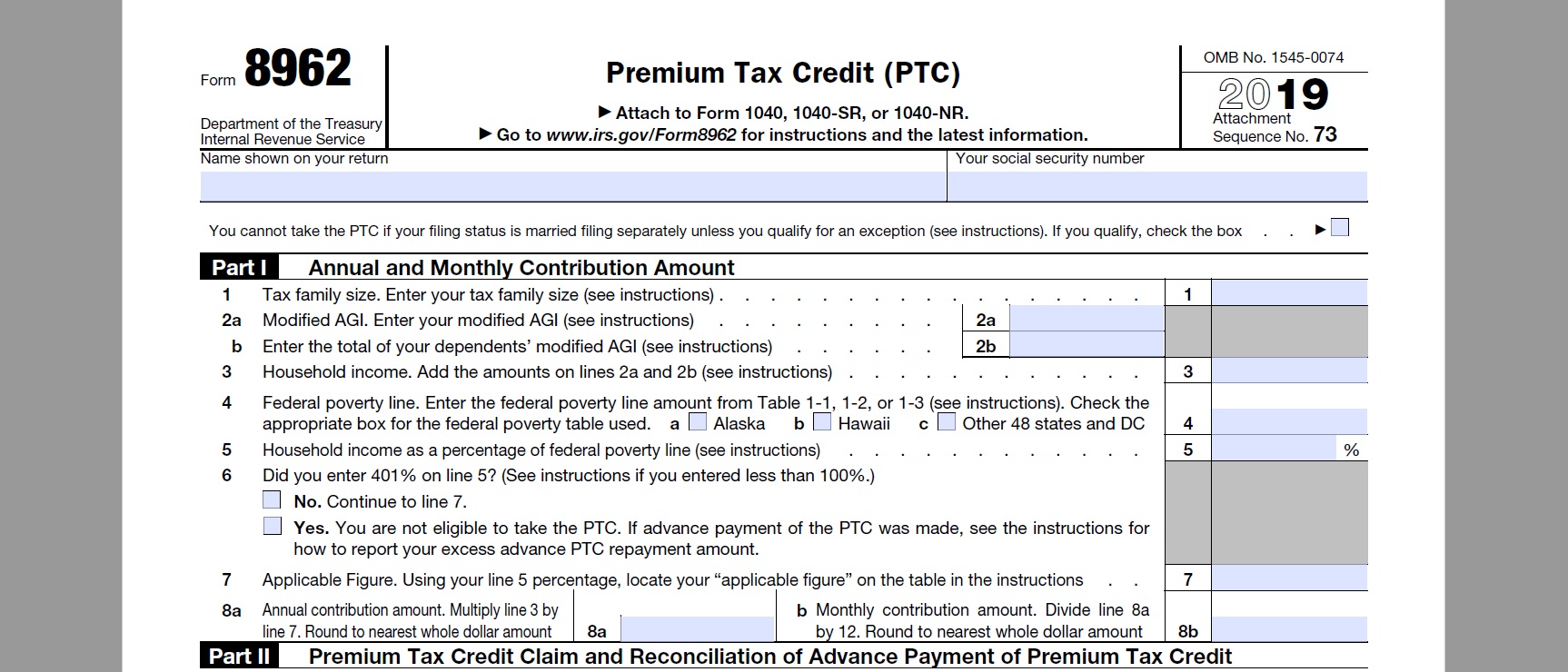

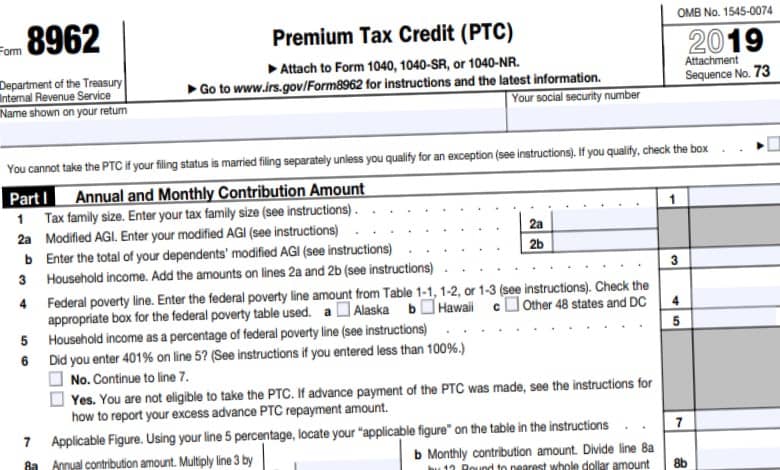

Form 8962 is used either 1 to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium or 2 to claim a premium tax credit.

