Featured

Health Insurance Tax Form

You may also need to use Form 1095-A to complete Form 8962 if you chose to have advance premium tax credit APTC. Youll use this form to reconcile to find out if you used more or less premium tax credit than you qualify for.

2014 Federal Tax Forms Will Ask About Your Health Insurance Coverage Wuwm 89 7 Fm Milwaukee S Npr

2014 Federal Tax Forms Will Ask About Your Health Insurance Coverage Wuwm 89 7 Fm Milwaukee S Npr

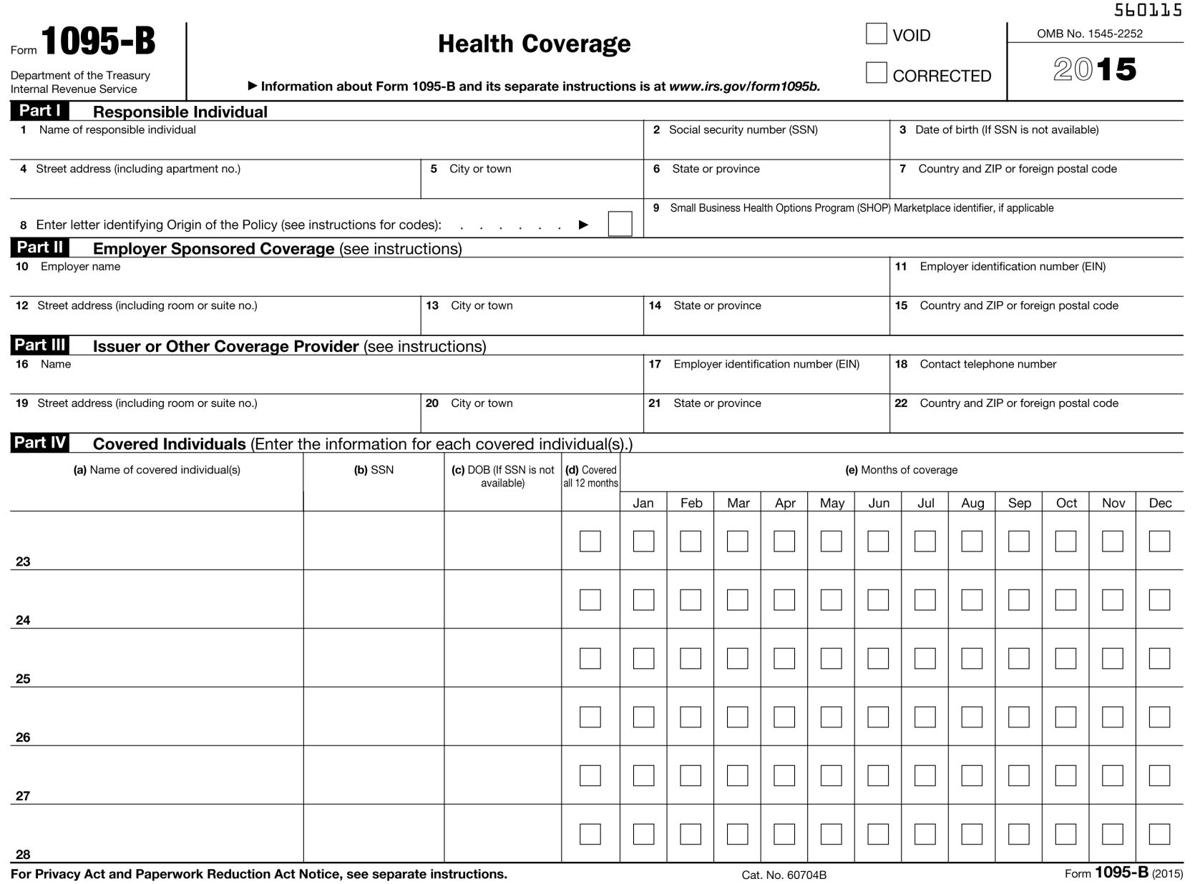

Form 1095-B is a tax form that reports the type of health insurance coverage you have any dependents covered by your insurance policy and the period of coverage for the prior year.

Health insurance tax form. Health Coverage is a tax form that is used to verify that you and any covered dependents have health insurance that qualifies as minimum essential coverage. You should wait to file your income tax return until you receive that form. If you had Marketplace insurance and used premium tax credits to lower your monthly payment you must file this health insurance tax form with your federal income tax return.

1 of Form RI-1040 or RI-1040NR Form IND-HEALTH must be completed. You must itemize to claim this deduction and its limited to the total amount of your overall costs that exceed 75 of your adjusted gross income AGI. Why do I need Form 1095-B.