Irs form for health insurance 8962. Youll use this form to reconcile to find out if you used more or less premium tax credit than you qualify for. Eligible taxpayers may claim a PTC for health insurance coverage in a qualified health plan purchased through a Health Insurance Marketplace. Health Care Law Your Tax Return IRS Suspends Requirement to Repay Excess Advance Payments of the 2020 Premium Tax Credit If you have excess advance Premium Tax Credit for 2020 you are not required to report it on your 2020 tax return or file Form 8962 Premium Tax Credit.

Some tax professionals call it the IRS health insurance form 8962 since the form kickstarts the process for receiving a valuable tax credit for households with little to moderate income levels. After you complete your return we will generate Form 8962 for you based on the information you have entered from your Form 1095-A. Name shown on your return.

If you didnt have insurance and qualify for an exemption you must complete the form. Taxpayers who are eligible claim a PTC for health insurance coverage in a qualified health plan purchased through a health insurance marketplace. Well help you create or correct the form in TurboTax.

Premium tax credits are sometimes known as subsidies discounts or savings. The 8962 form will be e-filed along with your completed tax return to the IRS. IRS Form 8965 is the Health Coverage Exemptions form.

Taxpayers use Form 8962 to figure the amount of their PTC and reconcile it with their APTC. How do I fill out form 8962. Whichever option you choose you must file Form 8962 Premium Tax Credit along with your tax return.