Premium tax credits are sometimes known as subsidies discounts or savings. Beginning in the 2019 tax year the federal penalty for failing to enroll in health insurance was discontinued. Dont file your taxes until you have an accurate 1095-A.

Members on an Individual Health plan through the Health Insurance Marketplace HIM receive Form 1095-A from CMS. For example if you or your spouse gave birth in April of 2020 you would Shared responsibility payment. Individual tax payors are no longer required to report or certify on their federal tax returns whether they had.

Should receive a Form 1095-B Health Coverage form from the provider. You must have your 1095-A before you file. Health Net will mail tax Form 1095-B to everyone who had individual or group health coverage with us in 2020.

You usually pay tax on the cost of the insurance premiums if your employer pays for your medical insurance. And Health Net Life Insurance Company Health Net. These forms help determine if you the required health insurance under the Act.

This form is used to verify on your tax return that you and your dependents have at. For tax years other than 2020 if advance payments of the premium tax credit APTC were made for your or a member of your tax familys health insurance coverage through the Health Insurance Marketplace you must complete Form 8962 Premium Tax Credit and attach it to your return. What you need to know about the 1095-B federal tax form.

Important 2020 Tax Information from Health Net of California Inc. This federal tax form provides information about your health insurance coverage who was covered and the coverage effective date. Fallon Health will send1099-HC forms to subscribers by January 31 2020 for the 2019 state tax filing.

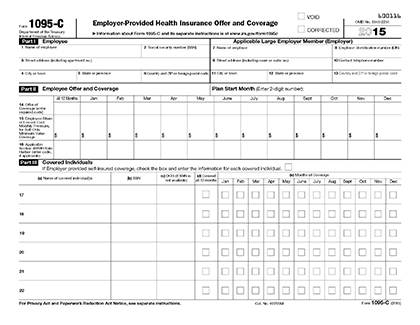

Worked for an applicable large employer in general an ALE is an employer with 50 or more full-time and full-time equivalent employees May receive a Form 1095-C Employer-Provided Health. The Affordable Health Care Act introduced three new tax forms relevant to individuals employers and health insurance providers. If you have coverage from different health care providers during 2019 you will receive a 1099-HC form from each health insurance provider from which you obtained coverage.

It may be available in your HealthCaregov account as soon as mid-January. You will receive Form 1095-A Health Insurance Marketplace Statement which provides you with information about your health care coverage. Youll need to use Form 1095-A Health Insurance Marketplace Statement when you file your federal income taxes to show proof that you have health insurance.

The forms are sent to individuals who are insured through marketplaces employers or the government. When will subscribers receive a 1099-HC form. They are forms 1095-A 1095-B and 1095-C.

This form shows the type of health coverage you have any dependents covered by your insurance policy and the dates of coverage for the tax year. Members on an Individual Health plan that is not part of the Federal Marketplace Exchange receives Form 1095-B from Humana. Form 1095 provides proof of health coverage for you and any covered dependents for the applicable monthsyear.

If anyone in your household had a Marketplace plan in 2020 you should get Form 1095-A Health Insurance Marketplace Statement by mail no later than mid-February. 1095-B This form provides information about your health insurance coverage who was covered and the coverage effective date. The Form 1095-A Form 1095-C or Form 1095-B.

If you or a member of your tax household did not have full-year health cov-erage and were not granted an exemption Form IND-HEALTH must still be completed. Form 8962 Premium Tax Credit. Individuals who have health insurance should receive one of three tax forms for the 2020 tax year.

Heres what you need to know. Health insurance costs are included among expenses that are eligible for the medical expense deduction. Form 1095-B and 1099-HC are tax documents that show you had health insurance coverage considered Minimum Essential Coverage during the last tax year.

Check how your employer works out how much tax. For individuals who bought insurance through the health care marketplace this information will help to determine whether you are able to receive an additional.

Annual Health Care Coverage Statements

Annual Health Care Coverage Statements

Watch Your Mail For Tax Reporting Documents

Watch Your Mail For Tax Reporting Documents

New Irs Form 1095 A Among Tax Docs That Are On Their Way Don T Mess With Taxes

Corrected Tax Form 1095 A Katz Insurance Group

1095 C Form Official Irs Version Discount Tax Forms

1095 C Form Official Irs Version Discount Tax Forms

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png) Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Affordable Care Act Aca Forms Mailed News Illinois State

Affordable Care Act Aca Forms Mailed News Illinois State

Tax Filing With The Affordable Care Act Katz Insurance Group

How Does Health Insurance Affect Your Taxes

How Does Health Insurance Affect Your Taxes

Tax Season Complicated By New Health Insurance Forms Health Bendbulletin Com

Tax Season Complicated By New Health Insurance Forms Health Bendbulletin Com

New Tax Document For Employees Duke Today

New Tax Document For Employees Duke Today

Comments

Post a Comment