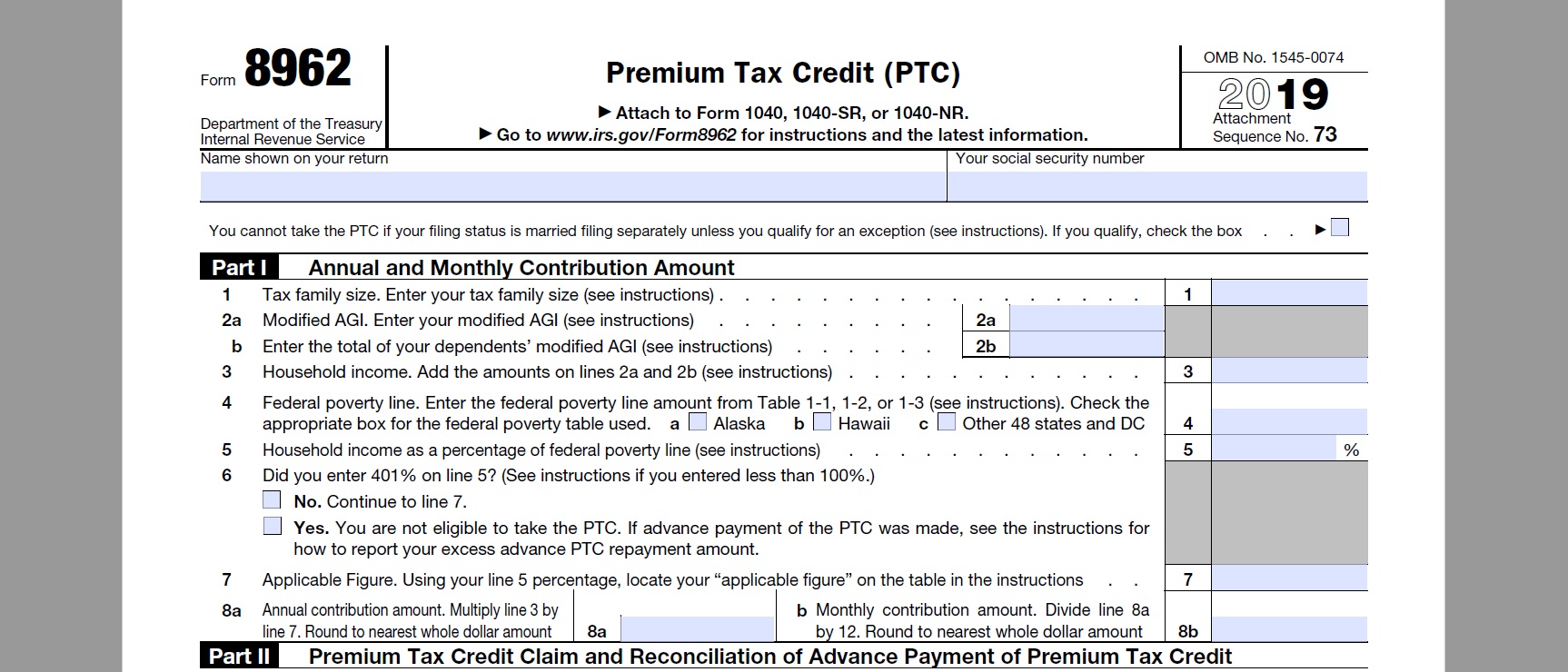

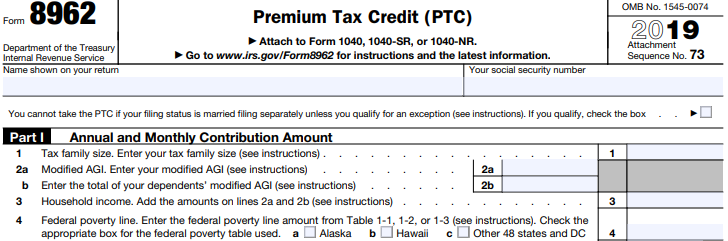

Form 8962 Department of the Treasury Internal Revenue Service Premium Tax Credit PTC Attach to Form 1040 1040-SR or 1040-NR. About Form 8962 Premium Tax Credit Internal Revenue Service. Form 8962 Premium Tax Credit.

Name shown on your return. Taxpayers use Form 8962 Premium Tax Credit to figure the amount of their PTC and reconcile it with their APTC. Form 8962 Premium Tax Credit is required when someone on your tax return had health insurance in 2020 through Healthcaregov or a state marketplace and took the Advance Premium Tax Credit to lower their monthly premium.

This premium tax credit is immensely useful. Your social security number. This is done in the Healthcare section of your account.

Go to wwwirsgovForm8962 for instructions and the latest information. This computation lets taxpayers know whether they must increase their tax liability by all or a portion of their excess APTC called an excess advance Premium Tax Credit repayment or may claim a net PTC. Why Is the Credit Refundable.

Form 8962 is an essential tax form that not only helps relieve the pressure of your return but also makes affordable health insurance through the marketplace viable to everyone. The following types of health insurance do not qualify for the advance premium tax credit. Form 8962 is used to calculate the amount of premium tax credit youre eligible to claim if you paid premiums for health insurance purchased through the Health Insurance Marketplace.

To claim the Premium Tax Credit PTC you must file IRS Form 8962 with your federal income tax return. The PTC is meant to help people recoup some of the money they spent on Marketplace health insurance premiums by lowering their tax burden. Form 8962 Department of the Treasury Internal Revenue Service Premium Tax Credit PTC Attach to Form 1040 1040-SR or 1040-NR.

Eligible taxpayers may claim a PTC for health insurance coverage in a qualified health plan purchased through a Health Insurance Marketplace. You will need to share the policy. Your social security number.

If you had Marketplace insurance and used premium tax credits to lower your monthly payment you must file this health insurance tax form with your federal income tax return. The IRS is requesting Form 8962 for 2020. The form in question is the IRS 8962 form.

Get the form from them to enter onto your return. Go to wwwirsgovForm8962 for instructions and the latest information. This only applies to Americans who dont have any coverage.

If you lost your job but bought coverage through the Marketplace or you purchased a private policy you dont have to complete the form. This computation lets taxpayers know whether they must increase their tax liability by all or a portion of their excess APTC called an excess advance Premium Tax Credit repayment or may claim a net PTC. If you claim a net Premium Tax Credit for 2020 you must file Form 8962.

Taxpayers use Form 8962 Premium Tax Credit to figure the amount of their PTC and reconcile it with their APTC. Should you choose to make advanced payments of the premium tax credit made to insurance you will resolve the amount with the actual credit you receive when you file your tax return. You must file Form 8962 if you obtained a marketplace health insurance plan for yourself or your family and part or all of your premium was paid with subsidies at any time of the year.

The deadline for the IRS Form 8962 for the year 2020 is 15 April 2020.

Printable Tax Form 8962 Fill Out And Sign Printable Pdf Template Signnow

Printable Tax Form 8962 Fill Out And Sign Printable Pdf Template Signnow

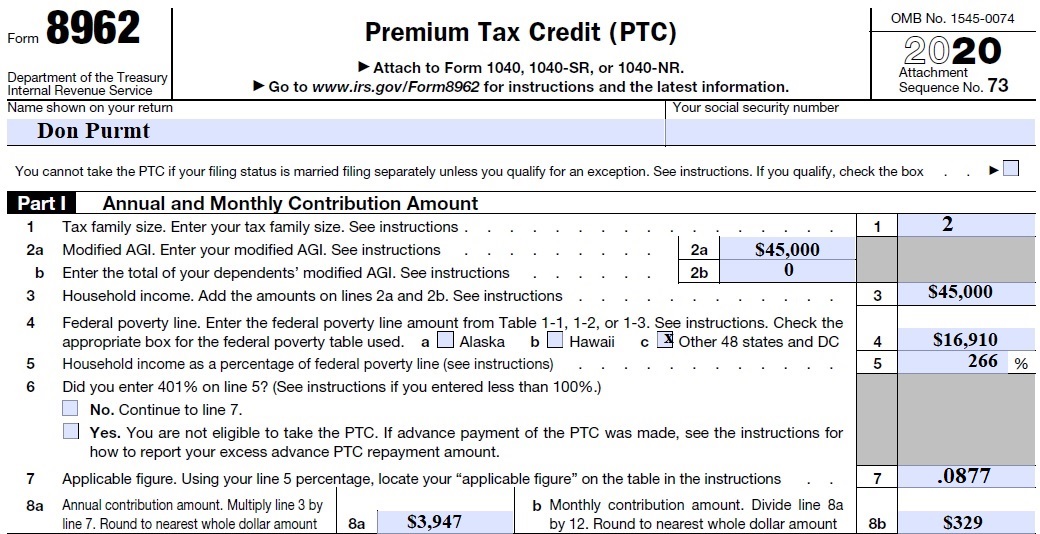

How To Fill Out Irs Form 8962 Correctly

How To Fill Out Irs Form 8962 Correctly

Aca Affordable Care Act Information Vita Resources For Volunteers

Aca Affordable Care Act Information Vita Resources For Volunteers

Irs Form 8962 Premium Tax Credit Community Tax

Irs Form 8962 Premium Tax Credit Community Tax

Health Insurance 1095a Subsidy Flow Through Irs Tax Return

Health Insurance 1095a Subsidy Flow Through Irs Tax Return

Premium Tax Credit Form 8962 And Instructions

Premium Tax Credit Form 8962 And Instructions

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

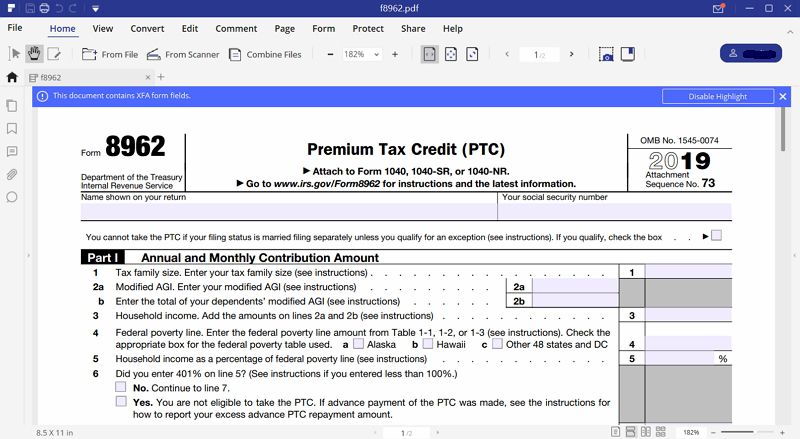

Irs Form 8962 Free Download Create Edit Fill Print Wondershare Document Cloud

Irs Form 8962 Free Download Create Edit Fill Print Wondershare Document Cloud

Https Www Irs Gov Pub Irs Prior F8962 2014 Pdf

What Individuals Need To Know About The Affordable Care Act For 2016

Irs 2019 Health Insurance Subsidy Tax Credit Reconciliation

Irs 2019 Health Insurance Subsidy Tax Credit Reconciliation

8962 Form 2021 Irs Forms Zrivo

8962 Form 2021 Irs Forms Zrivo

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png) Form 8962 Premium Tax Credit Definition

Form 8962 Premium Tax Credit Definition

How To Fill Out Irs Form 8962 Accounts Confidant

How To Fill Out Irs Form 8962 Accounts Confidant

Comments

Post a Comment